Disposable Income Definition Economics

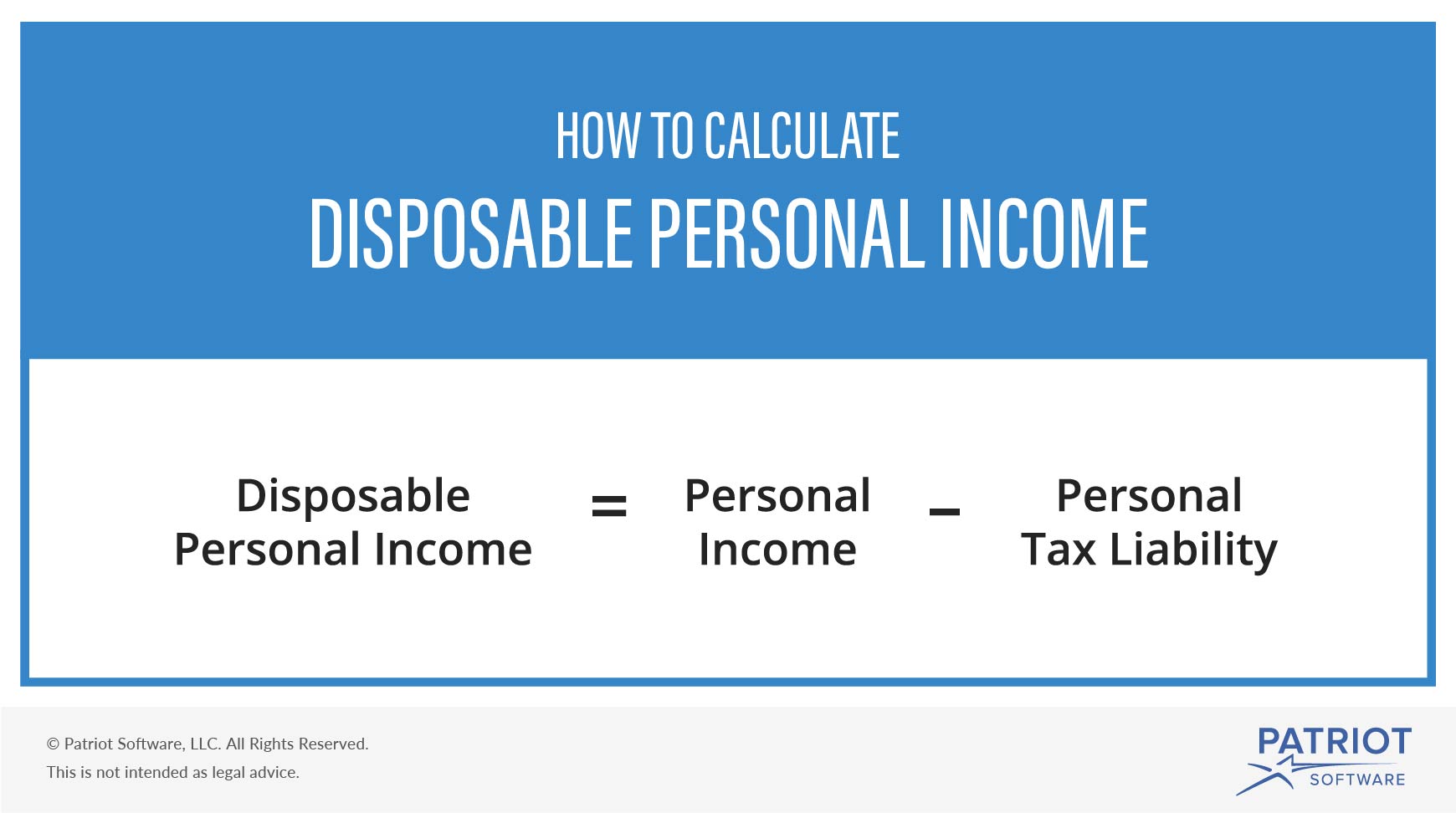

Disposable income is money that s remaining after paying taxes.

Disposable income definition economics. Discretionary income is the money that. Do customers have enough disposable income. Original income before government. Disposable income that portion of an individual s income over which the recipient has complete discretion.

