Income Tax Calculator Tennessee

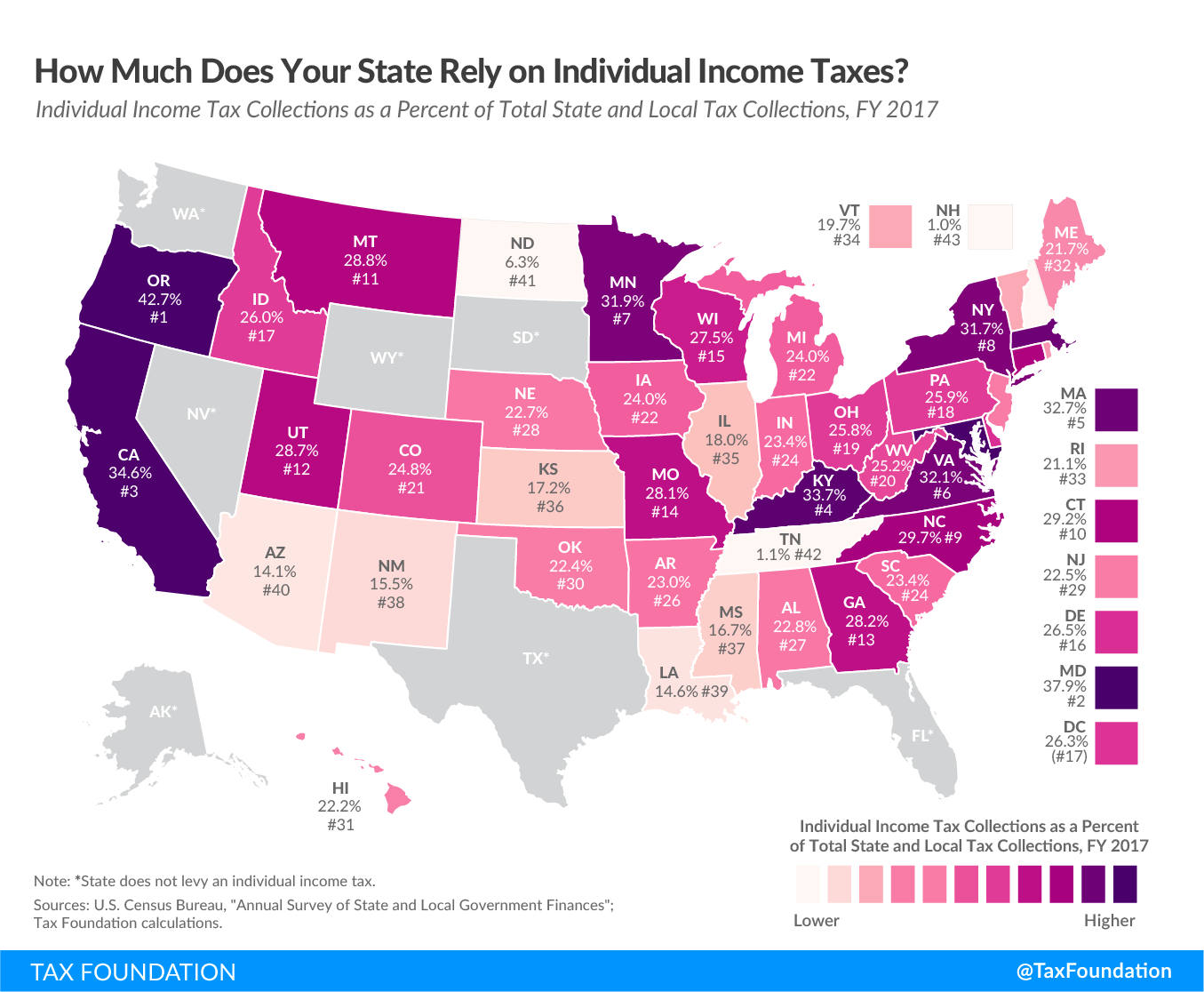

The state has a flat 1 tax rate that applies to income earned from interest and dividends though.

Income tax calculator tennessee. If you make 55 000 a year living in the region of tennessee usa you will be taxed 9 482 that means that your net pay will be 45 518 per year or 3 793 per month. Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. This breakdown will include how much income tax you are paying state taxes. To use our tennessee salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

The state does levy the hall income tax though named after the tennessee state senator who sponsored the legislation in 1929. After a few seconds you will be provided with a full breakdown of the tax you are paying. Tennessee has no state income tax on salaries wages bonuses or any other type of income for work. No tennessee cities have local income taxes.

In 2019 the tax was 2.