Fiscal Year 2019 Income Eligibility Guidelines

Fiscal year 2019.

Fiscal year 2019 income eligibility guidelines. The new income calculations are based on annual. Why am i unable to access the fy 2019 income limits documentation system using a prior year bookmark or using the results of web search. 1 monetary compensation for services including wages salary. The following are the income eligibility guidelines to be effective from july 1 2019 through june 30 2020.

Fiscal year 2019 income eligibility enrollment form page 3 of 3 child care centers ns 100c revised 4 2018 income eligibility enrollment form for child care centers july 1 2018 through june 30 2019 part 1. Using links from these methods generally result in broken webpages. Income is defined as any monies earned before any deductions such as income taxes social security taxes insurance premiums charitable contributions and bonds. July 1 2019.

New household income eligibility guidelines statements instructions and participant parent. Complete the information below for all children in care. Fiscal year 2020 income eligibility guidelines isbe 67 45 ieg20 3 19 the united states department of agriculture has issued the following income guidelines for the period july 1 2019 through june 30 2020. It includes the following.

Office of health and nutrition services. Child and adult care food program institutions. The liheap statute section 2605 b 2 b or assurance 2 says that to be eligible a household must have an income that does not exceed the greater of 150 percent of the federal poverty guideline fpg or 60 percent of the state median income smi level. Fiscal year 2019 income eligibility guidelines.

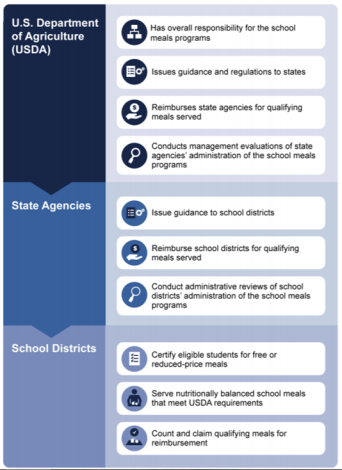

Operational memorandum 5. These guidelines are used by schools institutions and facilities participating in the national school lunch program and usda foods in schools school breakfast program special milk program for children child and. The following is the definition of income. Contract reimbursed non medicaid fy 2019 family income eligibility.

Child and adult care food program. Income eligibility guidelines effective from july 1 2019 to june 30 2020 free meals 130 federal poverty guideline reduced price meals 185 federal poverty guideline household size. The income limits documentation calculates median family incomes and income limits for each area of the country. The patient meets the income criteria and can supply documented proof of such 100 of the uniform or negotiated rate will be reimbursed.

If the child is an infant foster child legal responsibility of a foster care agency or the. The income eligibility guidelines. For each additional person add 8 640. The department s guidelines for free meals and milk and reduced price meals were obtained by multiplying the year 2019 federal income poverty guidelines by 1 30 and 1 85 respectively and by rounding.

Effective july 1 2019 through june 30 2020 participants from households with incomes at or below the following levels may be eligible for free or reduced price meals or free milk. Therefore certain parameters must be set for these calculations to be. Number of dependents annual income 1 24 280 2.