Formula Income Approach To Value

Income approach and relation between income and value the income approach considers the income that the asset will generate over its remaining useful life and estimates value through a capitalization process.

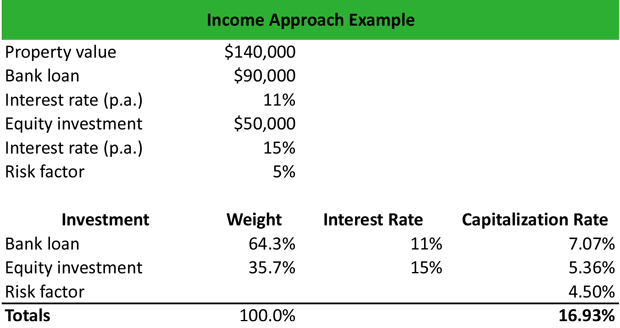

Formula income approach to value. Value net. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. Note in this formula the reversal of the irv formula for finding value. A initial period of say 5 years for which net cash flows and growth rate for each year can be determined and b period after the initial period for which year by year projection is unreliable.

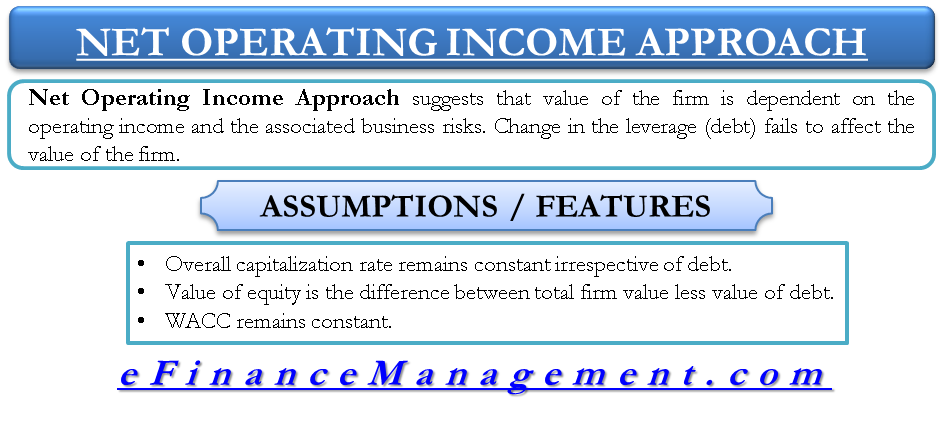

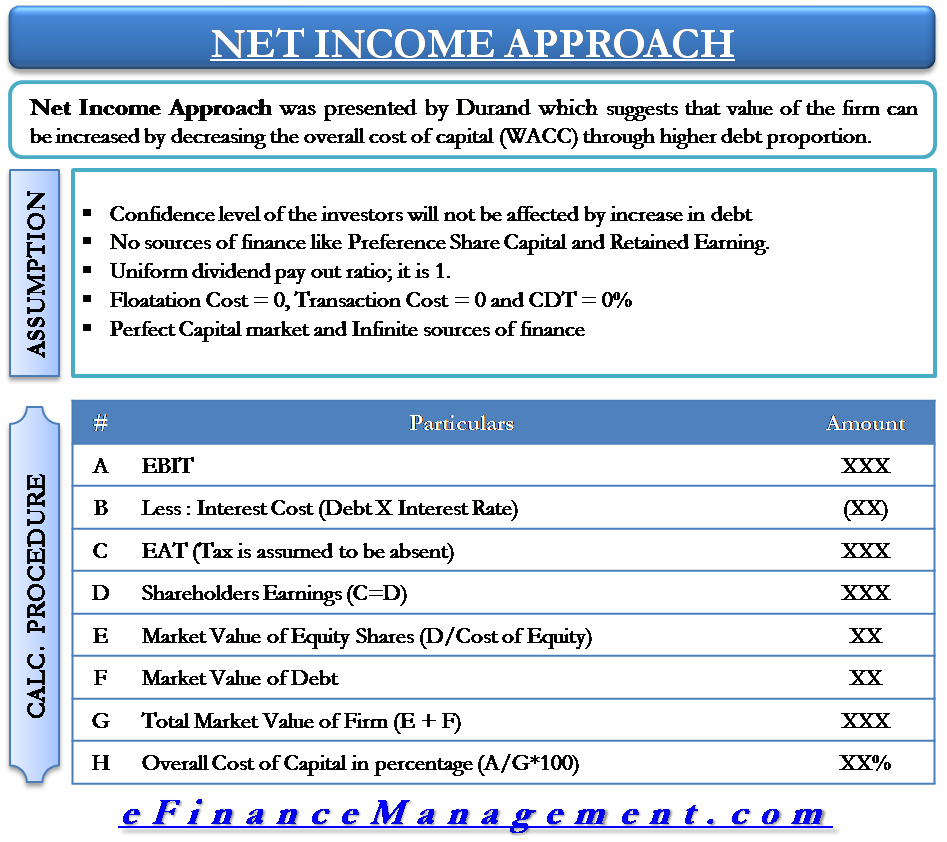

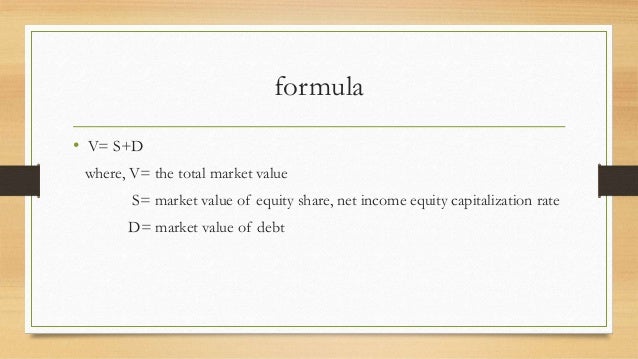

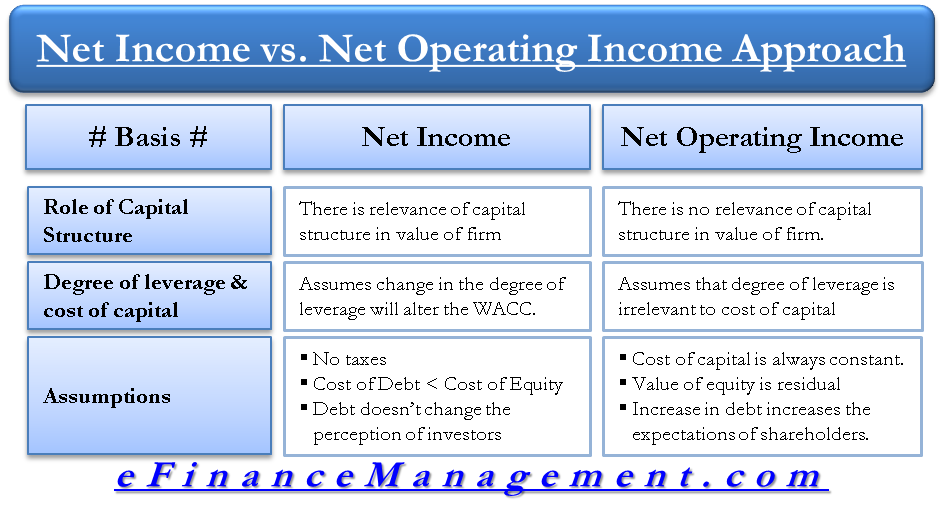

This process applies an appropriate yield or discount rate to the projected income stream to arrive at a capital value. Net operating income i sales price v capitalization rate r this