Income Tax Bracket History Us

The income tax enables the federal government to maintain the military construct roads and bridges enforce the laws and federal regulations and carry out other duties and programs.

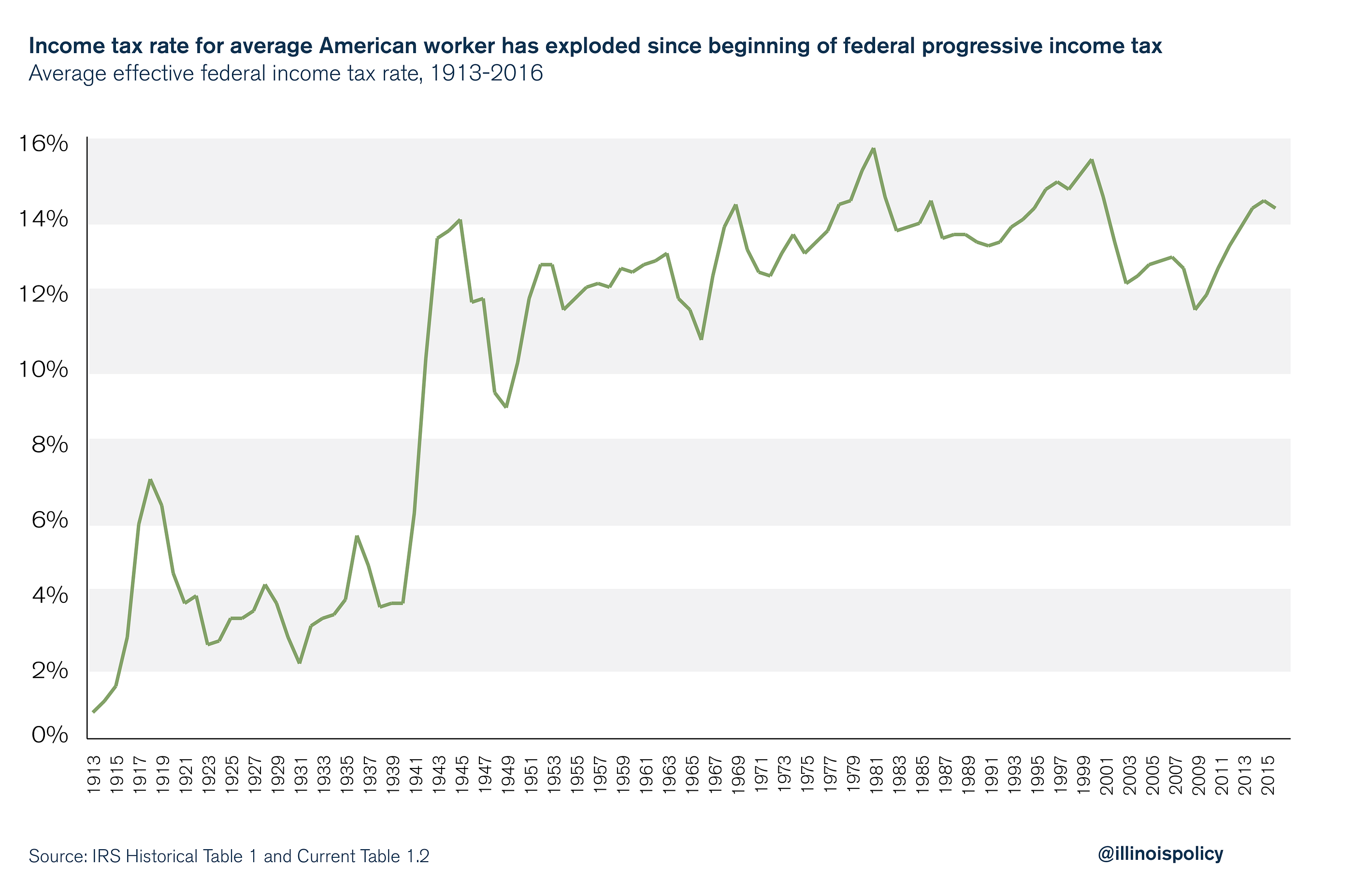

Income tax bracket history us. Here s a look at income tax rates and brackets over the years. For example when the federal income tax was implemented to help finance world war i in 1913 the marginal tax rate was 1 on income of 0 to 20 000 2 on income of 20 000 to 50 000 3 on. Congress sets the rates and a baseline income amount that falls into them when a tax law is created or changed. However the constitutionality of income taxation was widely held in doubt see pollock v.

