Gross Income Job Definition

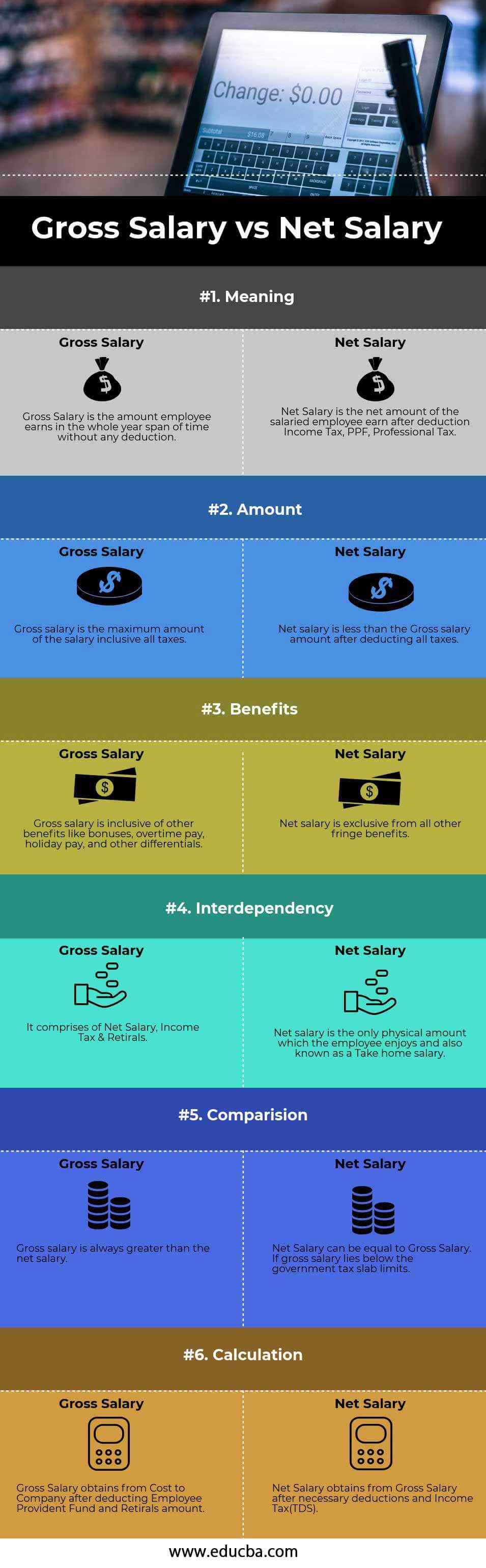

Gross income for an individual also known as gross pay when it s on a paycheck is the individual s total pay from his or her employer before taxes or other deductions.

