Income Classes In Germany

This will help your employer apply the correct tax rate on your payslip hence the name lohnsteuerklasse.

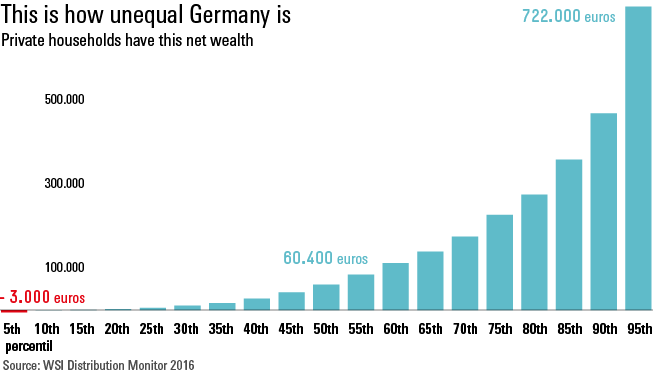

Income classes in germany. According to a new study from the german economic institute iw in cologne if your income as a single person is at least 3 440 euros net per month or more then you are part of the highest earning 10 percent in the country. In 2019 there were roughly 3 2 million german households with a household net income of under 900 euros per month. Individual salaries can vary greatly from this figure as they are affected by factors such as age seniority industry experience working hours and geographical location. In total there were approximately 41 51 million private households in germany.

There are six different tax classes in germany and here is a summary of each keeping in mind that two spouses might have different tax classes depending on circumstances. And by 2014 it had dropped to 43 percent. German income tax 2020 tax classes when working through the german tax system you may see computations that would indicate that the tax rate is very high as much as 40. Actually this is not always correct and this perception can be due to a misunderstanding of the various types of mandatory deductions.

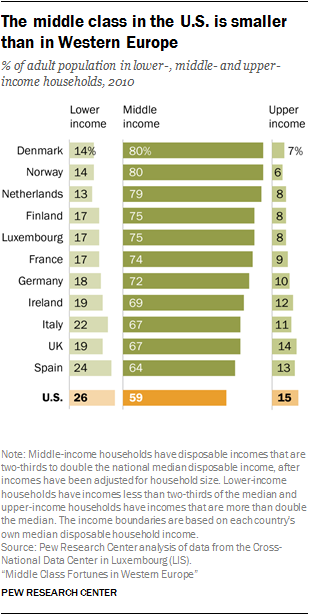

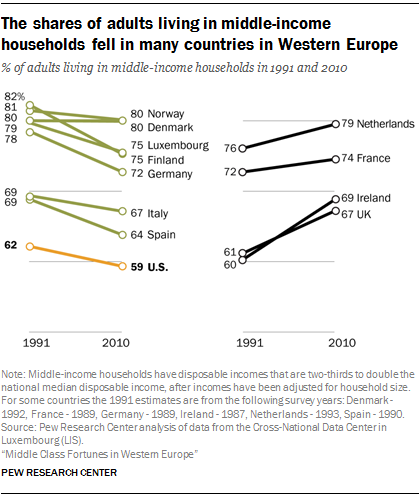

Single but entitled to single parent allowance. In 1980 the us middle class s share of the total income stood at roughly 60 percent. Do you earn 3 340 euros net per month. Income share of high income individuals in germany has risen to 31 percent.

At 64 the german middle class is larger than the average across oecd countries of the population by income class 2016 or latest available year die mittelschicht ist in deutschland größer als im oecd schnitt 64 anteil der bevölkerung nach einkommensschicht in 2016 oder letztes verfügbares jahr. If you earn 3 340 euros net per month then congratulations you are officially part of germany s wealthiest. Your tax class in germany is more or less defined by your marital status. Married but spouse does not earn wages is classified under tax category v recently deceased.

Depending on this you will be put in different categories by the finanzamt. Tax classes in germany. What are the tax classes in germany. In 1990 it was 54 percent.

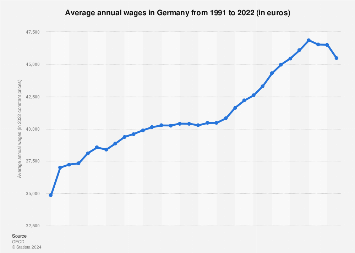

Married persons not in tax classes ii iii or iv. It is wealthy not only in gdp per capita terms but also in terms of average personal income. Average income in germany according to the federal statistical office of germany in 2018 the average gross annual salary was 46 560 euros or 3 880 euros per month.