Income Contingent Repayment Form

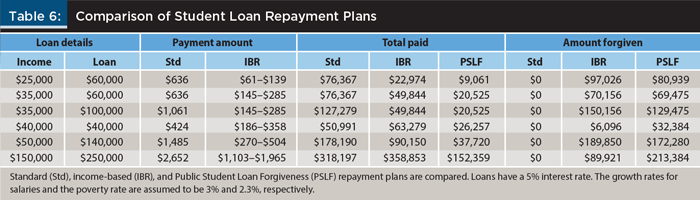

Between 1965 and 2010 most federal student loans were issued by private lending institutions and guaranteed by the government and most student loan borrowers made.

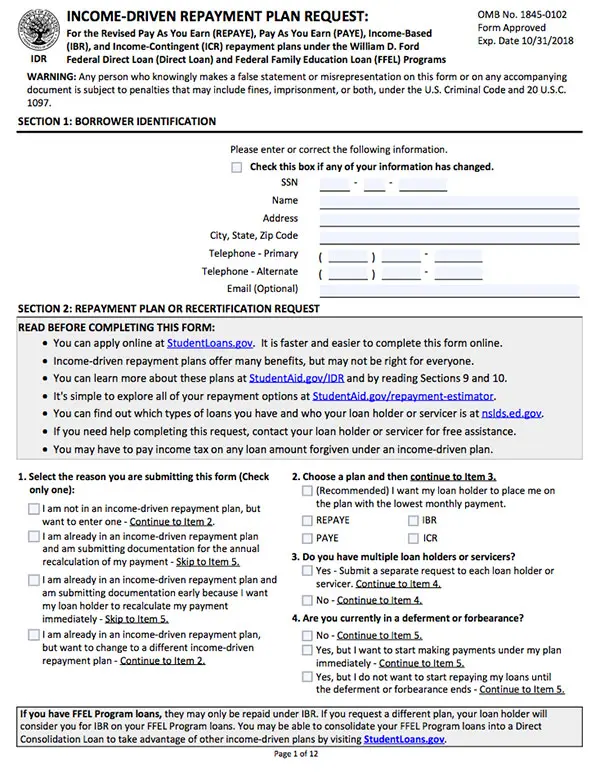

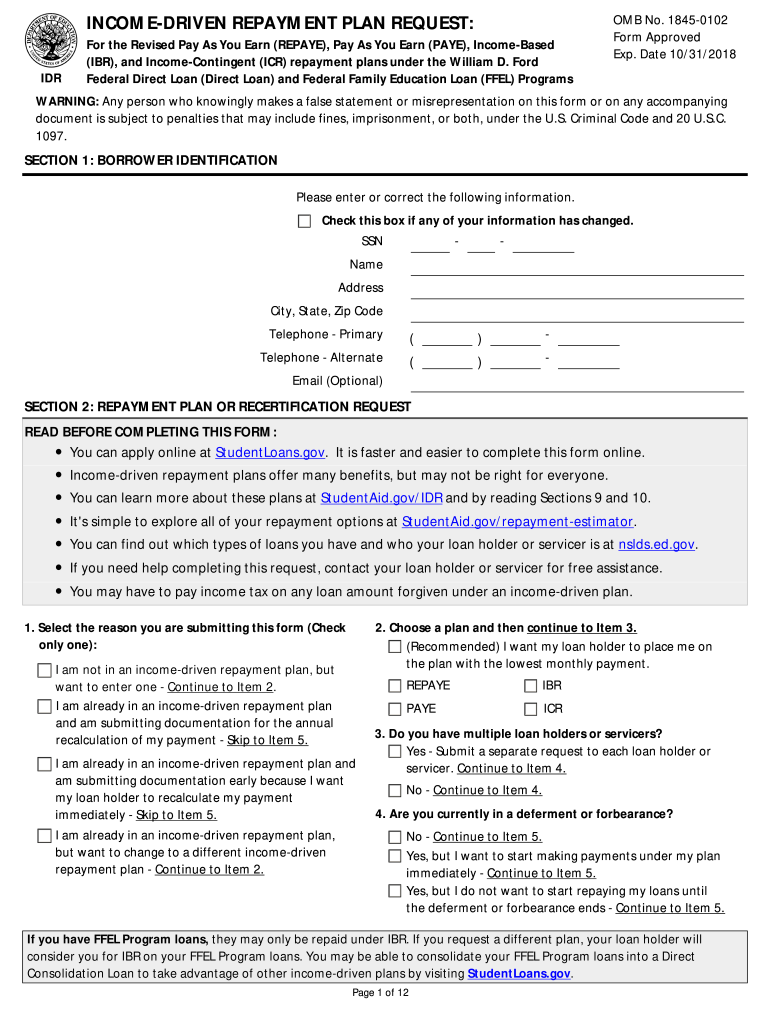

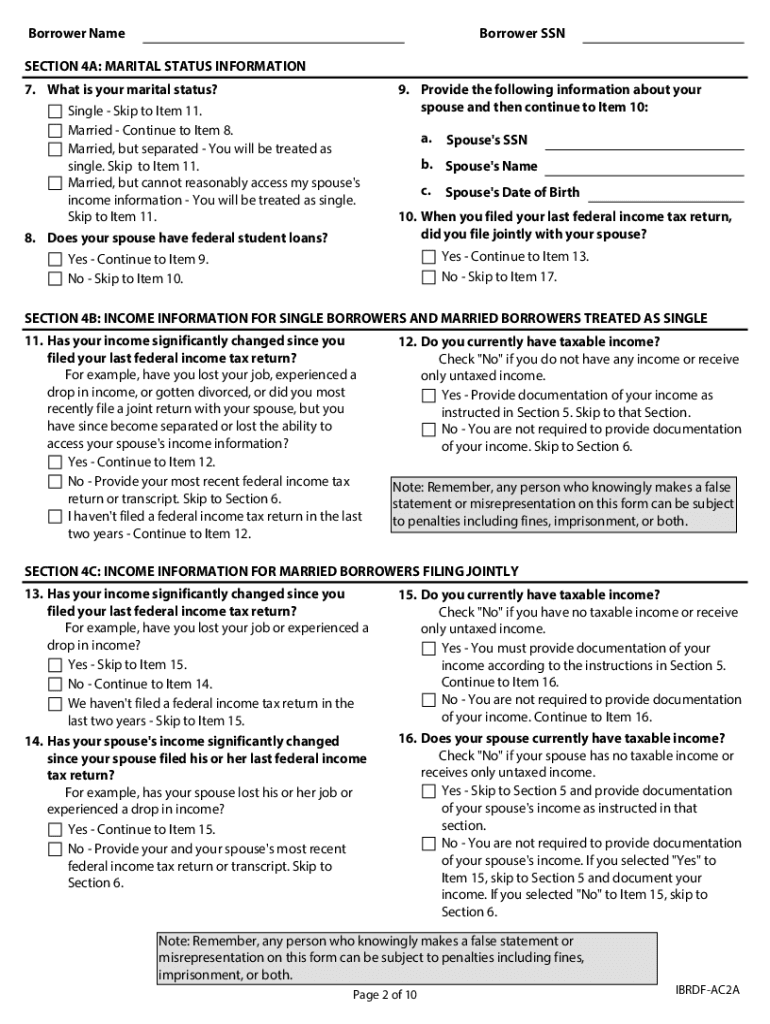

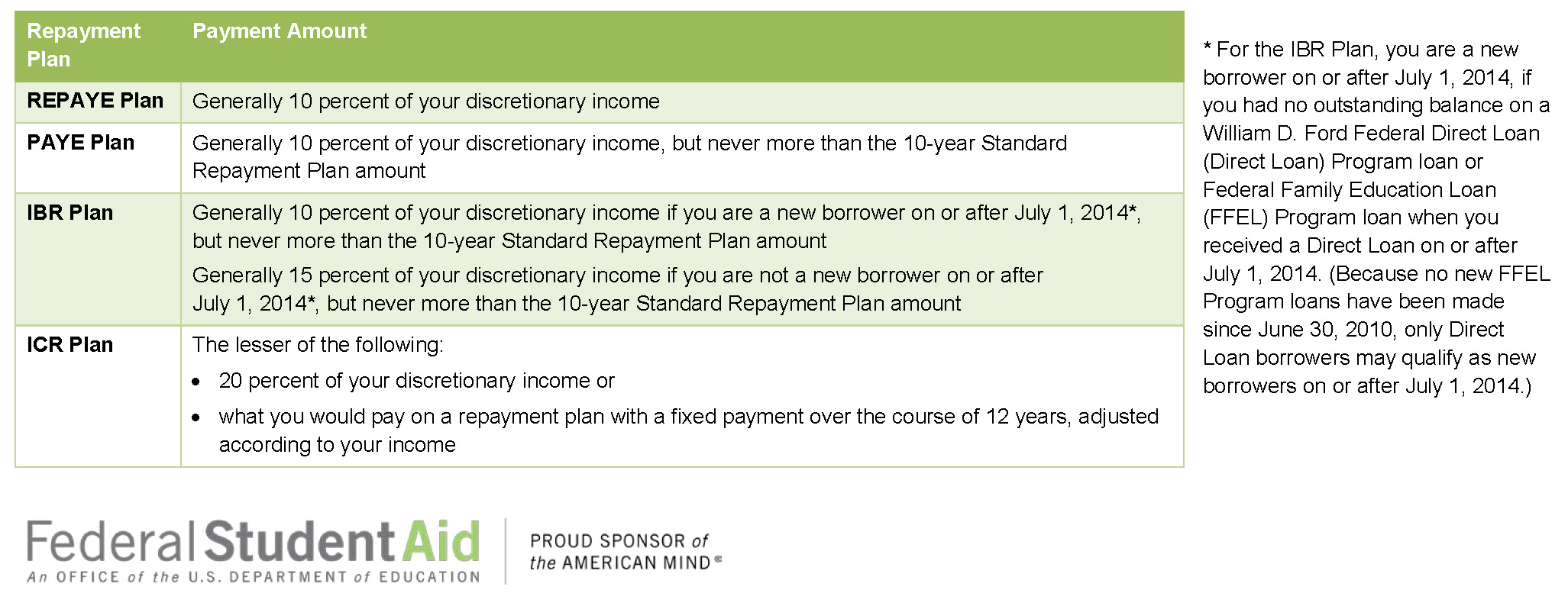

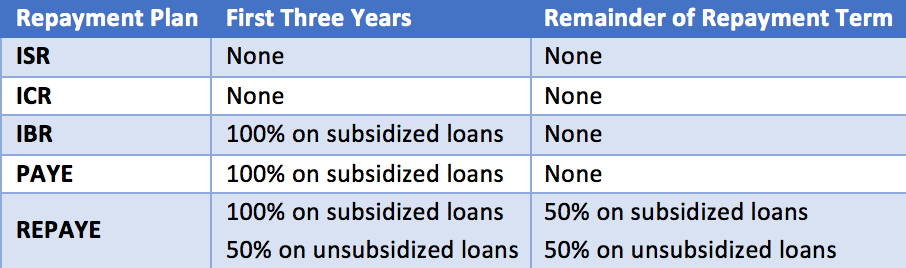

Income contingent repayment form. The icr program is the only income driven plan currently available for parent plus loan borrowers. This type of repayment arrangement is mostly used for student loans where the ability of the new graduate borrower to repay is usually limited by his or her income. The conditions for the income contingent repayment icr program are less strict than many other income driven repayment plans enabling borrowers with federal student loans not accepted by other plans to seek approval. 1845 0102 form approved expiration date.

The interest rate for the income contingent repayment plan is fixed for the life of your loan. Income contingent repayment icr is the oldest of the income driven repayment plans and it also may be the most expensive. Still if you have a parent plus loan income contingent repayment is. Income contingent repayment is an arrangement for the repayment of a loan where the regular e g.

The income contingent repayment icr plan is designed to make repaying education loans easier for students who intend to pursue jobs with lower salaries such as careers in public service. Any person who knowingly makes a false statement or misrepresentation on this form or on. Use this form to 1 requ est an availab le repayment p lan based on your income 2 provide th e required information f or the annu al reevaluation of your pa yment amount u nder on e of these plans or 3 request tha t your loan h older recalculate your monthly payment a mount. Budgetary costs and policy options february 2020.

The us approach to student loans changed fundamentally a decade ago in 2010. If you first consolidate your loans your interest rate through icr is the weighted average of the interest rates on the loans included rounded up to the nearest one eighth of 1. Monthly amount to be paid by the borrower depends on his or her income. Ford federal direct loan direct loan program and federal family education loan ffel programs.