The money you have left to spend or save after taxes have been paid. Sometimes called mad money discretionary income can be spent on all the things you might want but not really need for anything other than keeping up with the joneses perhaps. Important distinctions exist between the two. Disposable income in economics topic.

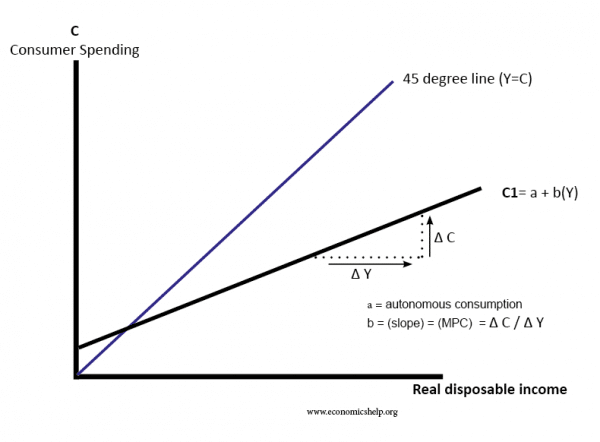

Disposable income is the amount of personal income direct taxes. But after income tax and ni contributions have been taken off their disposable income may be 19 000 a year. Income includes wages and salaries interest and dividend payments from financial assets and rents and net profits from businesses. Disposable income is the amount of money that individuals and families have available for spending or saving after they have paid their direct taxes and received any state welfare benefits.

Disposable income also known as disposable personal income dpi is the amount of money that households have available for spending and saving after income taxes have been accounted for. In the uk a person may have a gross salary of 31 000. Disposable income also known as disposable personal income dpi or net pay is the amount of money you have left over from your total annual income after paying all direct federal state and local taxes. A set of goals for spending saving and investing the money you earn.

Discretionary income is the income available to spend. Terms in this set 15 disposable income. For example a family with an annual household income of 90 000 that pays 20 000 in taxes has a net disposable. In view of the high local disposable income the potential for an evening dining out market is clearly high.

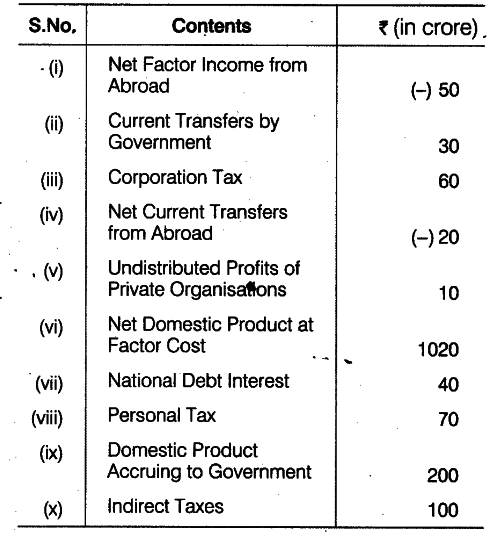

The money you have left to spend or save after taxes have been paid. Gross or net national disposable income equals gross or net national income at market prices minus current transfers current taxes on income wealth etc social contributions social benefits and other current transfers payable to non resident units plus current transfers receivable by resident units from the rest of the world. The amount of money you have left to spend after you have paid your taxes bills etc examples from the corpus disposable income economy. Direct taxes include income tax national insurance and local council tax.

