Income Driven Repayment Plan Definition

Income based repayment plans also called income driven repayment plans are recommended for federal loan borrowers whose monthly loans add up to more than 10 of their discretionary income.

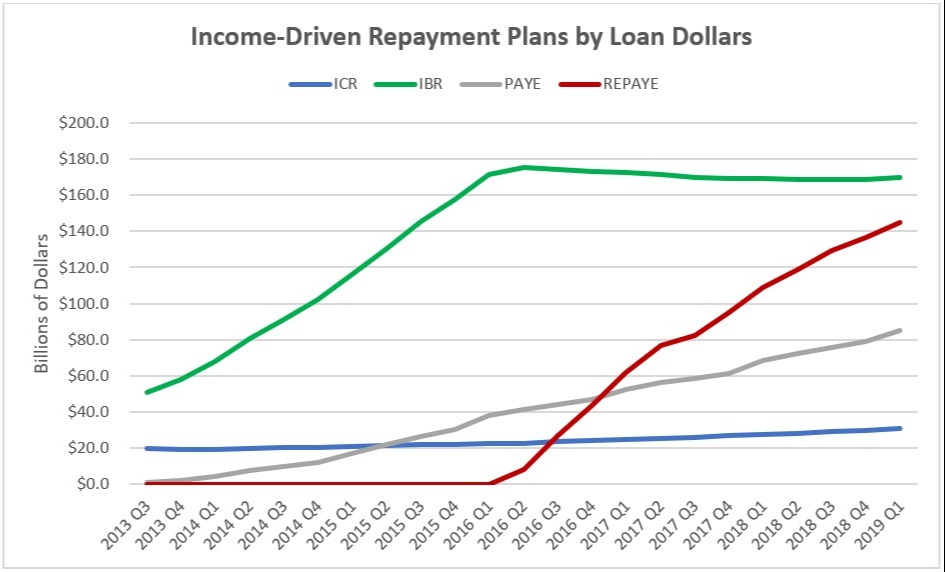

Income driven repayment plan definition. You can choose from four different types of federal student aid income driven repayment plans offered by the department of education. The phrase is an umbrella term for four specific repayment plans that are available within the william d. How income driven repayment plans work. An income based repayment plan called ibr for short reduces your monthly payment to 10 or 15 of your discretionary income and extends your repayment term to 20 or 25 years.

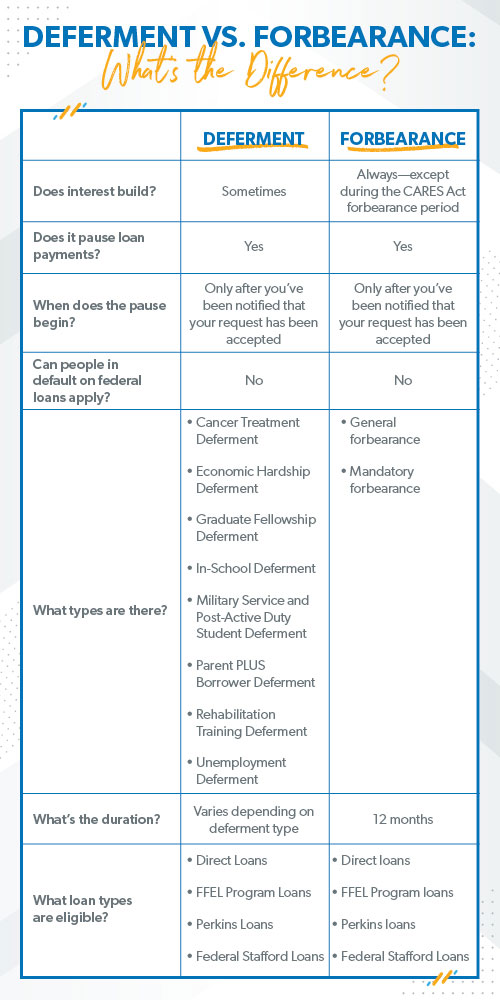

Under the paye plan the ibr plan or the icr plan if you don t renew by the annual deadline you ll remain on the same income driven repayment plan however your monthly payment will no longer be based on your income which may substantially increase your monthly payment amount. Income driven repayment idr plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. Instead your required monthly payment amount will be the. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income driven plans may be right for you.

If the borrower s goal is to have the lowest monthly payment the choice of income driven repayment plan matters. With an ibr plan your payment amount will be capped at a certain percentage of your discretionary income or the amount you would pay under the 10 year standard repayment plan. An income driven repayment plan allows you to set your monthly student loan payment to an amount that you can afford based on how much you earn. The choice of income driven repayment plan depends on the borrower s specific circumstances and goals.

The complexity of the income driven repayment plans can cause borrowers to choose the wrong income driven repayment plan. The lower payment amount and shorter term are reserved for new borrowers who took out their first loan on or after july 1 2014.