Us Income Distribution Graph 2018

In 2018 the median income of u s.

Us income distribution graph 2018. Everyone the 99 9999 percent is the bottom sliver. The median household income increased for the fifth consecutive year. Individuals families and households in the following animated chart the cumulative income data applies for the 2017 calendar year if you re looking for income data for the 2018 calendar year it will not be collected. In 2019 a little more than 53 percent of americans had an annual household income that was less than 75 000 u s.

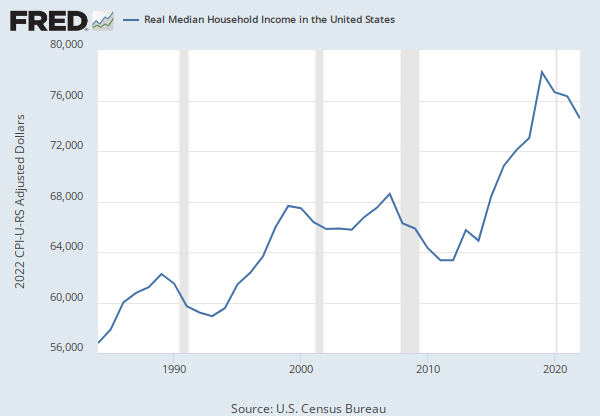

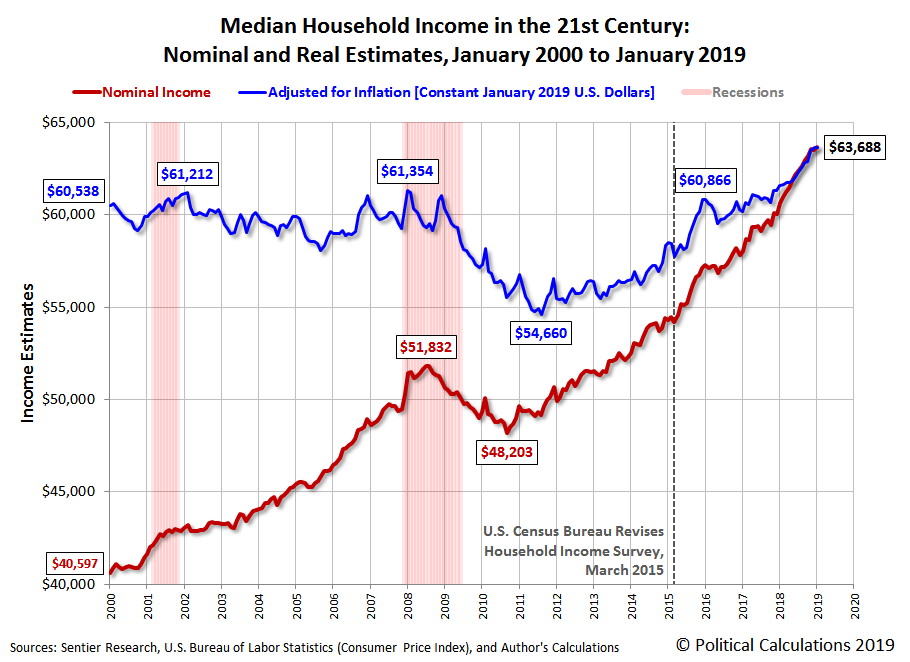

6 incomes are expressed in 2018 dollars but the overall trend masks two distinct episodes in the evolution of household incomes the first lasting from 1970 to 2000 and the second from 2000 to 2018. One half 49 98 of all income in the us was earned by households with an income over 100 000 the top twenty percent. In 2008 all households in the united states earned roughly 12 442 2 billion. Further while average pre tax income for the bottom 50 has stagnated at around 16 000 since 1980 the top 1 has experienced 300 growth in their incomes to approximately 1 340 000 in 2014.

Rising economic inequality over the past 40 years has redrawn the u s. The 2018 real median income of family households and nonfamily households increased 1 2 percent and 2 4 percent respectively between 2017 and 2018 figure 1 and table a 1. Median household income was 63 179 in 2018 not statistically different from the 2017 median figure 1 and table a 1. Census bureau has published its annual report on income and poverty in the united states which we ve used to visualize the cumulative distribution of income for u s.

Wealth and income landscape shifting many of the gains of prosperity into the hands of a smaller and smaller group of people and marginalizing members of vulnerable communities. Irs statistics of income individual income rates and tax shares 2018. This is the actual graph. Taxpayers at the very top of the income distribution the top 0 1 percent with agis over 2 1 million paid an even higher average income tax rate of 27 1 percent.

This transformation is in turn reducing income mobility and opening gulfs in educational achievement and health outcomes between different levels. In 2018 the total personal income earned in the united states was 17 6 trillion. Actually the sliver needs to be so much smaller because it should be 1 18 000 of that first tick mark at 0 5. Households stood at 74 600.