Income Tax Brackets Quebec 2018

Learn about income tax returns consumption taxes and the programs and credits for individuals self employed persons and members of a partnership.

Income tax brackets quebec 2018. 2019 quebec income tax brackets 2019 quebec income tax rate. Calculate the total income taxes of the quebec residents for 2018 including the net tax income after tax tax return and the percentage of tax. Income tax rates and income thresholds. For 2018 the income tax rate applicable to the first taxable income bracket which includes taxable income of not more than 43 055 has been decreased from 16 to 15.

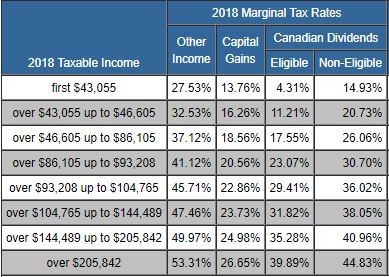

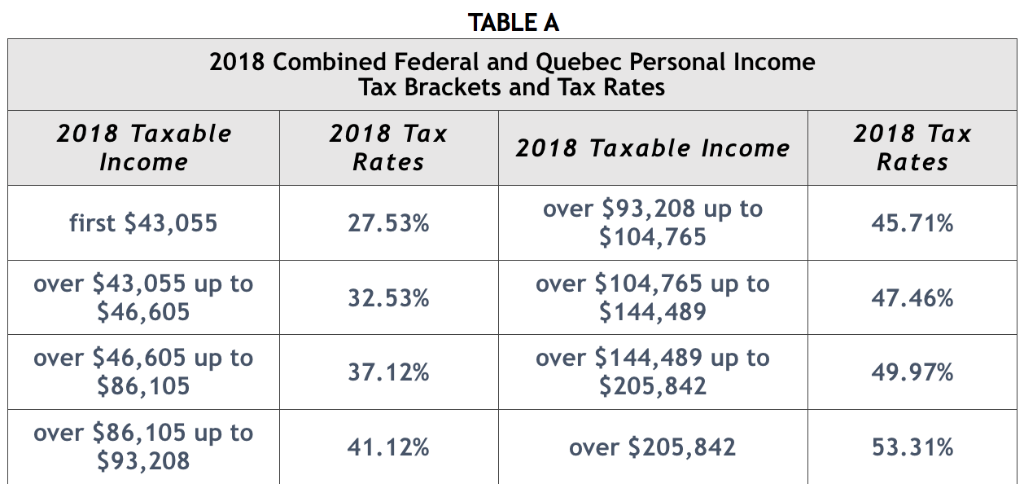

The quebec basic personal is rounded to the nearest 1 beginning with the 2018 taxation year. Income tax rates for 2017. Quebec federal tax3 taxable income2 excess rate on provincial tax taxable income2 taxable income2 combined tax rates on dividend income 20181 1. If your income after federal deductions is more than 43 055 but less than 86 105 the first 43 055 needs to pay 15 00 and the income over 43 055 portion.

The 2018 marginal tax rates for eligible and non eligible dividends reflect the rates that are in effect after march 27 2018 as announced in the quebec 2018 budget. The quebec november 21 2017 economic plan update reduced the 2017 personal tax credit rate and lowest tax bracket rate to 15 a further reduction from the quebec 2017 budget. 2018 personal income tax rates québec marginal rate taxable income federal tax québec tax total tax average rate for non eligible dividends received or deemed to have been received from january 1 to march 27 2018 the gross up is 16 the federal tax credit is 10 03 and the provincial tax credit is 7 05. The tax rates reflect budget proposals and news releases to 15 june 2018.

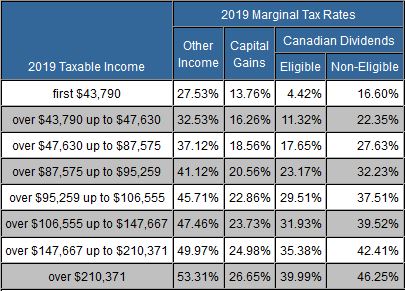

The income thresholds for all the brackets have been indexed. In 2017 quebec provincial income tax brackets and provincial base amount was increased by 0 74. All other income tax rates remain unchanged. Your situation low income owner parent student support payments.

Find out more selected subsection. The period reference is from january 1st 2018 to december 31 2018. 25 75 these amounts are adjusted for inflation and other factors in each tax year. Quebec reduced personal income tax rate for income lower then 42 705 from 16 to 15 basic personal amount in quebec for year 2017 is 14 890.