Income From Operations Can Be Determined Using

Choose whether the following characteristics are most often associated with absorption costing or variable costing.

Income from operations can be determined using. The cash flow direct method determines changes in cash receipts and payments which are. Choose whether the characteristics below are most often associated with absorption costing or variable costing. Operating income can be determined using a. Neither absorption nor variable costing.

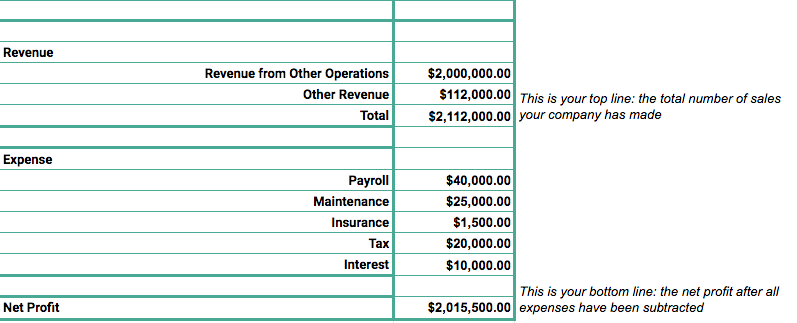

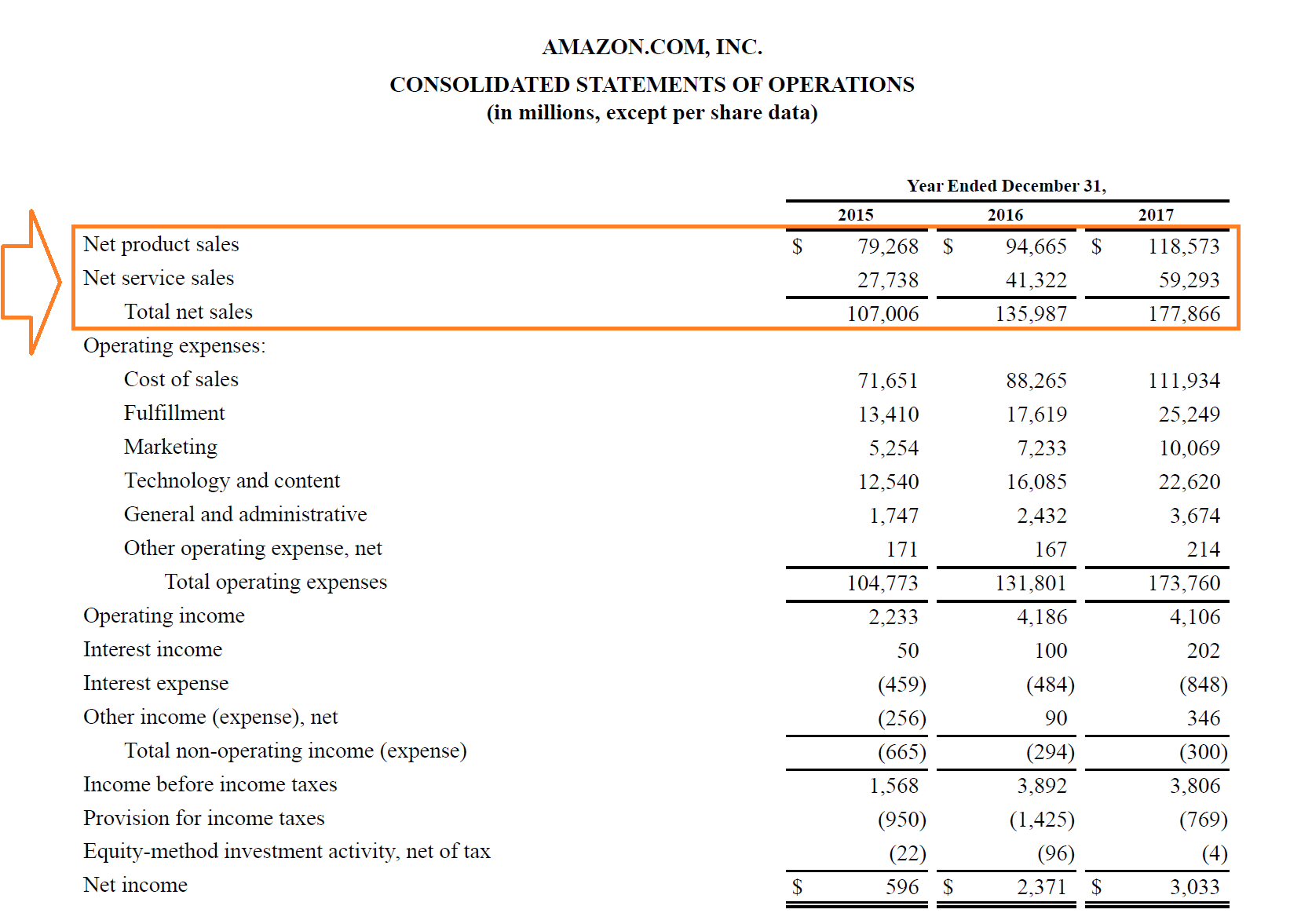

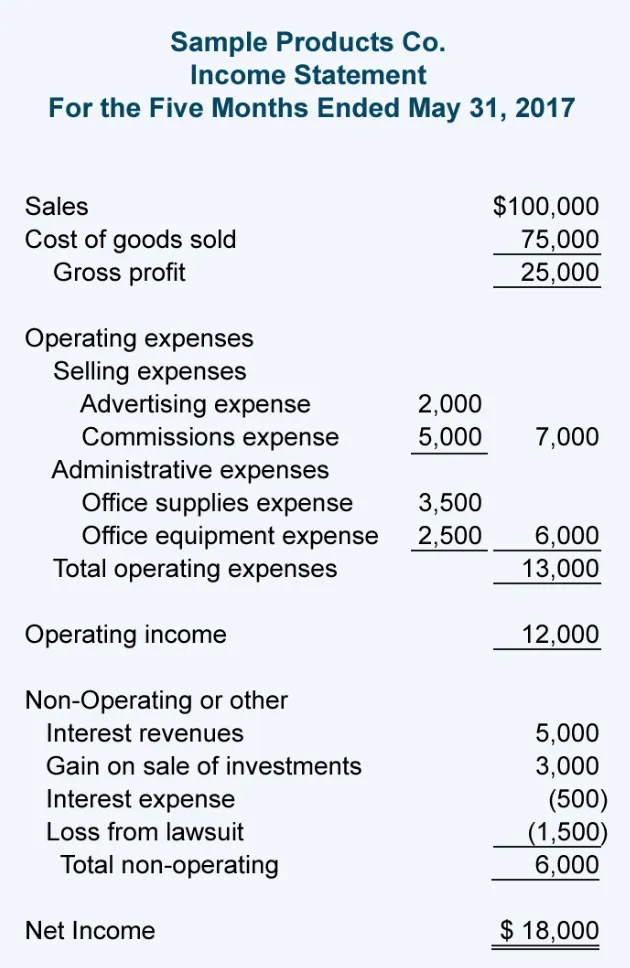

Income from operations is one of the most important items reported by a company. The variable cost of goods sold was 300 000. Income from operations is one of the most important items reported by a company. Cash flow from operations for a time period can be determined using either the direct or indirect method.

