Accounting Variable Costing Income Statement Example

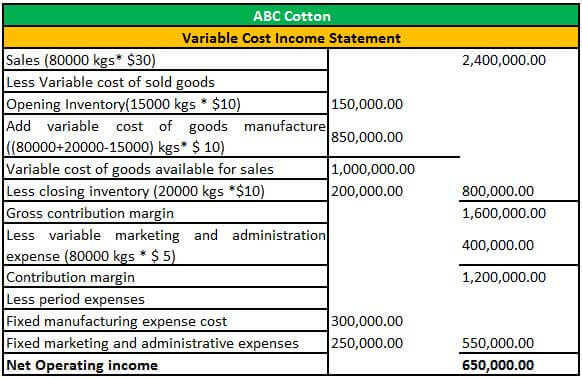

Manufacturing costs variable costs 10 per kg.

Accounting variable costing income statement example. A variable costing income statement example applied to different business spheres is available online and cannot be included in this paper due to word count limitations. Examples of variable costing income statement example 1. Ifc is a manufacturer of phone cases. Finished goods inventory at the closing of the period 20 000 kgs.

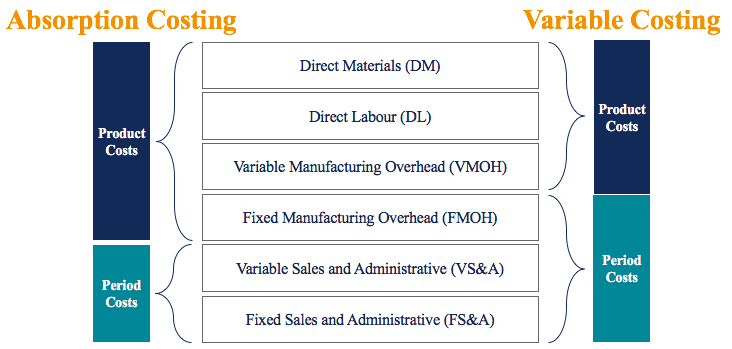

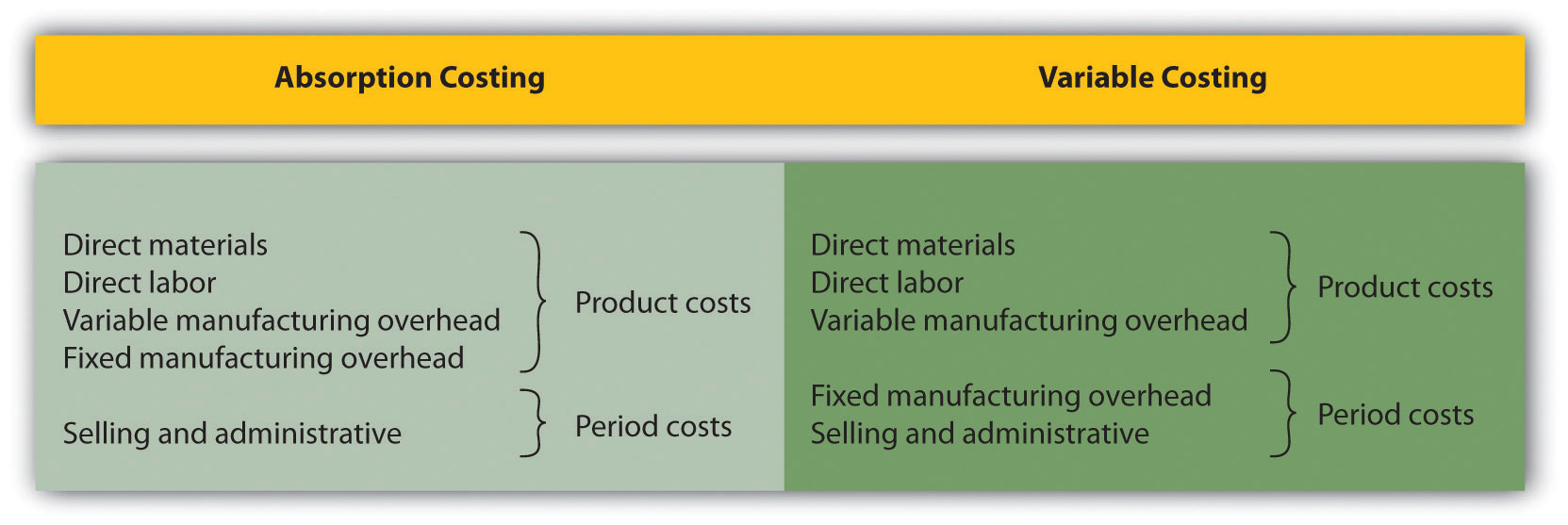

There are no uses for variable costing in financial reporting since the accounting frameworks such as gaap and ifrs require that overhead also. Variable costing is a methodology that only assigns variable costs to inventory this approach means that all overhead costs are charged to expense in the period incurred while direct materials and variable overhead costs are assigned to