Is Passive Income Eligible For Qbi

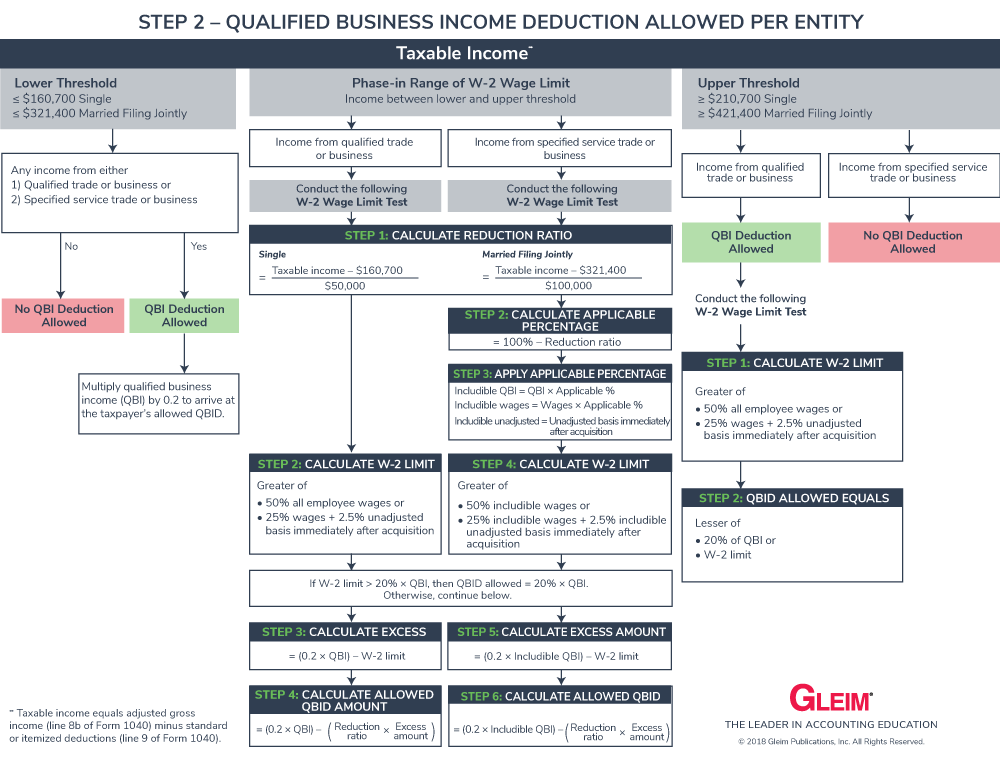

Therefore the only difference in calculation is the use of alternative minimum taxable income before the qbi deduction instead of regular taxable income before the qbi deduction.