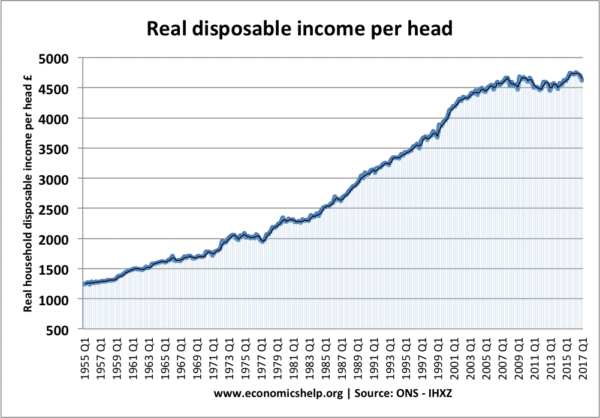

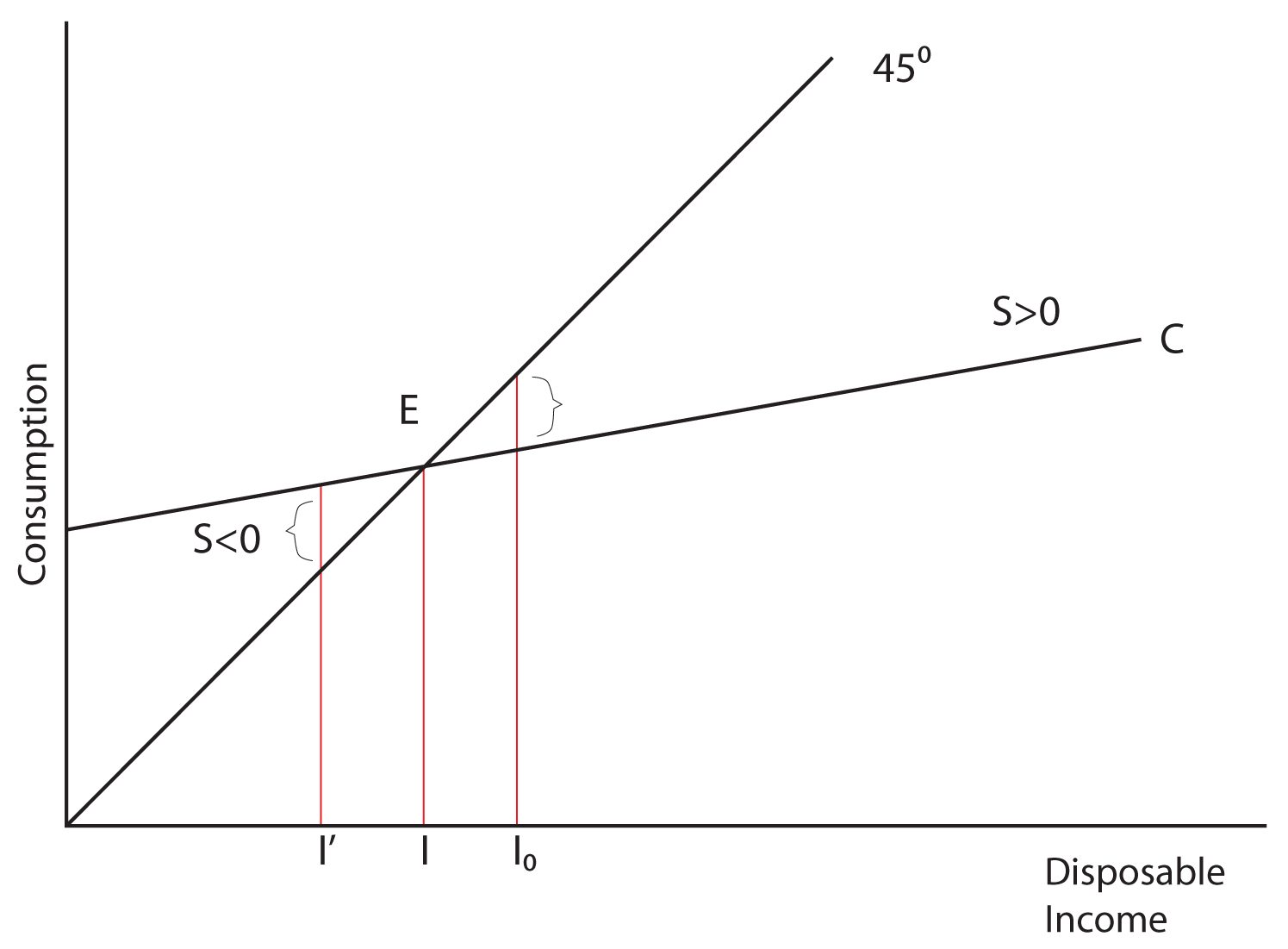

Stages in calculating disposable income.