formula is applied using the net operating income and sale price of each comparable that you re analyzing. Income approach is a real estate valuation method used by investors to appraisal a piece of real estate based on its earnings profitability and risk. Formula for income approach it s possible to express the.

Present value of the property ibdit capitalization rate 85 000 16 93 502 110. The above equation is based on the formula for present value of a perpetuity. A building sells for 200 000. The income approach is one of three techniques commercial real estate appraisers use to value real estate.

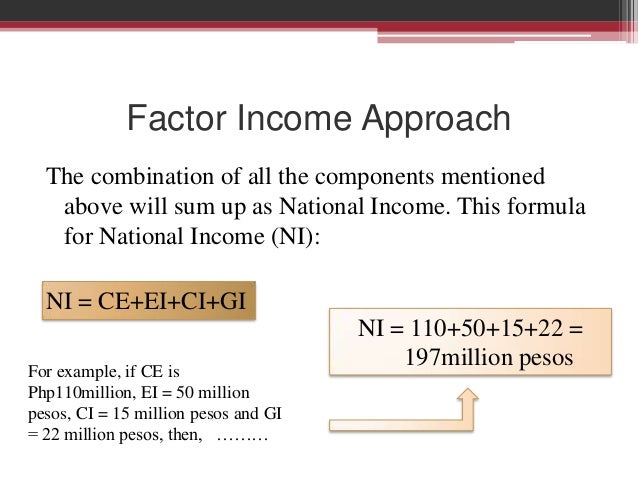

Conversely the income approach starts with the income earned wages rents interest profits from the production of goods and services. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. The formula you use is. Another approach called multi stage growth model divides future into two or more stages.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)