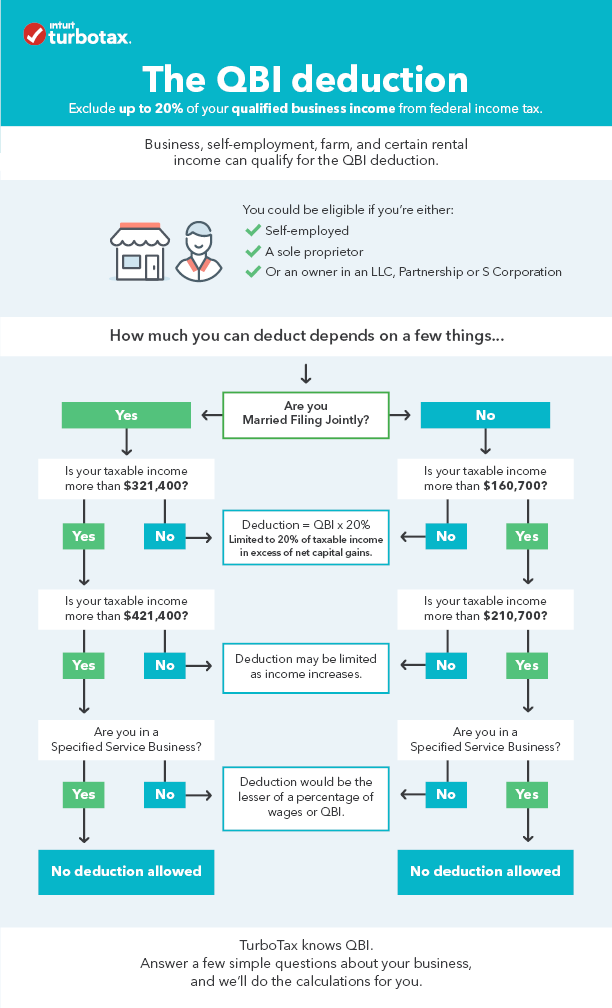

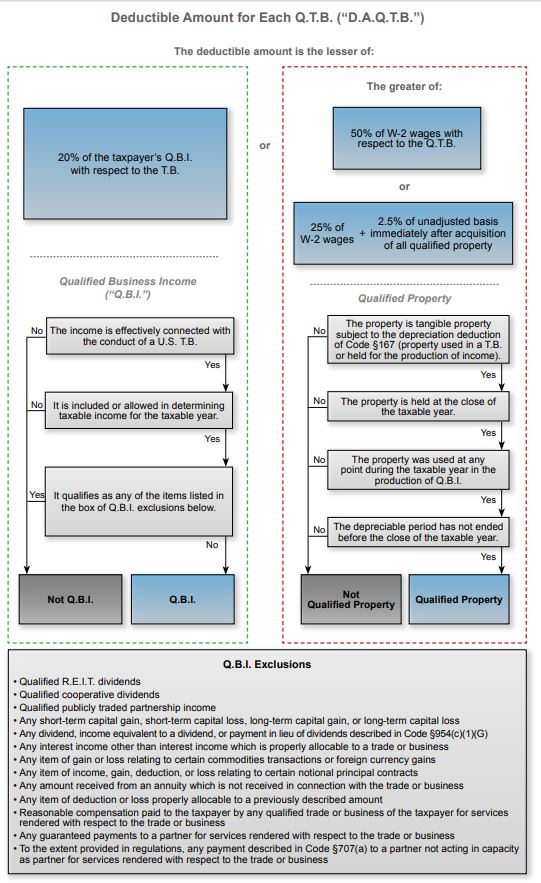

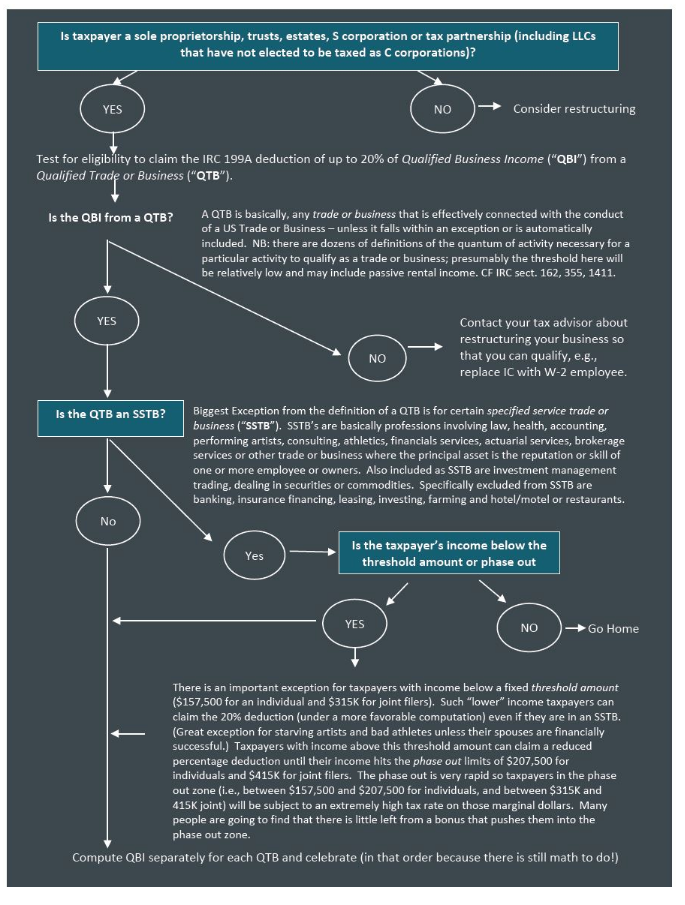

Is passive income eligible for qbi. In determining if a rental activity is eligible for the qbi deduction many commentators recommended linking the qbi income deduction to material participation. The preamble to the final irc 199a regulations highlight that the u s. Learn if your business qualifies for the qbi deduction of up to 20. Regardless if you are in a specified service trade or business and your taxable income exceeds your applicable limit the items taken into account in figuring the qualified business income deduction qbi w 2 wages the.

