Life Income Annuity With Period Certain Option

If you die during the period certain phase your beneficiary will receive the payments remaining in the period.

Life income annuity with period certain option. This annuity is also called period certain annuity. There is also a hybrid option often called an income for life annuity with guaranteed period certain benefit this type of annuity provides guaranteed payments for your lifetime but it also comes with a period certain phase. However premiums for this product may be more expensive. For example a life income 10 years certain selection mandates that if the annuitant dies after say three years a beneficiary would continue to receive payments for the remainder of the ten year time period.

If the annuitant dies before receiving total income payments equal to the purchase price of the annuity the payments continue to the beneficiary until. Life income period certain the annuity is payable over the owner s life with a minimum guaranteed payout period. Life income with period certain option a life insurance settlement option under which a beneficiary may have policy proceeds converted to a life annuity for the beneficiary with the benefit period based on the beneficiary s life expectancy and payments that continue for that period of time whether or not the beneficiary lives. The period certain option with a life annuity can manage longevity risk since you ll receive payments as long as you live.

Five year certain and life annuity means a reduced monthly benefit payable to a participant for his lifetime with a guarantee of 60 payments if the participant dies after the annuity starting date but before receiving 60 monthly payments the monthly payments shall be paid to the participant s beneficiary until the participant and his beneficiary have received a total of 60 monthly payments. If you die prior to the end of the fixed period the payments continue to pay your designated beneficiary until the period is up. Period certain annuity drawbacks. Life income with certain period is a type of annuity that provides money to the insured on a regular basis for a specific number of years.

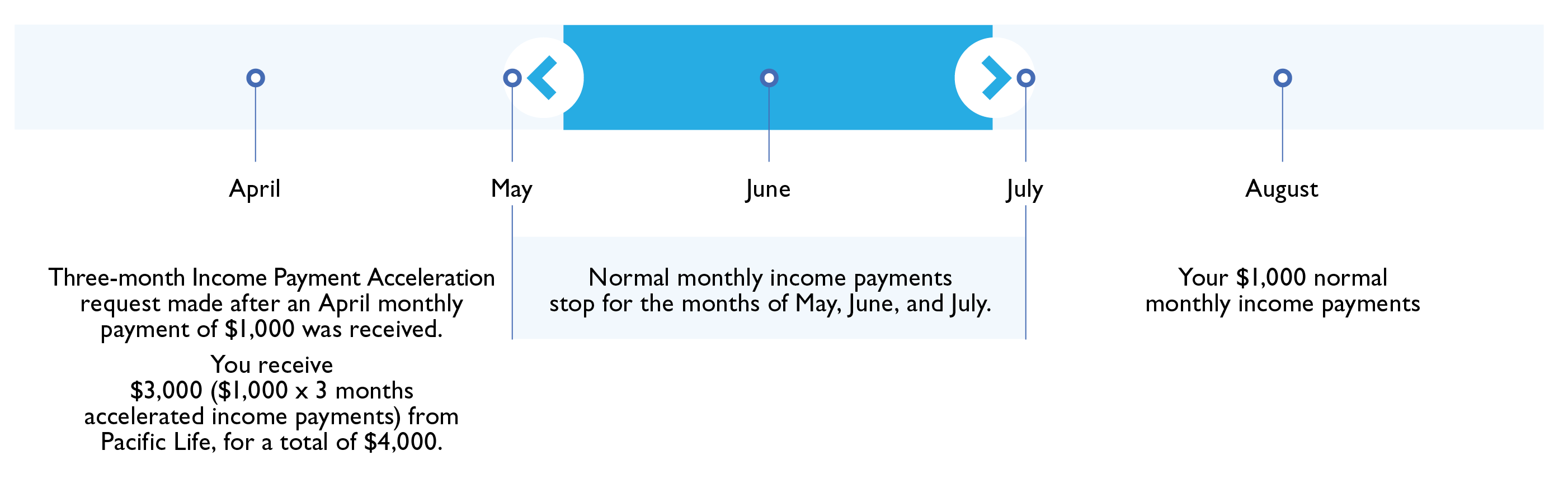

A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. Pays a life income to the annuitant with a certain number of guaranteed payments such as 5 10 15 or 20 years. If the insured dies before the period ends the beneficiary gets the remaining payments from the annuity. Installment refund option definition.

Annuity certain or period certain is when payments are distributed to you for a fixed period of time. An insurance company has to guarantee payments over the period certain even if you die. Life annuity with period certain definition. In most cases you can choose a period ranging from 5 years to 30 years.

Along with the straight life income option explained above there are three other options.