S Corp Passive Income Tax Rate

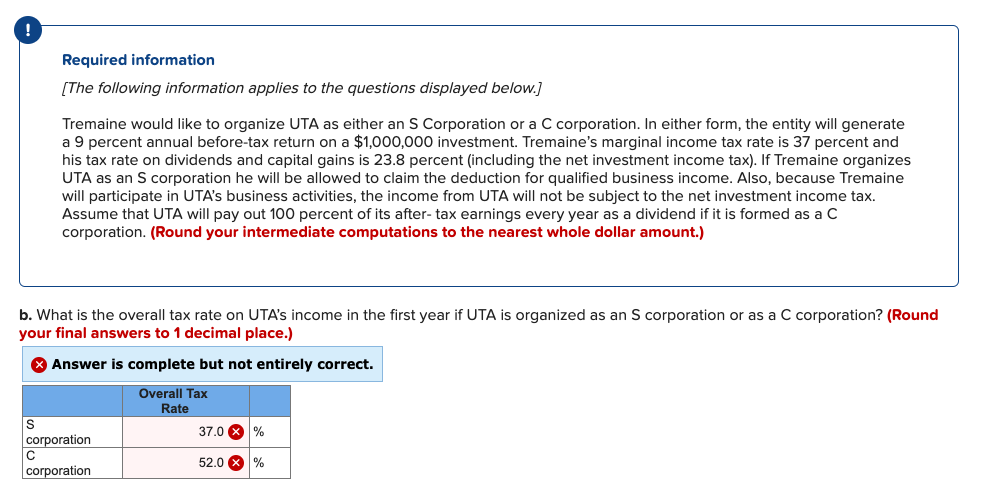

The excess net passive income tax applies to s corporations that were previously c corporations or have been restructured as a tax free company from their status as a c corporation.

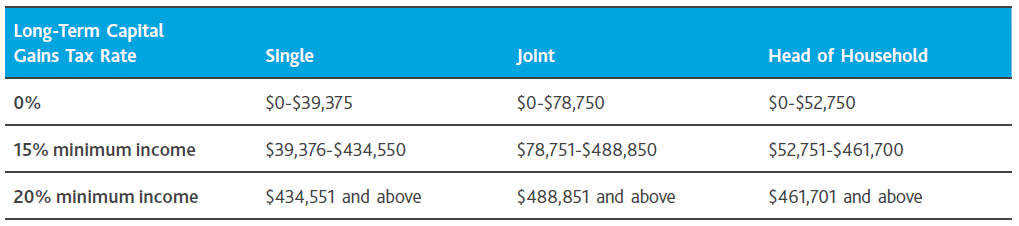

S corp passive income tax rate. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. That amount is ultimately taxed at the shareholder s ordinary tax rate. The corporate tax rate. S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes.

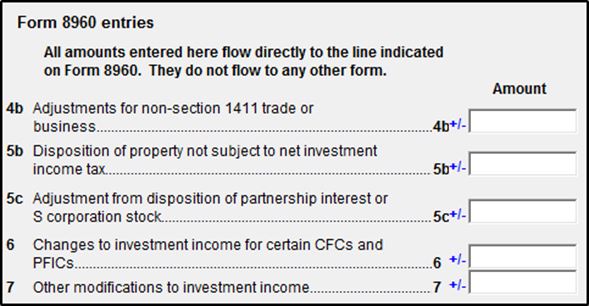

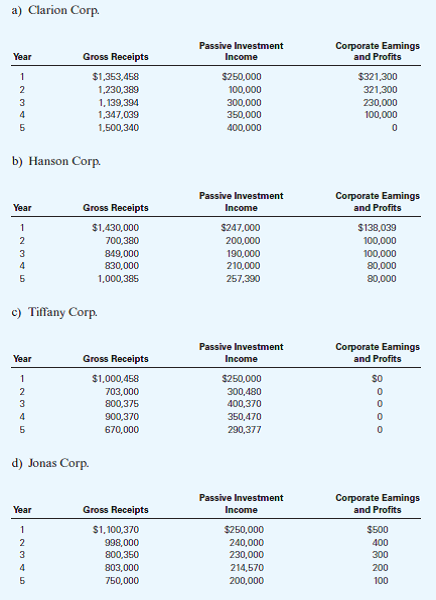

The shareholder s share of the s corporation s passive income is listed on line 28 section g. Capital gains and or losses. It is a tax on the company s passive income which includes interest income annuities rents royalties and dividends. The excess net passive income that is subject to the tax is limited to the taxable income calculated as if it were still a c corporation.

The three big advantages of the new tax plan include lower tax rates several additional tax deductions and a lower corporate tax rate. The tax cuts and jobs act tcja slashed the tax rate for c corporations from 35 to 21 in 2018. All shareholders in an s corporation will receive a schedule k 1. For example if an s corporation earns 100 000 in a year 35 000 of which is from passive income the total passive income percentage for the year would be 35 percent.

Passive income tax rate for 2020. Passive income like rents and royalties. The s corporation would have to pay tax on 10 000 or the difference between the total passive income it generated and how much passive income it was permitted to earn without. This allows s corporations to avoid double taxation on the corporate income.

The result is ultimately included on line 17 of the shareholder s 1040. The threshold for the enpi calculation is triggered when gross enpi is greater than 25 of gross receipts and the corporation has e p at year end. The consequences to a company claiming the sbd and having more than 50 000 of passive income in the year are limited to a loss of a deferral of tax 80 000 as shown in the example above and a relatively small increase in the integration cost of earning active business income in a corporation approximately 1 percent in the example above. Then the permissible passive losses are added to the passive income.

Shareholders of s corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. An s corporation must pay this type of tax. At the end of 2017 president trump signed the tax cuts and jobs act. These 2018 tax cuts basically lower taxes for individuals and business throughout the united states.