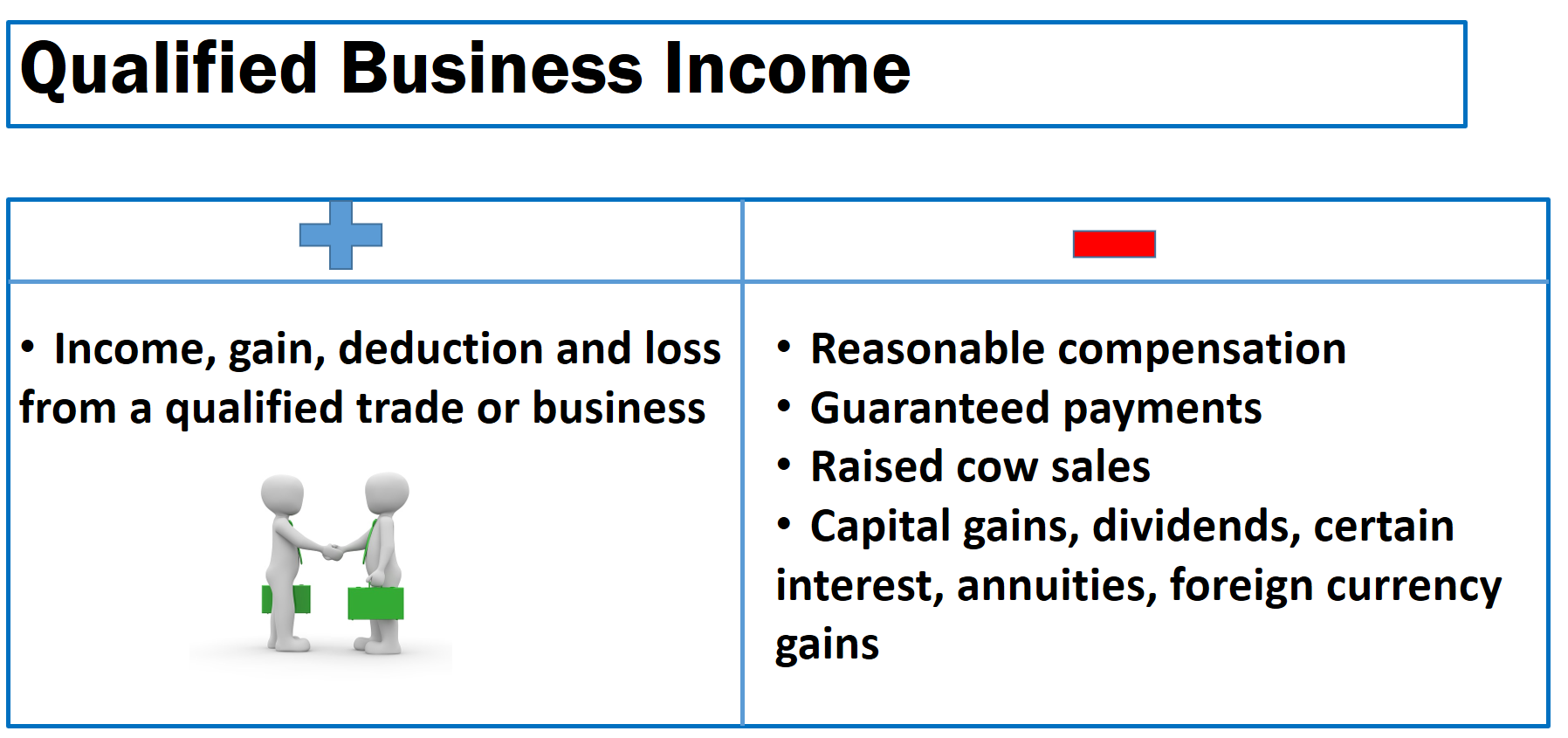

Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income qbi plus 20 percent of qualified real estate. Income from these types of rentals is specifically excluded for the purposes of the qbi deduction. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi.

When doing tax planning for 2019 it is important to make sure qbi is not inadvertently lowered by used. Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year. Department of the treasury treasury intentionally did not link irc 199a to a requirement for material.