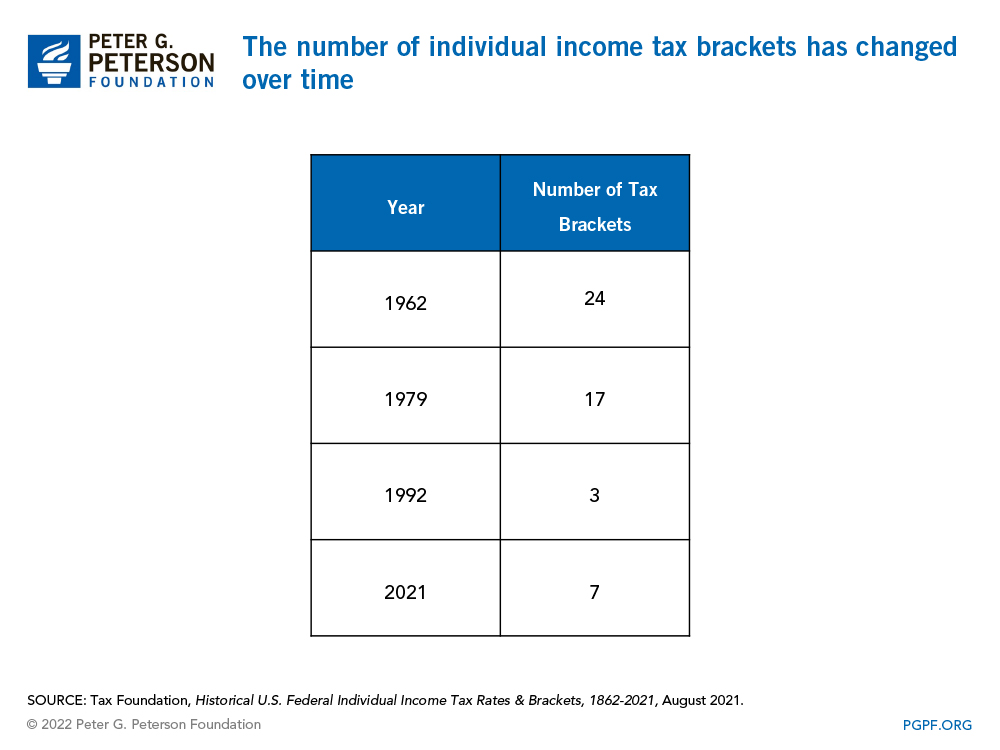

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The history of income taxation in the united states began in the 19th century with the imposition of income taxes to fund war efforts. Personal exemptions and lowest and highest bracket tax rates and tax base for regular tax tax years 1913 2012 soi tax stats historical table 23 internal revenue service. Federal individual income tax rates history 1862 2013 nominal and inflation adjusted brackets october 17 2013 to zoom in print select text or search the following document please use the grey toolbar below.

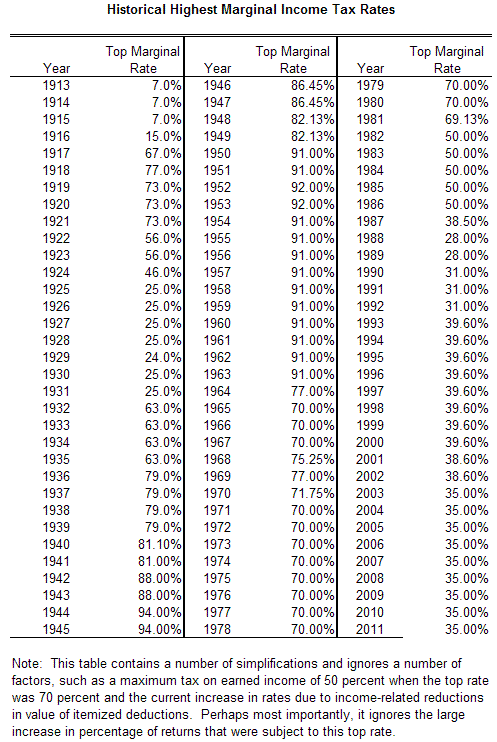

Historical highest marginal personal income tax rates 1913 to 2020. There are seven tax brackets for most ordinary income. 2021 tax rates and income brackets use these. Farmers loan trust co until 1913 with the ratification of the 16th amendment.

The taxes we pay depend on two things. In 1913 the top tax bracket was 7 percent on all income over 500 000 11 million in today s dollars 1. Tax brackets tax brackets tax brackets tax brackets tax brackets tax brackets tax brackets tax brackets tax brackets tax brackets note. And the lowest tax bracket was 1 percent.

Federal individual income tax rates history nominal dollars income years 1913 2013 nominal. Download toprate historical pdf 8 91 kb. Then the internal revenue service adjusts the income brackets each year usually in late october or early november based on inflation. By 1918 government revenue generated from the income tax exceeded 1 billion for the first time and topped 5 billion by 1920.

World war i. Download toprate historical xlsx 12 15 kb. Figures are presented in nominal dollar amounts.