inventory. Direct materials direct labor and variable manufacturing overheads. Variable costing also known as direct costing treats all fixed manufacturing costs as period costs to be charged to expense in the period received under variable costing companies treat only variable manufacturing costs as product costs.

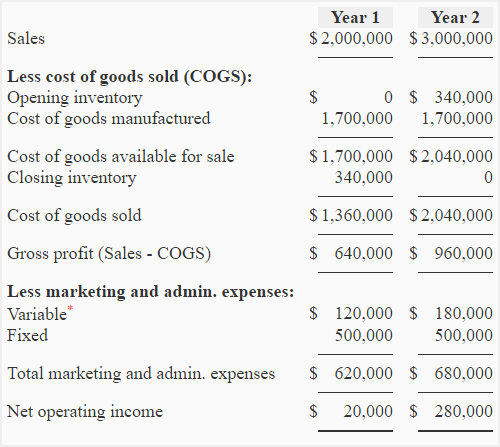

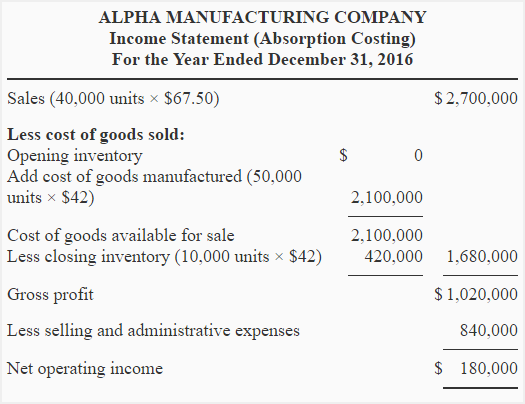

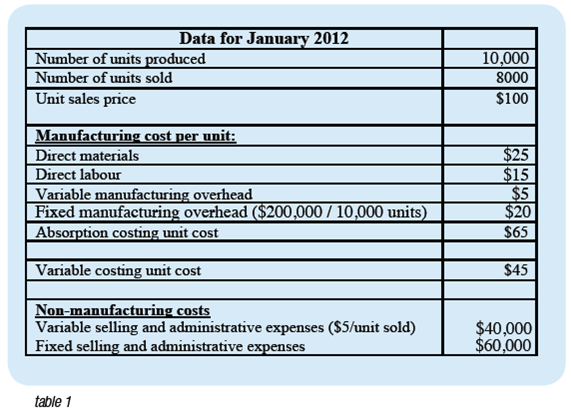

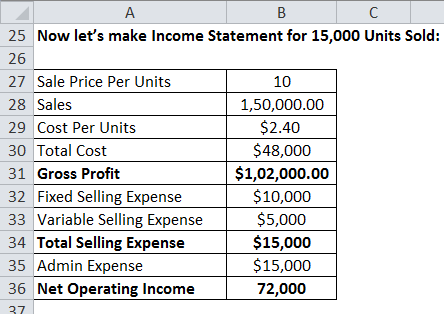

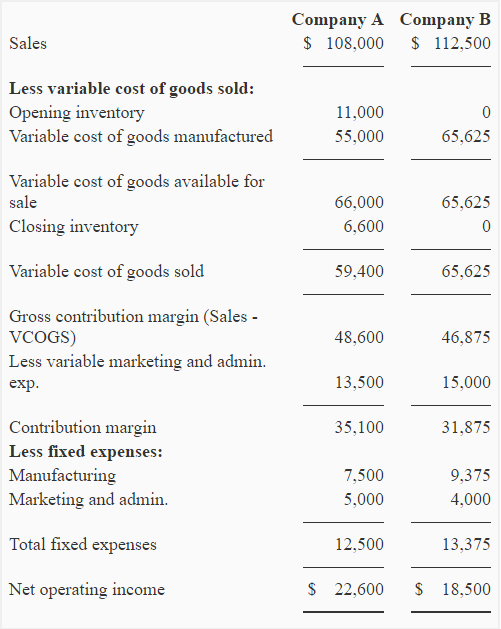

Xyz is an american company with a 1000 ipod order for a price of 1000. Hence with both methods he arrives at the same conclusion but the difference is in the way each method allocates the fixed manufacturing overheads on the income statement. The logic behind this expensing of fixed manufacturing costs is that the company would incur such costs whether a plant was in production or idle. Below are excerpts from the company s income statement for its latest year end 2018.

