Income Tax Calculator Take Home Pay

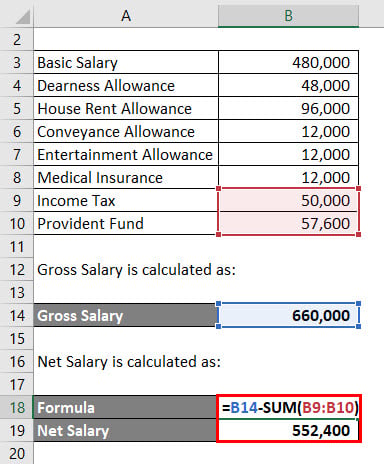

Your average tax rate is 32 90 and your marginal tax rate is 49 40 this marginal tax rate means that your immediate additional income will be taxed at this rate.

Income tax calculator take home pay. Why not find your dream salary too. With all this in mind the total amount that you would take home is 33 825 50. Personal income tax calculator 2019. Enter rrsp contributions.

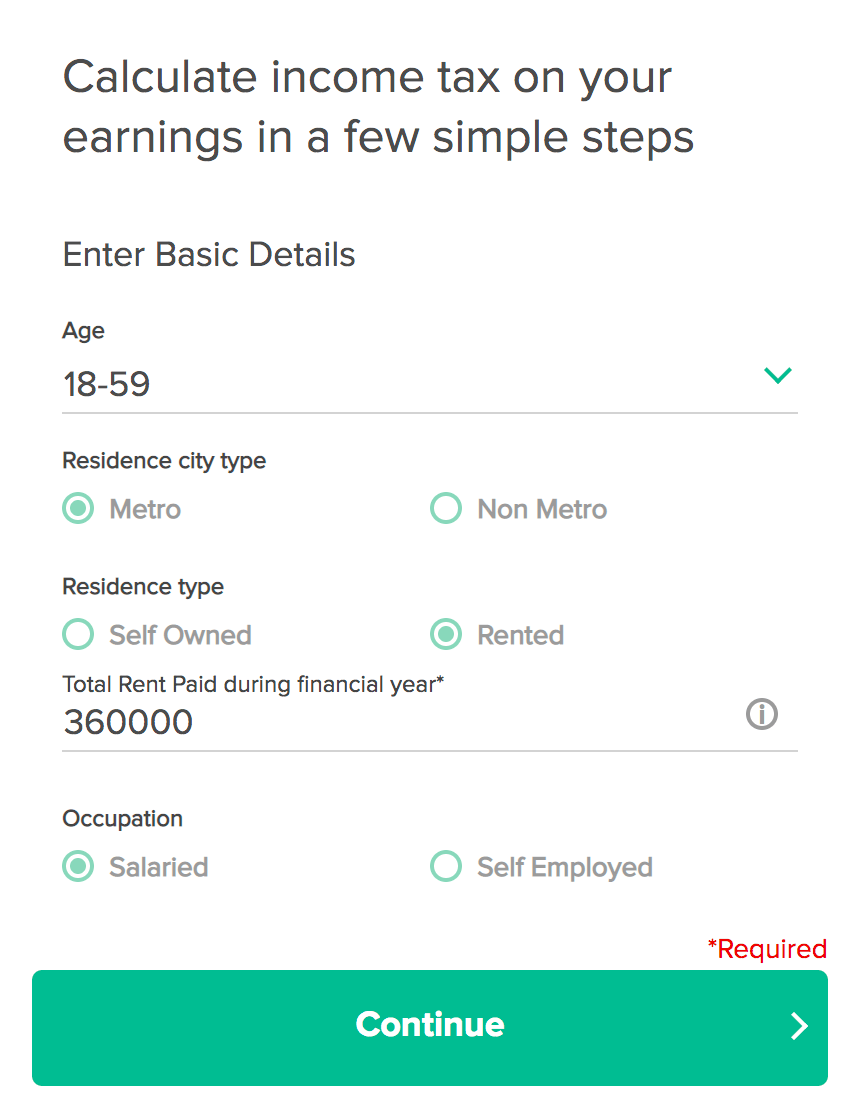

Sars income tax calculator for 2021 work out salary tax paye uif taxable income and what tax rates you will pay. This calculator is always up to date and conforms to official australian tax office rates and formulas. Can be used by salary earners self employed or independent contractors. Estimate your earned income tax credit eic or eitc for 2020 tax year with our eic calculator.

Your average tax rate is 23 00 and your marginal tax rate is 35 26 this marginal tax rate means that your immediate additional income will be taxed at this rate. Tax free childcare take home over 500 mth. If you make 52 000 a year living in the region of ontario canada you will be taxed 11 959 that means that your net pay will be 40 041 per year or 3 337 per month. The latest budget information from april 2020 is used to show you exactly what you need to know.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the u s. Enter canadian dividends enter eligible dividends enter self employment income. Hourly rates weekly pay and bonuses are also catered for. The salary calculator tells you monthly take home or annual earnings considering uk tax national insurance and student loan.

Simply select the appropriate tax year you wish to include from the pay calculator menu when entering in your income details. Which tax year would you like to calculate. The total federal tax that you would pay is 6 174 50 equal to your income tax on top of your medicare and social security costs. Uniform tax rebate up to 2 000 yr free per child to help with childcare costs.

This must be the entire amount including all benefits that your boss pays you. What is your total salary before deductions. If you make 40 000 a year living in finland you will be taxed 13 160 that means that your net pay will be 26 840 per year or 2 237 per month. Budget 2020 21 update this calculator has now been updated with tax changes set out in the october 2020 budget.

11 income tax and related need to knows. The money pay calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015 2016 tax year to the most recent tax year 2019 2020. Free tax code calculator transfer unused allowance to your spouse. Check your tax code you may be owed 1 000s.