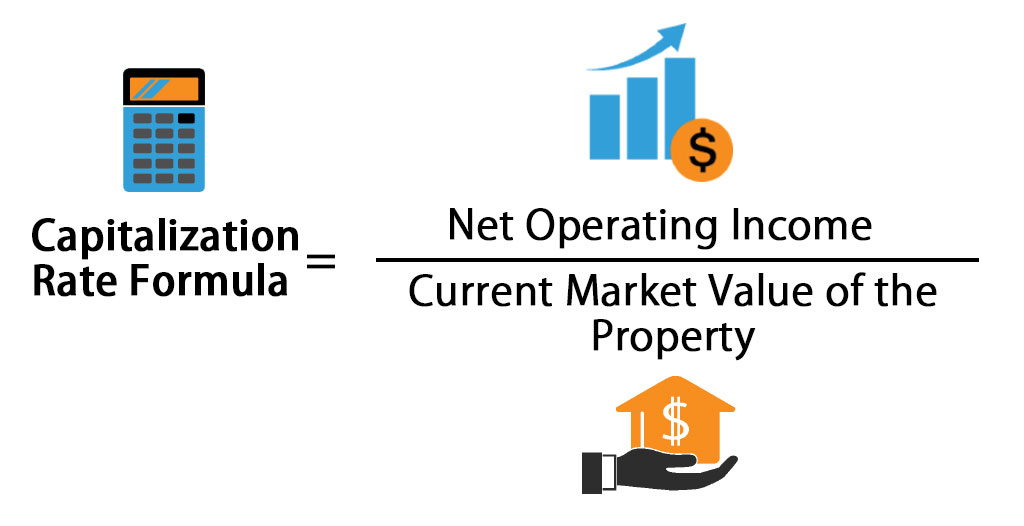

Income Capitalization Approach Formula

The income capitalization formula looks like this.

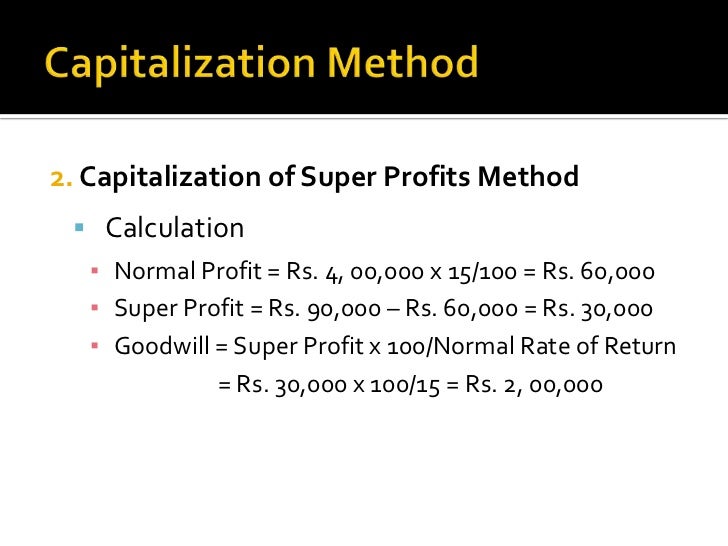

Income capitalization approach formula. So here s how to calculate each of the. The formula you use is. The yield capitalization method. This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market.

