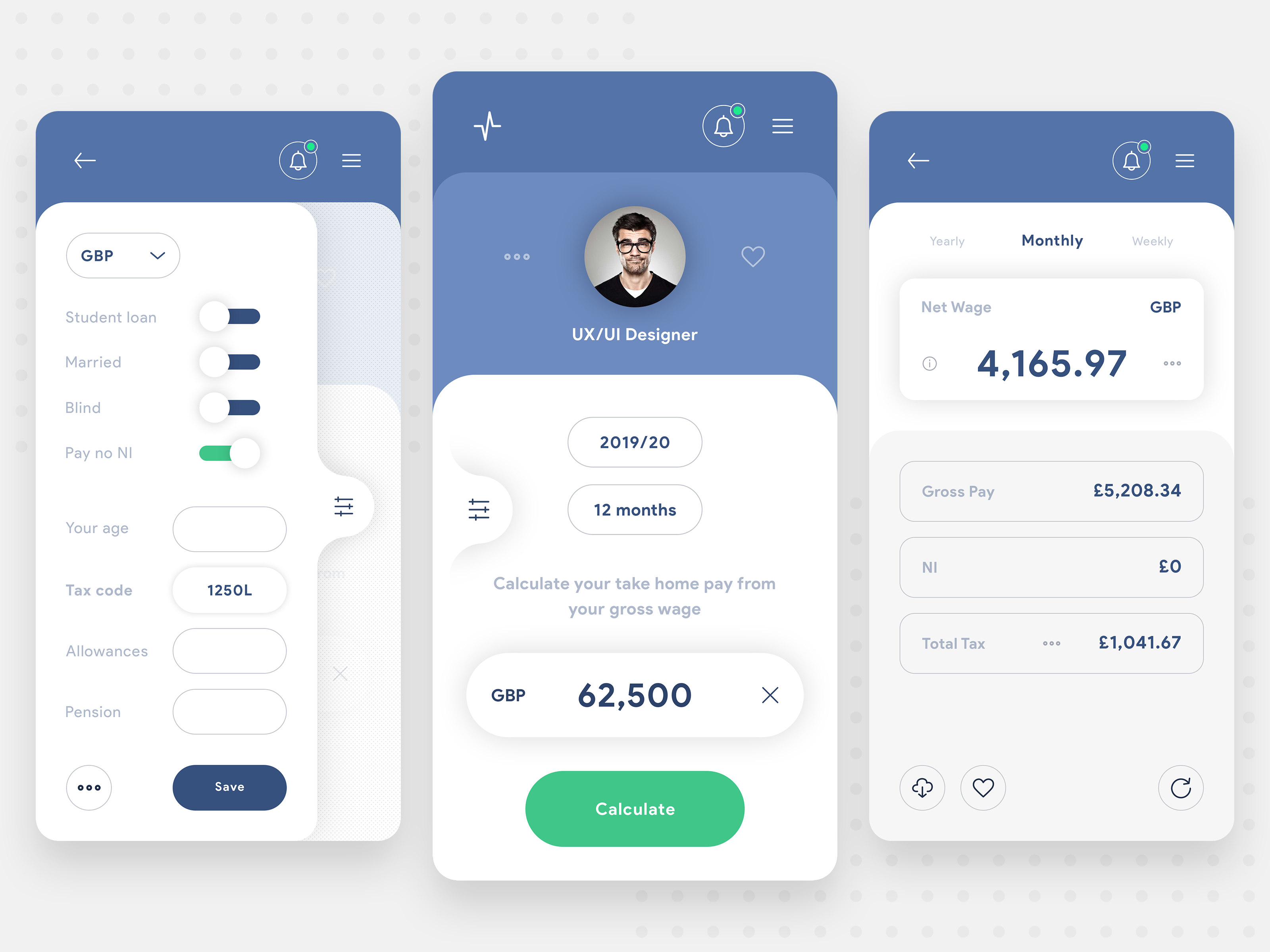

Income Tax Calculator Vancouver

This is income tax calculator for british columbia province residents for year 2012 2019.

Income tax calculator vancouver. This calculator include the non refundable personal tax credit of basic personal amount. Your average tax rate is 23 00 and your marginal tax rate is 35 26 this marginal tax rate means that your immediate additional income will be taxed at this rate. Your 2019 british columbia income tax refund could be even bigger this year. If you make 52 000 a year living in the region of ontario canada you will be taxed 11 959 that means that your net pay will be 40 041 per year or 3 337 per month.

Rates are up to date as of april 28 2020. Enter your annual income taxes paid rrsp contribution into our calculator to estimate your return. These calculations are approximate and include the following non refundable tax credits. The period reference is from january 1st 2020 to december 31 2020.

This tax calculator is used for income tax estimation please use intuit turbotax if you want to fill your tax return and get tax rebate for previous year. The basic personal tax amount cpp qpp qpip and ei premiums and the canada employment amount. After tax income is your total income net of federal tax provincial tax and payroll tax.