Income Tax Brackets Definition

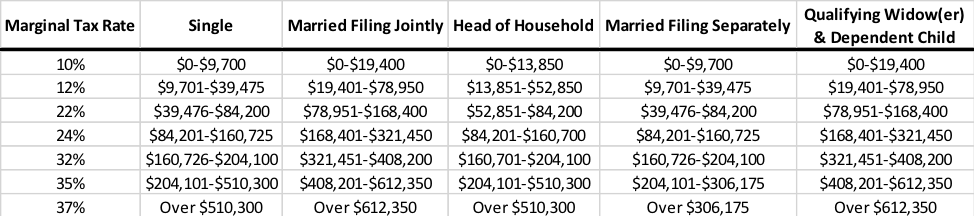

For the highest one the 37 tax rate is for anything made.

Income tax brackets definition. Marginal tax rate the tax rate that would have to be paid on any additional dollars of taxable income earned. Taxes on director s fee consultation fees and all other income. The definition of assessable covers the following. There are seven federal individual income tax brackets.

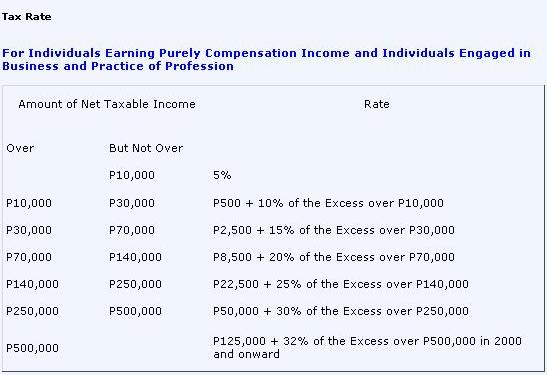

Imposes a progressive tax rate on income meaning the greater the income the higher the percentage of tax levied. A tax bracket is a range of income that is taxed at a specific rate. A tax rate is the percentage at which an individual or corporation is taxed. Employment income in indonesia is subject to tax regardless of where the income is paid.

In kind benefits paid for by the employer such as. A tax rate is a percentage at which income is taxed. Interests dividends and capital gains on securities. Each tax bracket has a different tax rate 10 12 22 etc referred to as the marginal rate.

All forms of earnings are generally taxable and fall under the personal income tax bracket. In a progressive individual or corporate income tax system rates rise as income increases. A tax bracket is the range of incomes taxed at given rates which typically differ depending on filing status. Employment or services rendered.

Tax brackets are the divisions at which tax rates change in a progressive tax system or an explicitly regressive tax system though that is rarer. In addition to salary taxable employment income includes bonuses commissions overseas allowances and fixed allowances for education housing and medical care. One who makes 100 000 per year has a higher marginal tax rate than one who makes 25 000. The federal corporate income tax system is flat.

This ranges from a work salary to. Income tax in thailand is based on assessable income. Essentially tax brackets are the cutoff values for taxable income income past a certain point is taxed at a higher rate. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

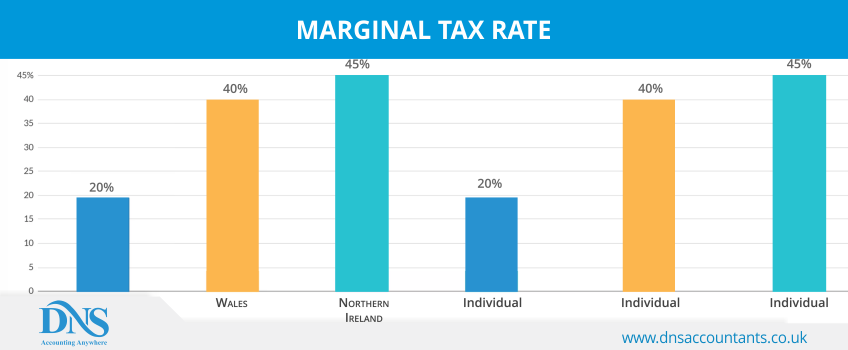

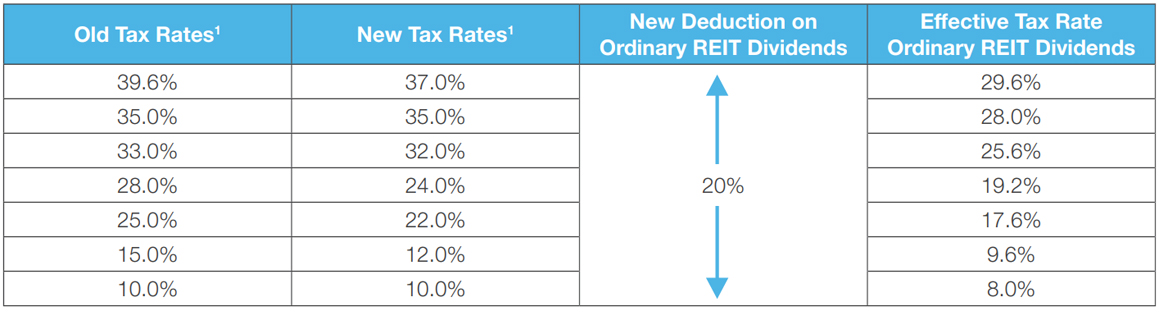

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Marginal tax rate a percentage of one s income that one must pay in taxes. 21 income tax rates. Many of these tax brackets are the same range of income as a single person filing the difference being in the two highest tax brackets.

However the marginal tax.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

:max_bytes(150000):strip_icc()/taxes-5bfc2b3fc9e77c005876f868.jpg)