Income Brackets Us 2020

The 2020 tax rates themselves are the same as the rates in effect for the 2019 tax year.

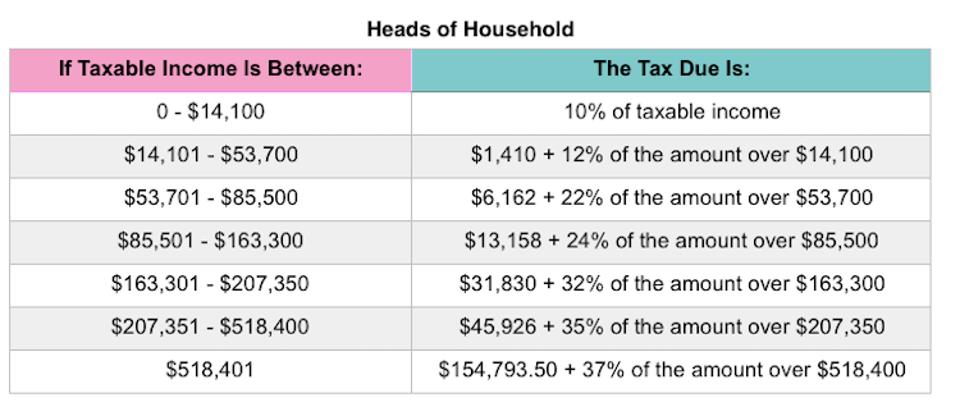

Income brackets us 2020. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. View 2020 and 2021 irs income tax brackets for single married and head of household filings. The irs released the federal tax rates and income brackets for 2020 today. The seven tax rates themselves remain the same as they were in 2019.

The tax rates for 2020 are. However as they are every year the 2020 tax brackets were adjusted. However the income limits for each have been. Individual incomes are limited to americans who worked or wanted to work in 2018.

On this page are estimated united states individual income brackets for 2020 you ll also find the average median and top 1 of individual incomes in the united states. For single taxpayers and married individuals filing separately the standard deduction rises to 12 400 in 2020 up 200 and for heads of households the standard deduction will be 18 650 for the tax year 2020 up 300. Methodology on 2020 united states household income brackets data originated in the united states census bureau s annual asec survey first released in september 2020. It s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the.

10 12 22 24 32 35 and 37. Federal poverty guidelines used to determine financial eligibility for certain federal programs federal register notice january 17 2020 full text prior poverty guidelines and federal register references since 1982 frequently asked questions faqs further resources on poverty measurement poverty lines and their history computations for the 2020 poverty guidelines. 2020 federal income tax adjustments. The university of minnesota s minnesota population center harmonizes it making it easy to do these calculations especially for the household income by year post.

2020 individual income tax brackets. Incomes are earned between january and december 2019. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples filing jointly. The standard deduction for married filing jointly rises to 24 800 for the tax year 2020 up 400 from the prior year.

Apr 6 2020 13 18 pm updated.