Earned Income Definition Economics

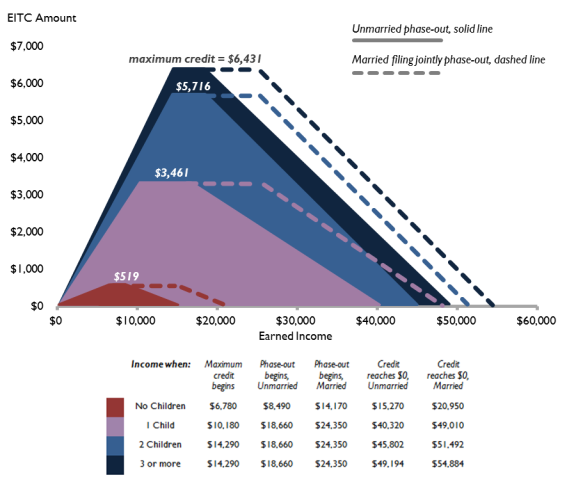

Taxpayers with low incomes may be eligible for an earned.

Earned income definition economics. Earned incomes are influenced by a different kind of inheritance. Earned income includes amounts received as wages tips bonuses other employee compensation and self employment income whether in the form of money services or property. Earned income is income for services rendered as distinguished from income generated by property or other sources. Income is money what an individual or business receives in exchange for providing labor producing a good or service or through investing capital.

Earned income includes only wages commissions and bonuses as well as business income minus expenses if the person is self employed. Access to well paid jobs and social status is largely the product of education and opportunity. Dictionaries have inconsistent definitions. One common definition is that earned income comes from labor while unearned income comes from the ownership of assets.

The terms earned and unearned income do not have single meanings. The earned income credit eic is a united states tax credit that helps certain taxpayers with low incomes from work in a particular tax year. You work for someone who pays you or. Earned income is any income from a job or self employment.

Taxable earned income includes. Generally earned income includes taxable employee compensation and net earnings from self employment as well as certain disability payments. You own or run a business or farm. Individuals most often earn income through wages.

Typically therefore well educated children of wealthier parents tend to retain their parents status and earning power. Wages salaries tips and other taxable employee compensation. There are two ways to get earned income.

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)