Passive Income Foreign Tax Credit

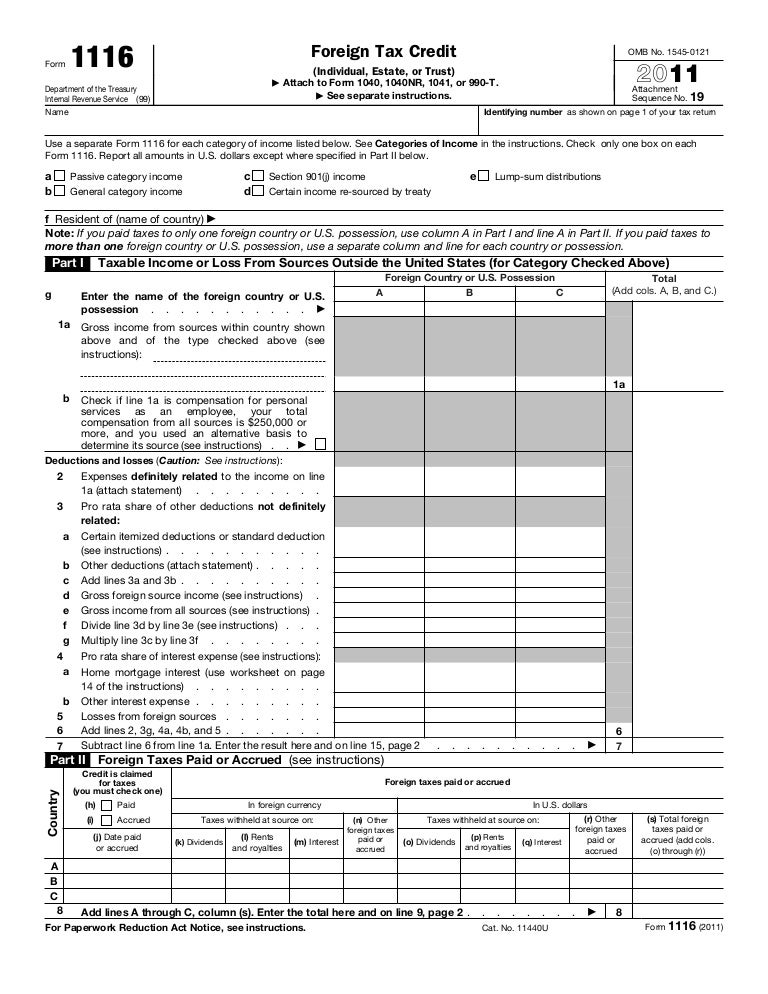

Single filers who paid 300 or less in foreign taxes and married joint filers who paid 600 or less can omit filing the foreign tax credit form.

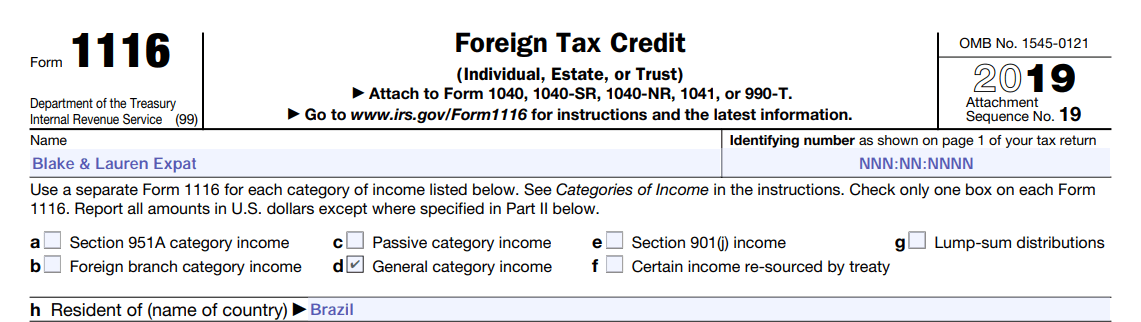

Passive income foreign tax credit. 3 foreign branch income. The foreign tax credit is usually calculated using irs form 1116. You can t take a carryover on unused tax credit based on wage income and use it to offset new taxes from dividend income for example. However you are not always required to use this form.

