Income Tax Calculator Guyana

Review the full instructions for using the guyana salary after tax calculators which details guyana tax allowances.

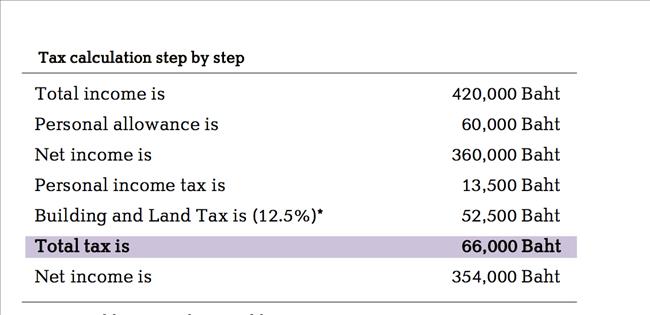

Income tax calculator guyana. The calculator is designed to be used online with mobile desktop and tablet devices. The calculator is designed to be used online with mobile desktop and tablet devices. The annual wage calculator is updated with the latest income tax rates in guyana for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income. Individuals with chargeable income of less than gyd 1 560 000 per annum pay tax at the rate of 28.

The calculator is designed to be used online with mobile desktop and tablet devices. Guyana revenue authority 200 201 camp street georgetown guyana. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. Savings calculators savings calculatoruse this calculator to determine how much you can earn by saving a little each month launch calculator loan calculator loan installment calculatorplanning to buy a car renovate your home or need a loan for medical expenses.

Nis non taxable allowance chargeable income and the taxes deducted as per the 28 and 40 tax bands are generated automatically. Review the full instructions for using the guyana salary after tax calculators which details guyana tax. 592 227 6060 or 592 227 8222. The monthly wage calculator is updated with the latest income tax rates in guyana for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income.

The year to date calculations e g. File an income tax return. The following changes will be applied to the assessment of income tax for the year 2020. You can enter the gross income paid to an employee as per the different pays and period stated above.

Seven hundred and eighty thousand guyana dollars g 780 000 or one third of the individual s income earned on an annual basis will be allowed as a deduction or free pay to determine the chargeable income i. The annual wage calculator is updated with the latest income tax rates in guyana for 2020 and is a great calculator for working out your income tax and salary after tax based on a annual income. Where their chargeable. Zero rated exempt supplies.

This calculator will help you determine the monthly installment on the loan amount that you desire launch. Present in guyana for at least 183 days in the calendar year will be entitled to a personal allowance of 780 000 guyanese dollars gyd or 1 3 of their income per annum whichever is greater. Calculate your income tax in guyana salary deductions in guyana and compare salary after tax for income earned in guyana in the 2020 tax year using the guyana salary after tax calculators.