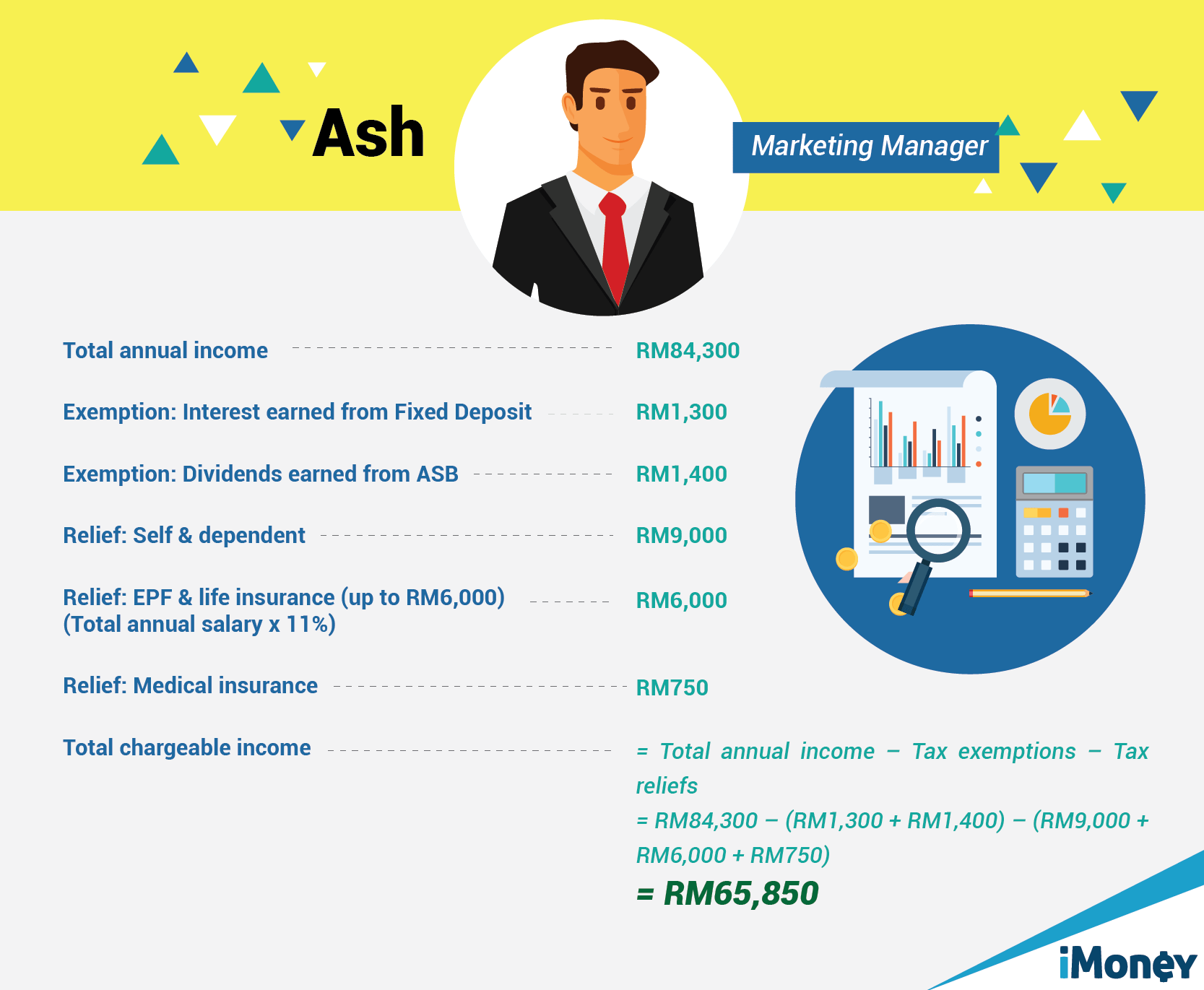

Gross income job definition. Gross monthly income is the amount paid to an employee within a month before taxes or other deductions. However a full time employee may also have other sources of income that must be considered when calculating their income. It s usually measured over a year but companies usually report their gross income on. Because of this take home pay can be much less than gross wage due to withholdings.

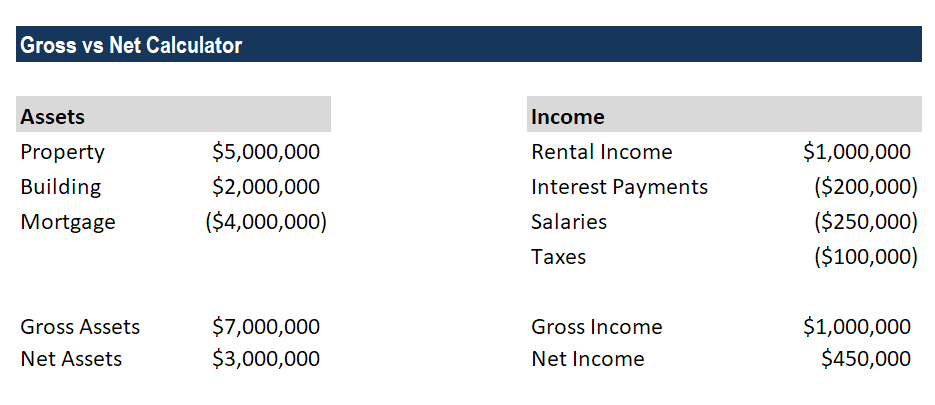

For households and individuals gross income is the sum of all wages salaries profits interest payments rents and other forms of earnings before any deductions or taxes. Your gross annual income and gross monthly income will always be larger than your net income. Your gross income is the total amount of money you receive annually from your monthly gross pay. Gross wages are the full amount an employer pays before taxes and other deductions are withheld.

Gross salary is determined by the employer when the job is offered. The specific amount appears on both job offer letters and paychecks. Gross income is essentially the total amount you or a business earns over the course of certain period of time. Required deductions can include but are not limited to.

The reason your gross pay is always higher than your net pay is due to some mandatory and voluntary deductions from your employer and potentially due to choices you have made about savings or benefits. An individual employed on a full time basis has their annual salary or wages before tax as their gross income. It is opposed to net income defined as the gross income minus taxes and other deductions. You can find your gross wages on your pay stub.

Potential additions to gross monthly income include overtime bonuses and commission. This gross salary might come from different sources such as wage commissions tips bonuses and any other economic incentive received as part of the wage and it is the baseline for any calculation made regarding the employee s income. This is different from operating profit. The amount earned depends on the employment status and wage rate set by the employer.

The gross income for an individual is the amount of money earned before any deductions or taxes are taken out.