Passive Income Tax Bill

Gee that sure beats the 40 tax treatment on an extra work shift in december.

Passive income tax bill. The cumulative tax bill above is 1 835 on 14 373 of gross annual passive income yielding a blended passive income tax rate of 13 on my personal lineup of passive investments. Other forms of passive income like intellectual rights or intellectual property to things such as a song book or patent are paid or affiliate income earned from websites are treated identically to actively earned income in the eyes of the tax office. Dividend paying stocks and other investments. The federal government has recently introduced a bill into parliament to ensure that companies with more than 80 passive income will not qualify for the reduced 27 5 company tax rate otherwise available to companies that carry on a business and have an aggregated turnover below the prescribed relevant threshold 25 million for 2017 2018.

Other forms of taxable passive income in australia. The first passive income idea on this list does take some start up cash but it absolutely helps me earn more than 1 000 per month. The federal income tax rate on unearned income varies from one type of passive income to another. In canada the canada revenue agency cra is always quick to recognize any taxable income and adds to your tax bill.

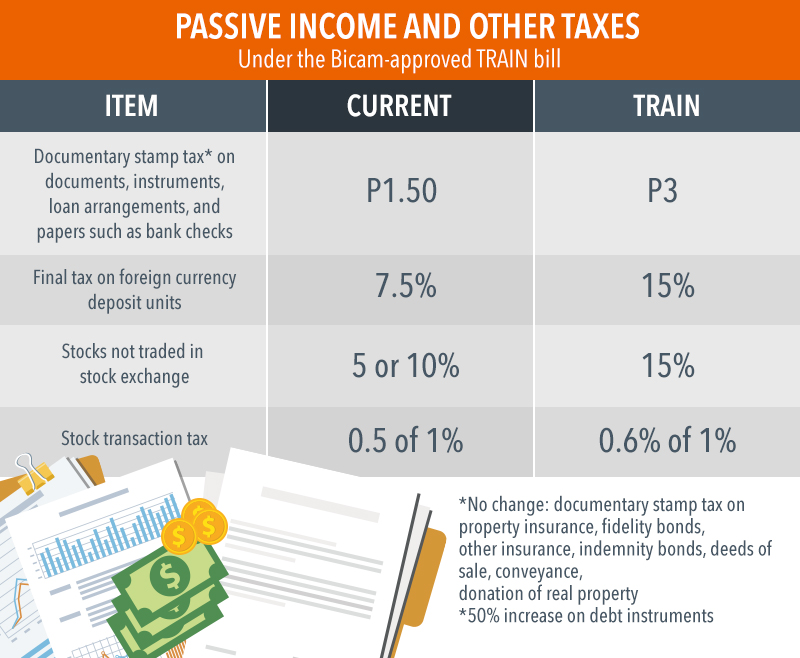

The tax reform act of 1986 tra was passed by the 99th united states congress and signed into law by president ronald reagan on october 22 1986. The passive income and financial intermediary tax act pifita bill is the 4th package of the duterte administration. Provided the bill passes both houses of parliament it will apply prospectively from the 2017 18 income year commencing on 1 july 2017. The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to 28 percent.

Note that the tax rate for passive income will differ for the 2018 tax year as the new tax bill signed in december 2017 changes some of these provisions. Current eligibility a company is eligible for the concessional tax rate if it is. The tax reform act of 1986 was the top domestic priority of president reagan s second term. This bill proposes that corporate entities with no more than 80 passive income will be eligible for the lower corporate tax rate.