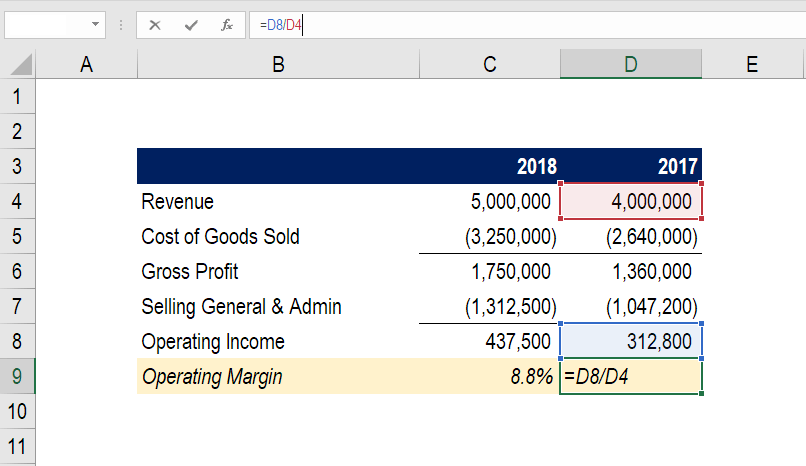

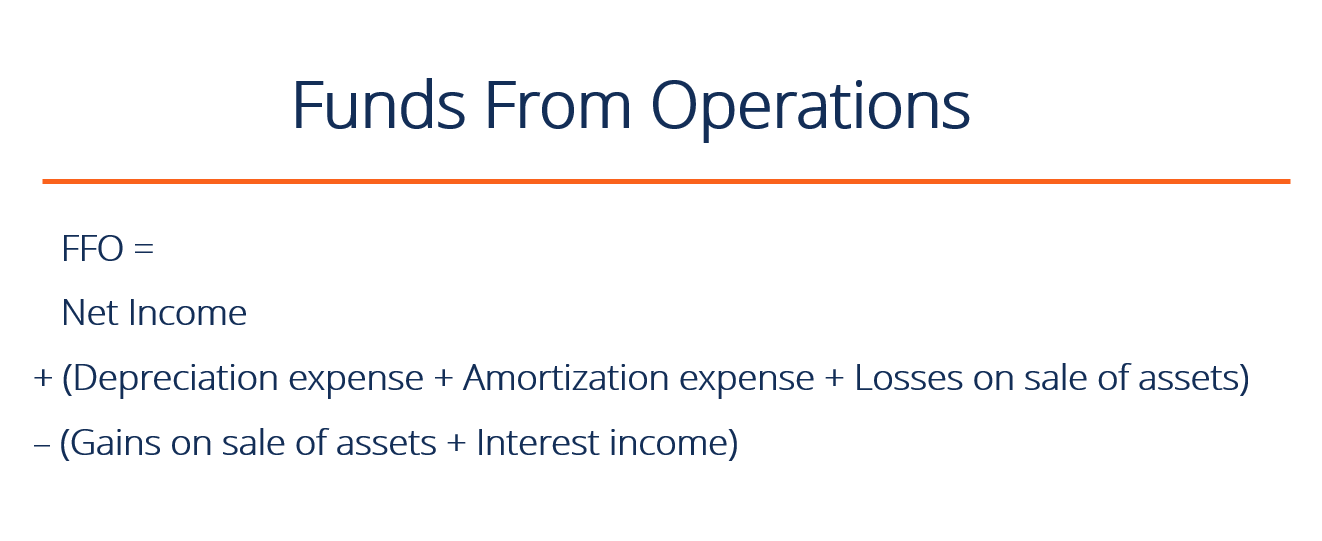

The variable selling and administrative expenses were 75 000. Absorption costing variable costing required under generally accepted accounting principles gaap often used for internal use in decision making cost of goods. Depending on the decision making needs of management income from operations can be determined using absorption costing or variable costing. Interest expense interest income and other non operational revenue sources are not considered in computing for operating income.

Income from operations is generated from running the primary business and excludes income from other sources. Using variable costing what. Absorption and variable costing. Fixed costs were 60 000.

