Net Investment Income Tax And Passive Activities

As with most items relating to the internal revenue code there is an exception.

Net investment income tax and passive activities. If that passive business income activity can be grouped with other business activities so as to achieve material participation the niit can be eliminated. Income from passive activities including rental real estate may also be subject to the 3 8 medicare contribution tax on net investment income. Interest dividends annuities royalties and rents less properly allocated deductions. Passive business income in pre 2013 tax years and would now face the niit on that passive business income beginning in 2013.

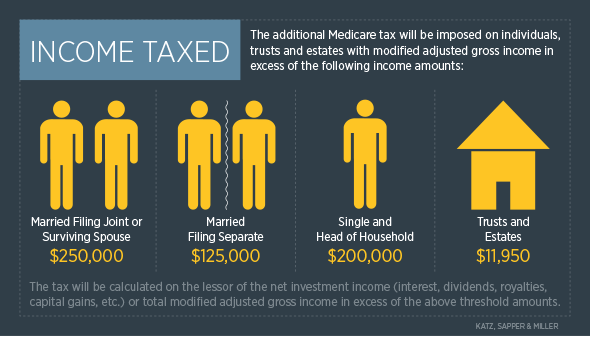

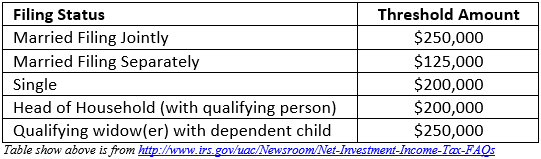

However this opportunity cannot be viewed solely within the confines of the nii tax. In our last few tax letters we have discussed passive activities versus nonpassive activities in the context of the 3 8 percent net investment income nii tax. 1411 imposes the 3 8 percent net investment income tax niit on the net investment income of individuals trusts and estates. Rental activities are inherently passive according to the irs pending a few exceptions.

Gross income from a trade or business that is a passive activity. Since 2013 an additional 3 8 percent tax has been assessed on various types of investment income including passive activities. For the purposes of niit net investment income nii is defined as the following items. As mentioned above income from passive activities is generally included in net investment income and is subject to the niit.

Gross income from a trade or business of trading in financial. If you can increase level of participation in an activity so that the business income becomes non passive the tax can be avoided. And if you hold rental real estate investments the losses are passive even if you materially participate unless you qualify as a real estate professional. This grouping is under the.

In addition any income from a passive trade or business activity is always net investment income regardless of its character. So a taxpayer with income from a partnership or s corporation will generally include all of it in net investment income if the activity is a passive activity with respect to the taxpayer. Passive activities that generate net investment income include notably real estate rental activities. Passive activities are trades or businesses in which the taxpayer does not materially participate and or rental activities.

Therefore a taxpayer must materially participate in a trade or business to be considered active active income test. Effective january 1 2013 code sec.