This includes carryover taxes too. If all of your foreign taxed income was 1099 reported passive income such as interest and dividends you don t need a 1116 provided that any dividends came from stock you owned for at least 16 days. Since the foreign taxes paid on passive income has covered the entire portion of us taxes imposed on passive income part iv of the form 1116 will be empty. Your only foreign source gross income for the tax year is passive income as defined in publication 514 under separate limit income.

If you sell a property and make a profit from the sale this is a passive income. Person is subject to double taxation when income from foreign sources is taxed both by the united sates and by the foreign country in which the income is earned. The carryfoward rule also applies to excess passive credits. The same goes for passive income like interest income and the same goes for wages.

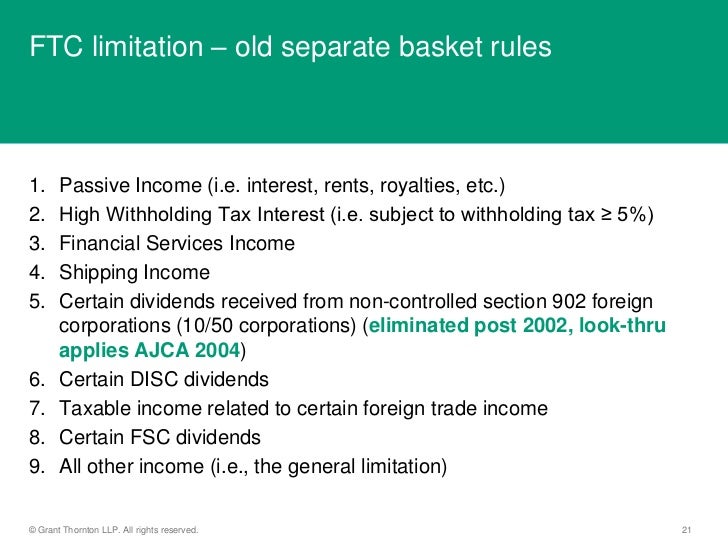

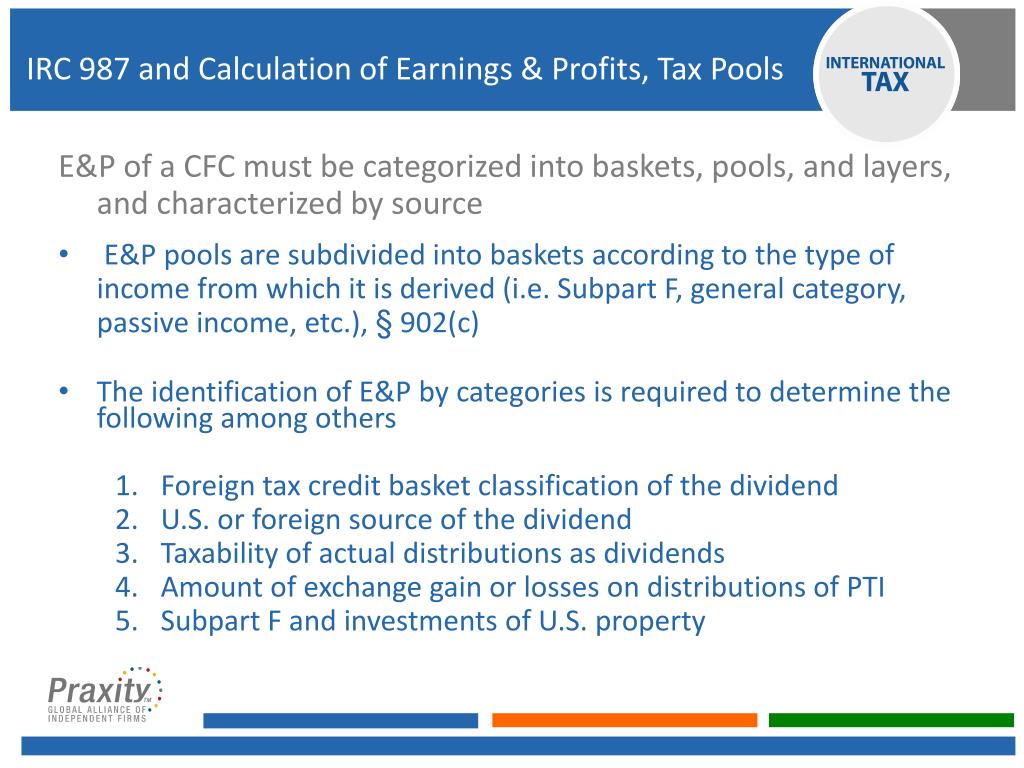

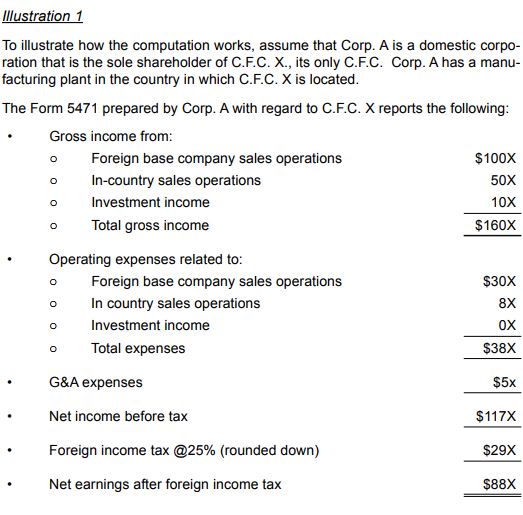

