Passive Income Tax Rate Bc

Net tax rate on active business income up to 500 000.

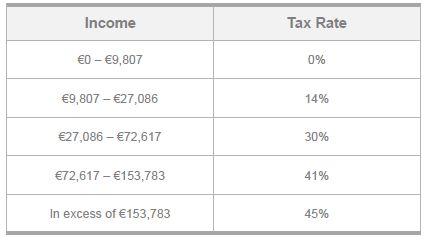

Passive income tax rate bc. Effective tax rate on income eligible for the small business deduction. Short term passive income tax rates. Tax rates are applied on a cumulative basis. It is set up as a progressive tax system similar to other jurisdictions in canada and you pay more in taxes as your taxable income increases.

At 150 000 of passive income none of the active business income will qualify for the small business tax rate. 10 12 22 24 32 35 and 37. The current tax rates for short term gains are as follows. The combined federal and provincial small business tax rate varies from 10 to 13 5 between all provinces from british columbia to ontario.

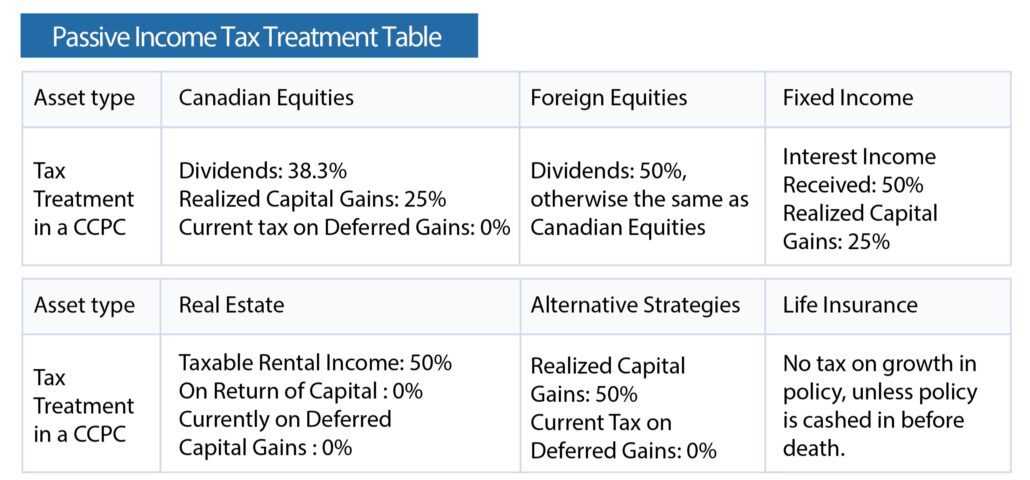

The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010. The new proposals reduce the small business deduction by 5 for every 1 of investment passive income earned above the 50 000 passive investment income threshold. With the exception of inter corporate dividends passive income earned by ccpcs or any corporation in canada is ineligible for deductions and consequently fully taxable at the corporation s combined provincial and federal tax rate. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different.

The personal income tax brackets and tax rates in british columbia are average compared to more heavily taxed provinces like manitoba and quebec. In 2020 is 5 06 and it applies to income up to 41 725. For 2019 the small business deduction can reduce the tax rate on the first 500 000 of active business income for a corporation resident in bc from 27 to 11 a corporate tax saving of 16 worth a maximum of 80 000. Please read the article understanding the tables of personal income tax rates.

Budget 2020 proposes adding a new tax bracket for income above 220 000 at a rate of 20 5. For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income is taxed at 7 70 the next 12 361 of taxable income is taxed at 10 5 the next 20 532 of taxable income is. In other words short term capital gains are taxed at the same rate as your income tax. 4 1 4 3 4 52 4 69.

For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. British columbia tax rates current marginal tax rates bc personal income tax rates bc 2021 and 2020 personal marginal income tax rates bc income tax act s. Assumed average provincial tax rate on this type of income 3. This has a dramatic effect on the amount of tax on that 500 000.

The lowest tax rate in b c. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income.