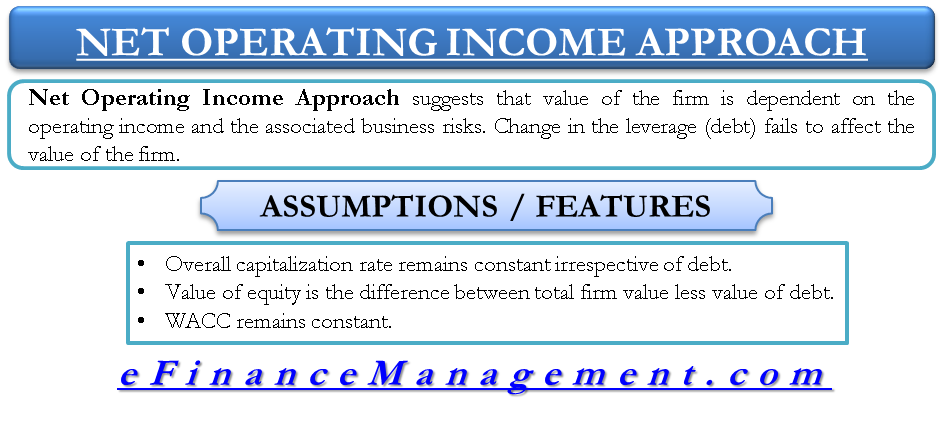

The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on the. Using capitalization rate cap rate to estimate value. In other words the higher the cap rate the lower the asking price. As you can see this appraisal approach consists of two main variables.

The income capitalization approach formula. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. This method uses net operating income estimates for a typical investment holding period. There s an inverse relationship between the asking price and cap rate.

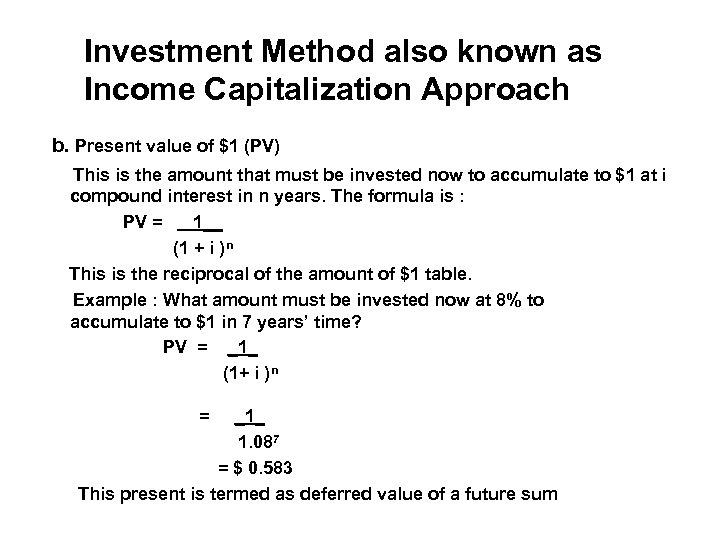

Therefore the resulting property value accounts for future expected changes in rental rates vacancy and operating expenses. Note in this formula the reversal of the irv formula for finding value. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. Property market value net operating income noi capitalization rate.

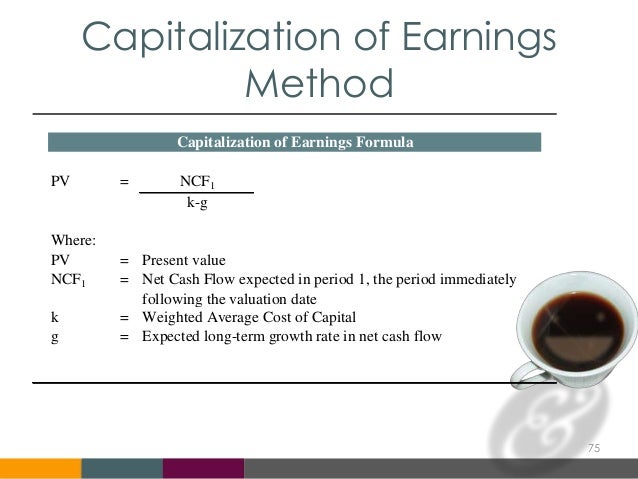

Another approach called multi stage growth model divides future into two or more stages. The above equation is based on the formula for present value of a perpetuity. First the annual gross income of the investment must be. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies lower risk while a low capitalization rate implies higher risk.

A initial period of say 5 years for which net cash flows and growth rate for each year can be determined and b period after the initial period for which year by year projection is unreliable. Estimates of value via the income approach are highly sensitive to changes in revenue expense and capitalization rates. When all variables are known calculating the capitalization rate is achieved with a simple formula operating income purchase price. The capitalization rate and the net operating income noi.

A building sells for 200 000. The income approach is often given primary emphasis when appraising a commercial real estate used to generate income. Net operating income i sales price v capitalization rate r this formula is applied using the net operating income and sale price of each comparable that you re analyzing.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)