Income Tax Brackets London

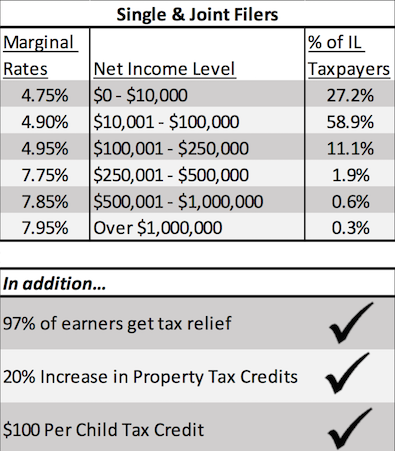

Getty images getty the seven brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Income tax brackets london. Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your. 2 fortunately it s not necessary to wade through these massive libraries to get a basic understanding of how income taxes work. It is almost 75 000 pages long with footnotes. The irs used to use the consumer price index cpi as a measure of inflation prior to 2018.

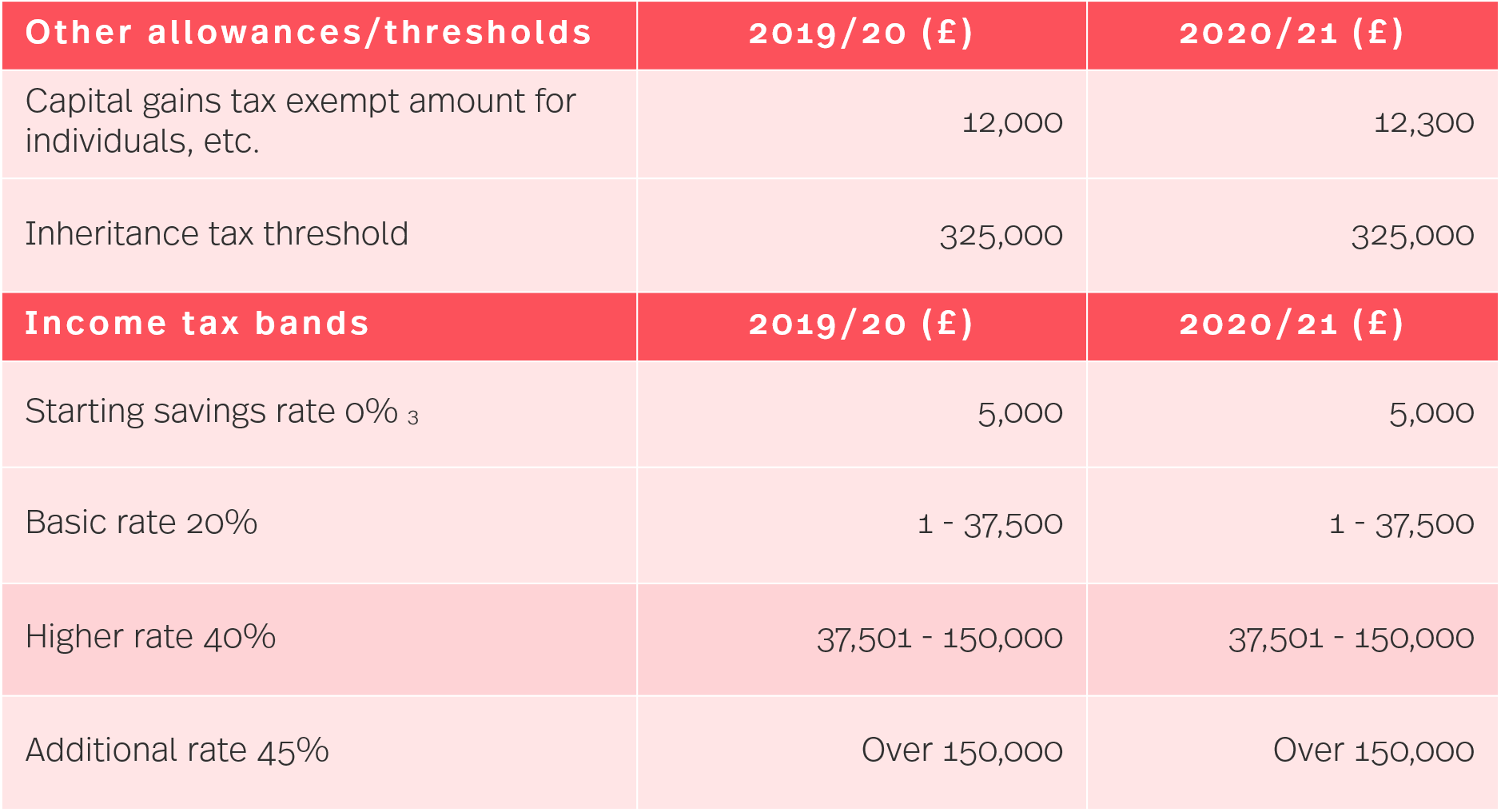

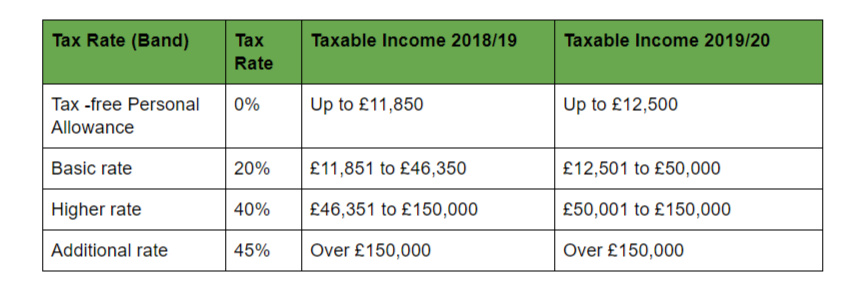

Each person has an income tax personal allowance and income up to this amount in each tax year is free of tax. This is done to prevent what is called bracket creep when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation instead of any increase in real income. The irs has released the new income tax brackets for 2021 credit. For the 2019 20 tax year the tax free allowance for under 65s.

The new tax year in the uk starts on 6 april 2020. If you need the tax rates for next year click the link to get the current 2020 21 uk income tax rates. However the couple s total federal tax would be 36 289 just under 20 of their adjusted gross income. Below is a look at the uk income tax rates for 2019 20.

How much income tax someone pays in each tax year from 6 april to the 5 april the following year. London tw9 4du or email. The irs also announced that the standard deduction for tax year. How are income tax rates changing in 2019 20.

Understanding marginal income tax brackets. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12 500. The scottish parliament has full control over income tax rates and thresholds on all non savings and non dividend income liable for tax by taxpayers resident in scotland. By any measure the tax code is huge.

Each dollar over 168 400 or 31 600 would fall into the 24 federal income tax bracket. Say a married couple filing jointly in 2019 had a taxable income of 200 000. We ll also explain how these changes will affect your tax bill. The government announces changes to income tax in the autumn budget.

And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. The above rates apply to taxable income after the standard deduction or itemized deductions and other tax breaks have been taken. Income tax bands are different if you live in scotland. This is a hypothetical example used for illustrative.