Income Tax After Death India

Income tax for that arrears should be filled in which ay year.

Income tax after death india. The online provision to file the taxes makes it easy for everyone. Will i be allowed to file his itr in ay. Interest earned by him after his death should be included in whose itr and which ay. How to claim income tax after death.

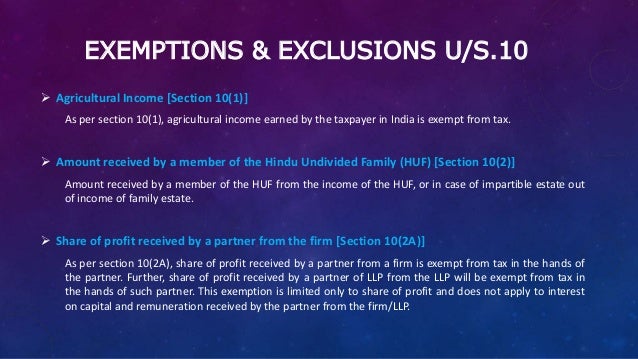

But unfortunately at some point the heirs of the deceased person s estate or the beneficiaries of the deceased person s trust need to address taxes that will be due as the result of their loved one s death. Below you will find a list of taxes that the estate or trust of a deceased person. 1 family pension 20000 per month 2 death gratutity of rs. As per the section 159 of the indian income tax act 1961 the legal heir is liable to file the itr and pay the income tax dues if any.

Union of india v. Xyz person filed return 2013 14 he there after non filing of income tax return his death 2018 he can filed return 14 15 15 16 16 17 17 18 18 19 which section legal ground knowledge as income tax act 1961. Where after death of one b who had not filed returns j one of his ten legal representatives filed returns and notice was issued to j under sections 142 1 and. Is it fine if i fill that in this year itr.

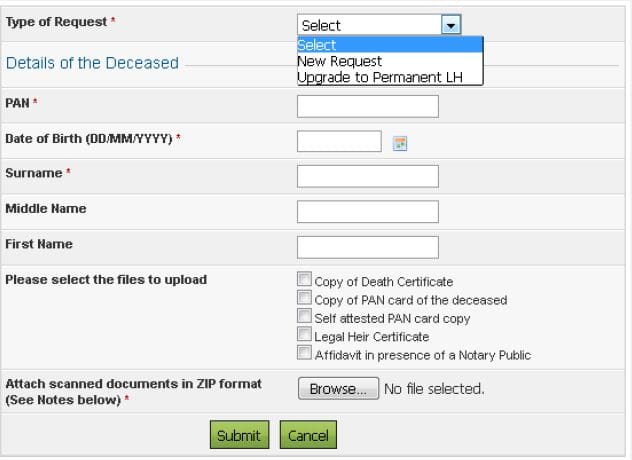

These vary from state to state and even from municipality to municipality so you ll have to check the exact figure with the. Who will file the income tax return or itr on behalf of the deceased. As per indian income tax act 1961 return of income for a deceassed person can be filed after his death. If you inherited an immovable property you ll also need to pay property taxes.

2 there is arrears added to his account on 02 04 2019. When someone dies taxes are not going to be the first thing on the minds of the loved ones left behind. India doesn t have inheritance tax. Sarojini rajah 1974 97 itr 37 mad.

Further you can also file tds returns generate form 16 use our tax calculator software claim hra check refund status and generate rent receipts for income tax filing. According to section 159 of the income tax act 1961 if a person dies then his legal representatives legal heir shall be liable responsible to pay any tax liability of a deceased person. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. There are a lot more of these question bounces in everybody mind in this article you will get all your answers.

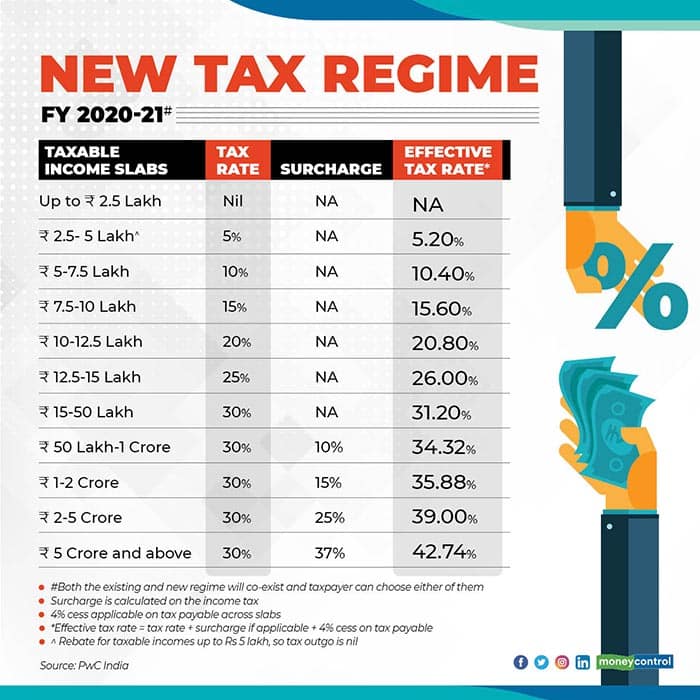

Income tax rebate calculation can be done by a chartered accountant. 04 august 2016 ncome tax liabilities of employee s wife on amount recevied on death of her husband. However you may need to pay income tax capital gains tax and wealth tax on your inheritance. He can filed sue again party motor vehicles act 1988 compensation mr raja seker are and please give me compostion rules.

7 lakhs 3 insurance claim of rs.