And 4 gilti income. All of the gross income from the foreign source including interest and dividends was passive income. There are currently five baskets for calculating foreign tax credits. If you receive foreign source distributions from a mutual fund or other regulated investment company that elects to pass through to you the foreign tax credit in most cases the income is considered passive.

The high tax kickout rule applies when the effective tax rate for foreign source income allocated to the passive basket exceeds the greatest u s. You can also make passive income from gains in foreign currency or commodities transactions. You can generally claim the credit without using form 1116 if all of the following conditions are met. Your qualified foreign taxes for the tax year are not more than 300 600 if filing a joint return.

For example current year passive losses in excess of passive income are carried forward to the next tax year. Capital gains that occur without active trade or sales are considered passive income. Foreign taxes paid on capital gains can only be used in the us toward capital gains tax. The rules for passive losses are similar in some ways to those for passive credits.

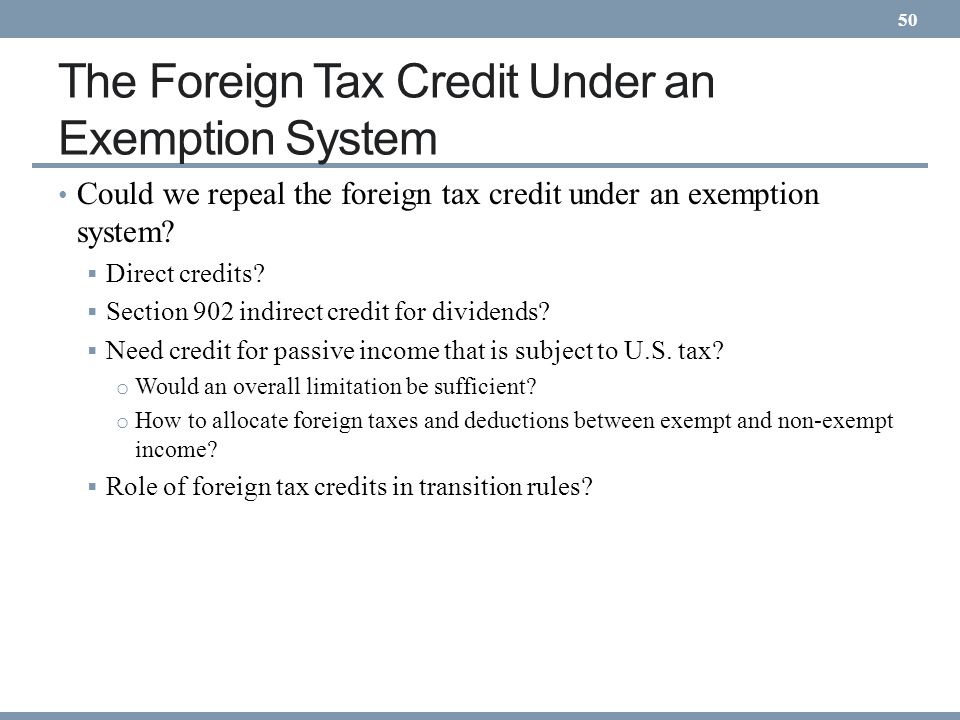

The purpose of the foreign tax credit ftc is to provide relief from double taxation. Foreign branch category income. You can t mix and match.