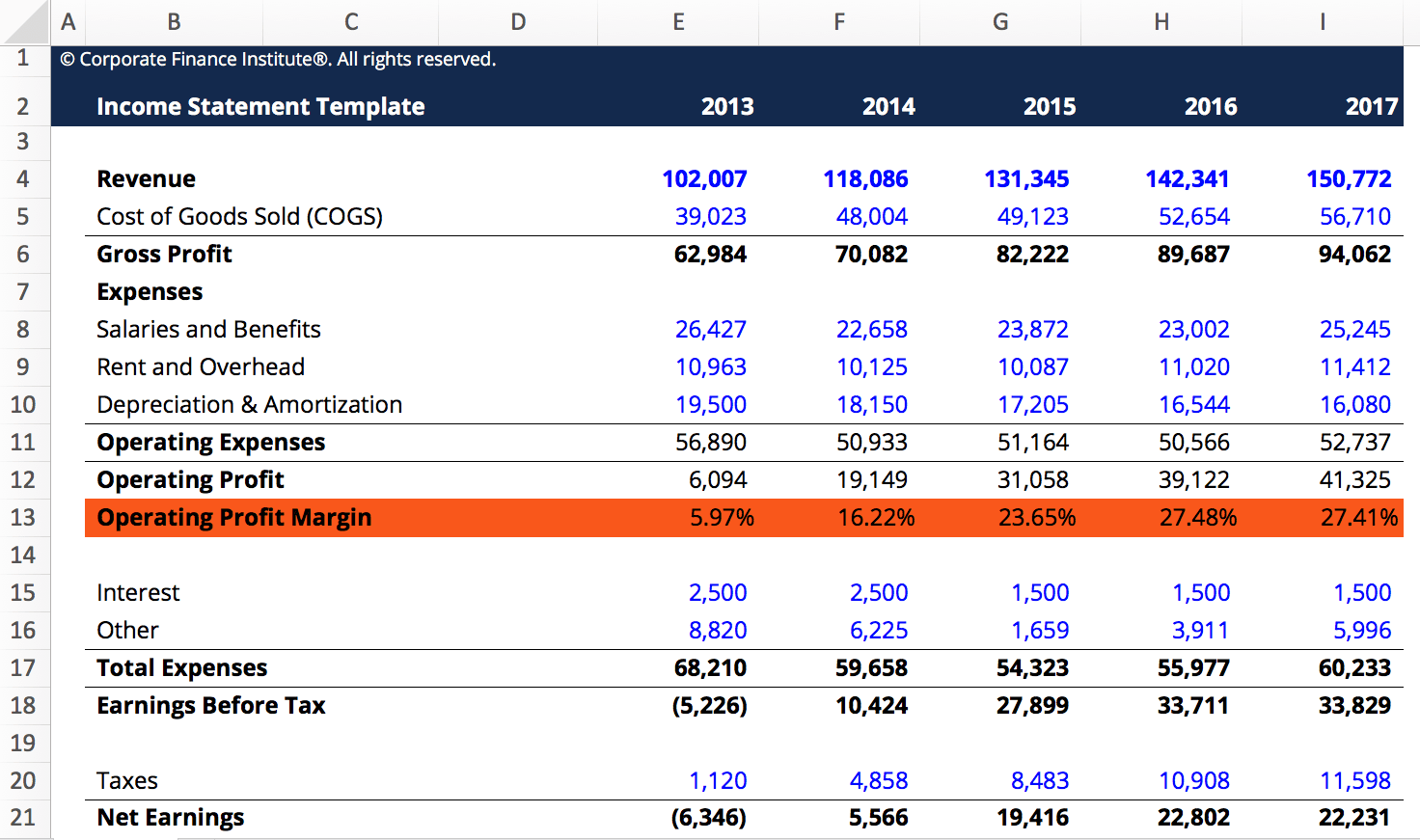

Income from operations 70 898 million. Variable absorption costing income from operations can be determined using absorption or variable costing. Income from operations net income interest expense taxes. Absorption and variable costing.

Choose whether the following characteristics are most often associated with absorption costing or variable costing. Depending on the decision making needs of management income from operations can be determined using absorption costing or variable costing. Mathematically operating income can be calculated using two methods method 1. Income from operations is the profit realized from a business own operations.

Depending on the decision making needs of management income from operations can be determined using absorption costing or variable costing. Income from operations is calculated using the formula given below. Income from operations 54 286 million 3 240 million 13 372 million. Absorption costing absorption costing is required under generally accepted accounting principles for financial statements distributed to external users.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)