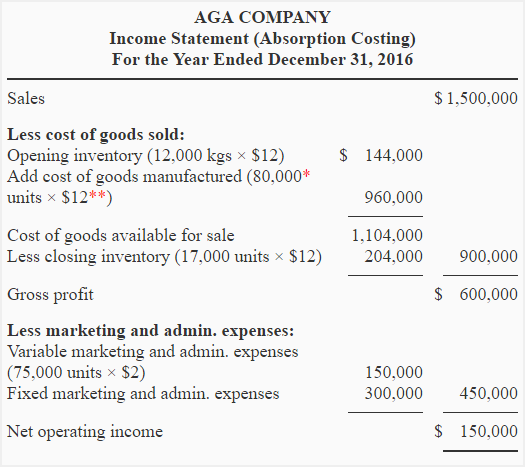

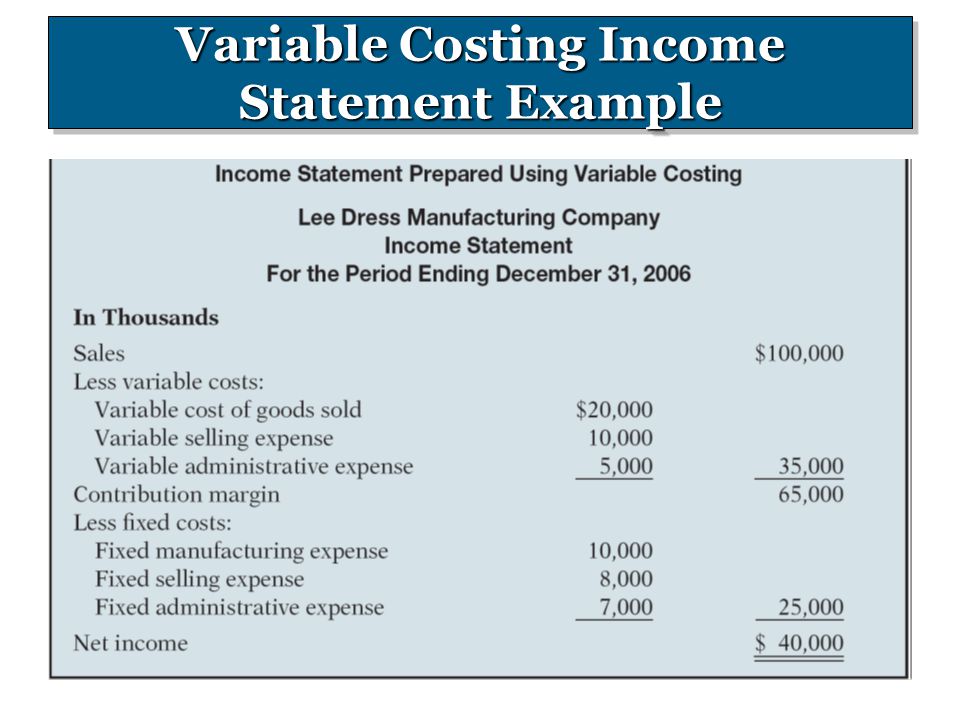

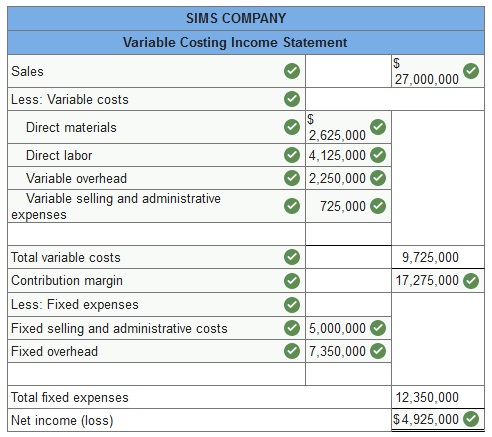

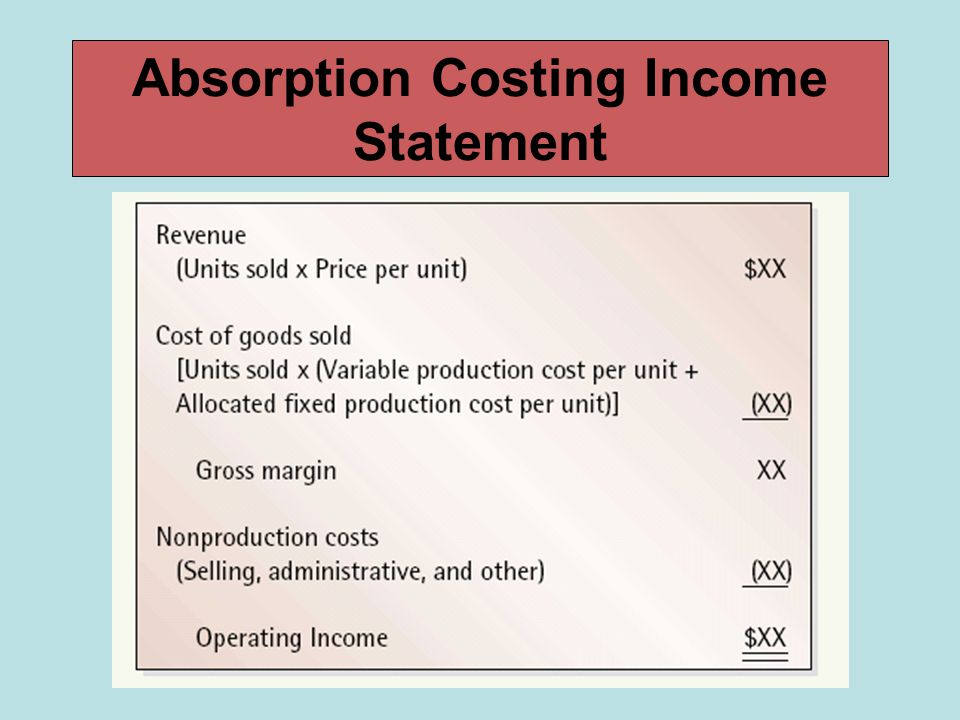

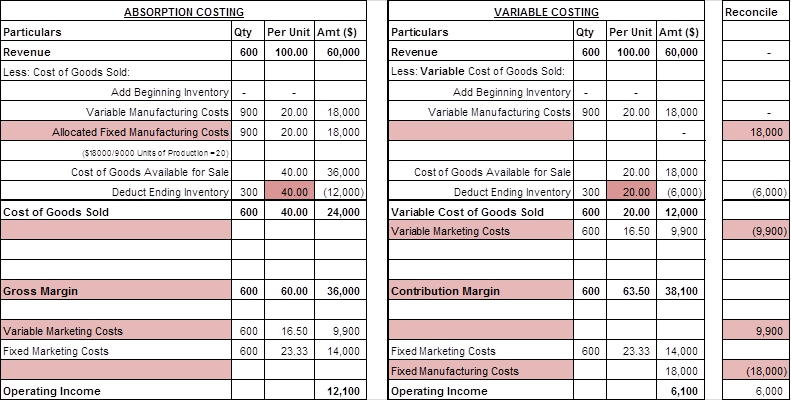

A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. The following are examples of variable costing in order to understand the concept in a better manner. Now let us explain how variable costing income statement vs absorption differ. Finished goods inventory at the beginning of the period 15 000 kgs.

Illustrative example of variable costing. In variable costing cost of inventories comprises only of variable manufacturing costs i e. Ifc does not report an opening inventory. Example of variable costing.

Variable costing means a method of accounting for production expenses where all variable costs are included in the product. During 2018 the company manufactured 1 000 000 phone cases and reported total manufacturing costs of 598 000 around 0 60 per phone case. Variable costing is one of approach which is used for the purpose of valuation of inventory or calculation of the cost of the product in the company where only the cost linked directly with the production of output are applied to the inventory cost or the cost of the production and other expenses are charged as expense in the income statement. Variable costing also called marginal costing is a costing method in which fixed manufacturing overheads are not allocated to units produced but are charged completely against revenue in the period in which they are incurred.