Net Income Approach Problems And Solutions

Our tutors can break down a complex net operating income approach problem into its sub parts and explain to you in detail how each step is performed.

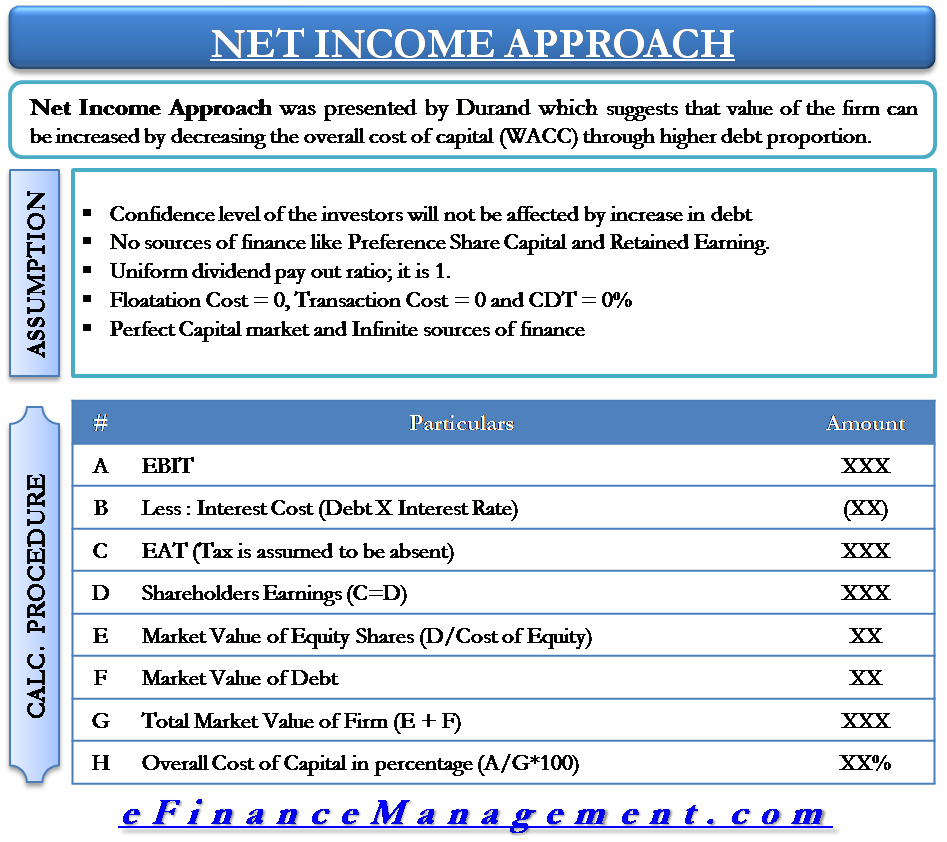

Net income approach problems and solutions. Mehta company limited is expecting an annual ebit of rs. Net income approach and net operating income approach were proposed by david durand. 5 00 000 in 10 debentures. According to ni approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm.

According to this approach the value of the firm is increase and decrease overall cost of capital by increasing the proportion of debt financing in capital structure. The company has rs. That is the total exports minus total imports. Compute the value of the firm.

Capital structure is the proportion of debt and equity in which a corporate finances its business. Net income approach illustration 1. However from the balance sheet you can also calculate net income as total net worth plus cash dividends less issued stock. Ebit 50 000 wacc overall capitalization rate 12 5.

And while calculating national income you need to calculate the net exports nx. As a result the entire equity balance is due to net income. Problems solutions posted in questions by james hobert on september 11 2018 her owner s equity decreased by 14 000 for the operating expenses recorded on august 10th by 400 for the interest expense recorded on august 24th and by 10 000 for the cash dividend recorded on august 29th. Using the expenditure approach national income can be represented as.

The cost of equity capital or capitalization rate is 12 5. You usually calculate total net income as total revenues less total expenses. Net income approach by. The capital structure of a company firm.

Now while calculating national income using the expenditure approach you need to also deduct depreciation on capital assets and indirect taxes. Net income ni approach this theory was propounded by david durand and also known as fixed ke theory. Net income approach suggests that value of the firm can be increased by decreasing the overall cost of capital wacc through higher debt proportion. Net income approach 1.

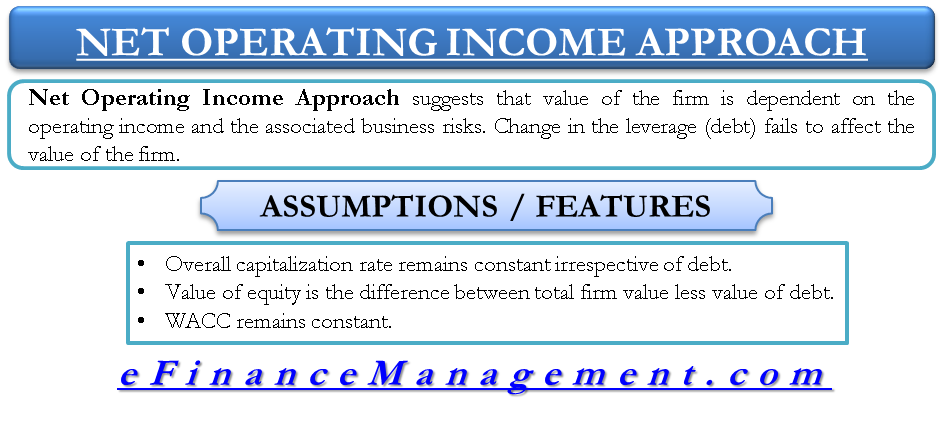

Cost of preference share capital. This approach of breaking down a problem has been appreciated by majority of our students for learning net operating income. At a price that is easy on your pocket you can get to finish your assignment on time and you ll be able to learn new tricks to answering common accounting problems as well. There are various theories which propagate the ideal capital mix capital structure for a firm.

In this problem there are no cash dividends and no new stock issued.