Income Tax Brackets Luxembourg

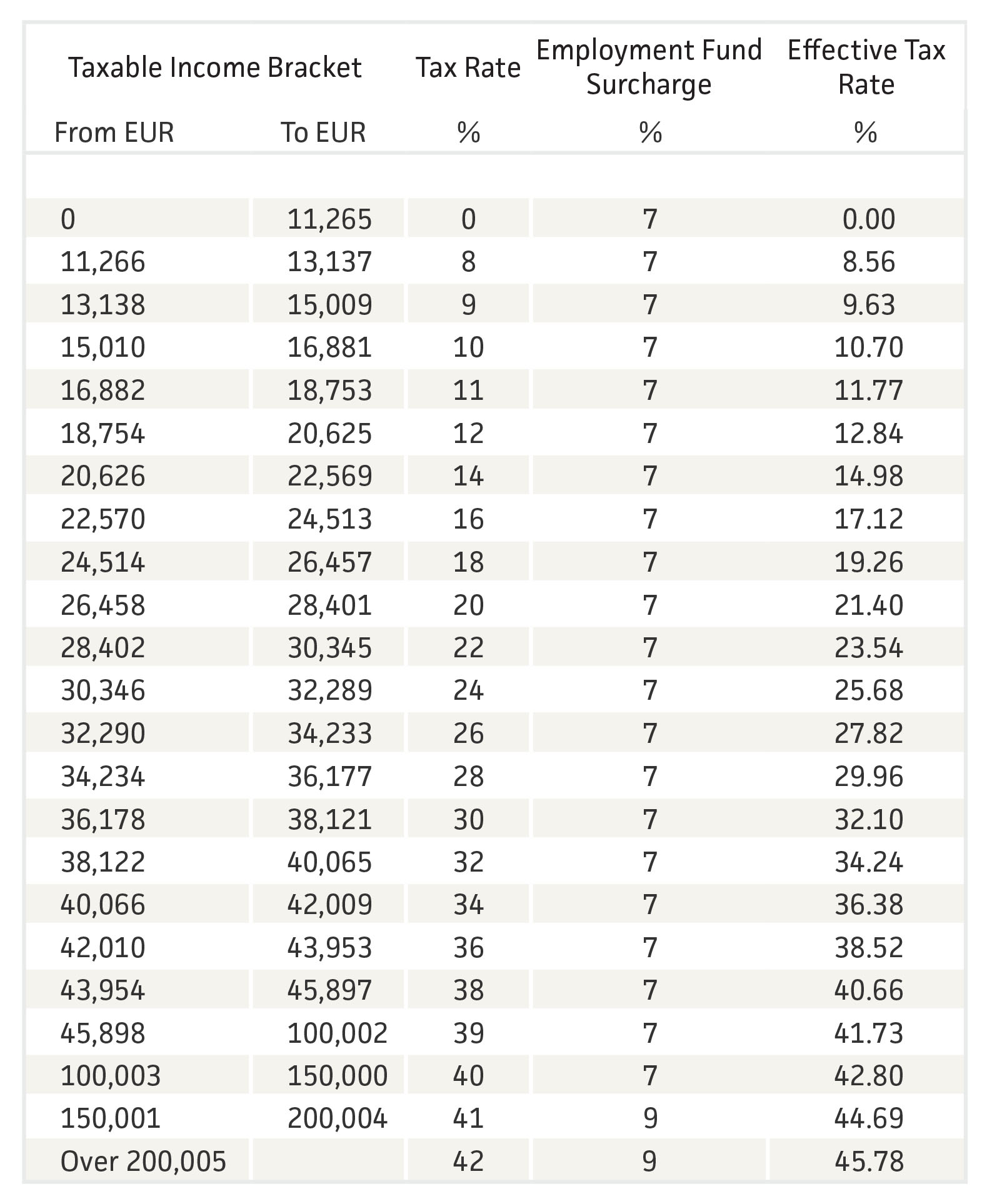

Income tax in luxembourg is charged on a progressive scale with 23 brackets which range from 0 to 42.

Income tax brackets luxembourg. How does the luxembourg tax code rank. The first 11 265 is offered tax free with the lowest rate of 8 kicking in thereafter. Icalculator lu excellent free online calculators for personal and business use. Personal income tax rate in luxembourg averaged 43 43 percent from 1995 until 2020 reaching an all time high of 51 30 percent in 1996 and a record low of 39 percent in 2002.

While this top rate might sound high it remains lower than the likes of neighboring countries such as belgium. Review the full instructions for using the luxembourg salary after tax calculators which details luxembourg tax. This page provides luxembourg personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Luxembourg has a bracketed income tax system with seventeen income tax brackets ranging from a low of 0 00 for those earning under 11 265 to a high of 38 00 for those earning more then 39 885 a year.

For this purpose individuals are granted a tax class. Luxembourg has one of the most complicated income tax systems in europe with three tax classes and 23 different brackets ranging from 0 up to 42. Personal income tax rates. The calculator is designed to be used online with mobile desktop and tablet devices.

Workers must also pay between 7 and 9 as an additional contribution to the employment fund. They vary from 0 up to 42. What are the basic principles of income taxation in luxembourg. A 7 surcharge for the employment fund applies on the income tax due.

Tax rates income tax rates are progressive. The first step towards understanding the luxembourg tax code is knowing the basics. Find answers to these questions and many more in the new 2020 issue of our luxembourg income tax guide. How does the luxembourg income tax compare to the rest of the world.

Individual income tax is levied on the worldwide income of individuals residing in luxembourg as well as on luxembourg source income of non residents. Luxembourg income tax liability is based on the individual s personal situation e g. The net income is then reduced by various deductions in order to determine the taxable income. The annual wage calculator is updated with the latest income tax rates in luxembourg for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income.

Review the 2020 luxembourg income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in luxembourg. Below we have highlighted a number of tax rates ranks and measures detailing the income tax business tax consumption tax property tax and international tax systems. How am i taxable as a non resident taxpayer.