How To Calculate Income Capitalization Approach

The income capitalization approach formula.

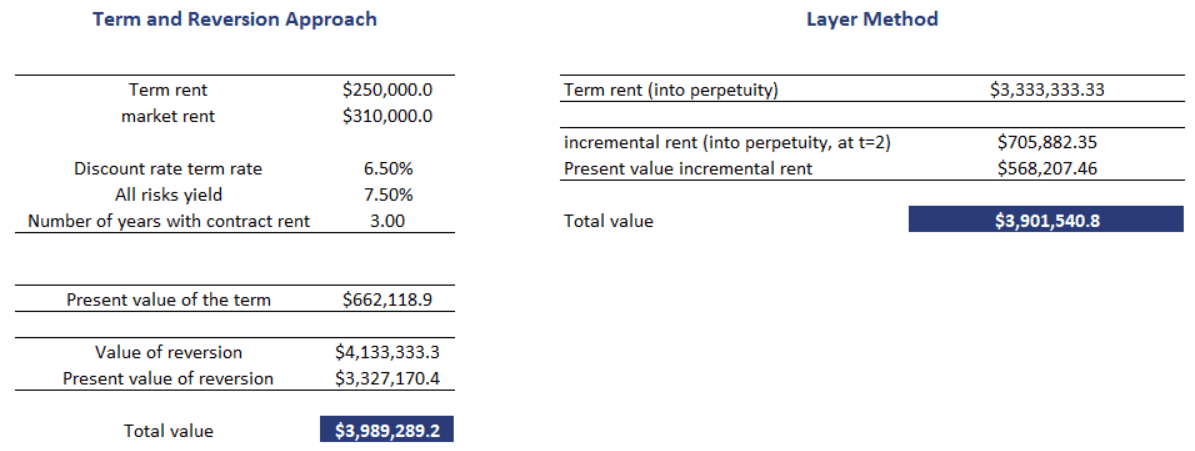

How to calculate income capitalization approach. There are two approaches that fall under the income approach the direct capitalization approach and the discounted cash flow method. Use the seller s income statements to estimate income before depreciation interest and tax ibdit. Capitalization of earnings is a method of determining the value of an organization by calculating the worth of its anticipated profits based on current earnings and expected future performance. So here s how to calculate each of the.

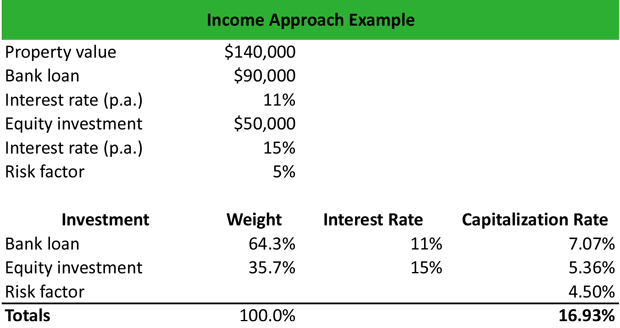

As you can see this appraisal approach consists of two main variables. Income approach has two main variants. The capitalized income approach or direct capitalization income approach is a valuation method used for real estate. Process of calculating a company s value using the capitalized earnings method.

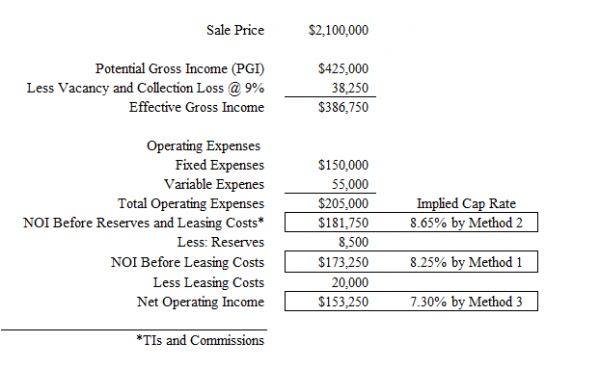

This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market. Property market value net operating income noi capitalization rate. Compared to the other two techniques the sales comparison approach and the cost approach the income approach is more complicated and therefore it is often confusing for many commercial real estate professionals. Adjust ibdit for potential increases in expenses after the business is purchased due to building equipment and fixtures furniture maintenance and replacements.

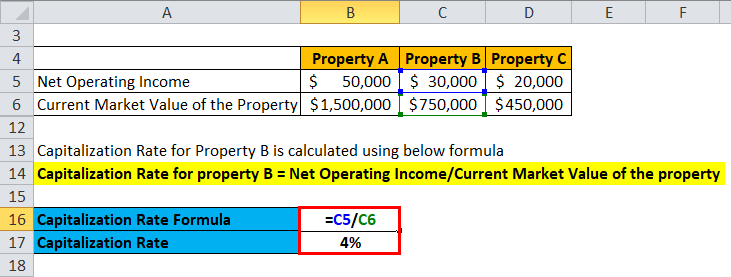

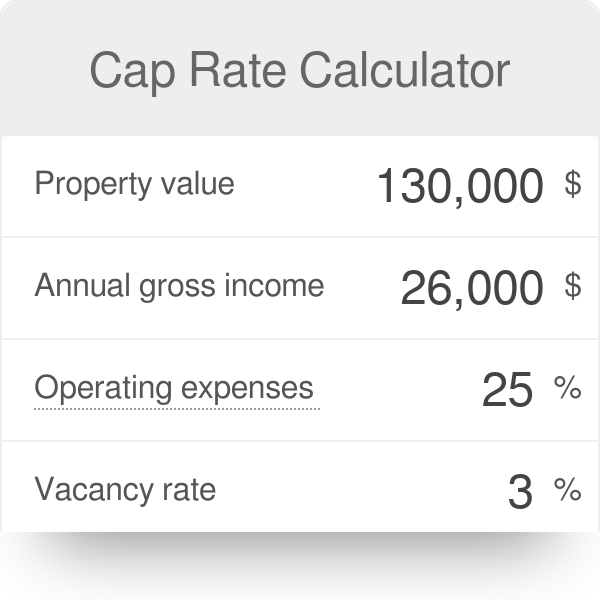

Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies lower risk while a low capitalization rate implies higher risk. On this page we focus on the direct capitalization method.

The income approach is one of three techniques commercial real estate appraisers use to value real estate. By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building. The income capitalization formula looks like this. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property.

The capitalization rate and the net operating income noi. You can use the numbers from the previous examples to calculate the value.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)