Monthly Income Limits For Medicaid Ohio

However ohio medicaid does not have an income cap meaning applicants with income above the 2 250 limit may still qualify for benefits under certain circumstances.

Monthly income limits for medicaid ohio. This includes both earned income the money you make from jobs and unearned income cash assistance social security unemployment insurance and child support etc. Adults ages 19 to 64 can earn no more than 133 percent of the federal poverty level in order to qualify for medicaid in ohio. How much money your household makes. 2020 income guidelines for ohio medicaid for families households with more than 8 persons add 4 480 for each additional person.

For married couples in which only one spouse is applying for nursing home medicaid or a hcbs medicaid waiver there is a minimum monthly maintenance needs allowance mmmna. Instead all of their income except for a personal needs allowance which ranges for 30 150 month must go towards paying for their cost of care. As of january 2020 this figure is 3 216 month. Those who fall well below the poverty line as well as children and pregnant women qualify most often.

How many people you live and buy make food with. 2 10 2020 adults ages 19 64 pregnant women uninsured children up to age 19 children with private insurance are eligible for medicaid as. To figure out if you qualify for food stamps ohio needs to know your. For the eligibility groups reflected in the table an individual s income computed using the modified adjusted gross income magi based income rules described in 42 cfr 435 603 is compared to the income standards identified in this table to determine if they are income eligible for medicaid or chip.

While persons residing in nursing homes paid for by medicaid are permitted to have monthly incomes as high as 2 349 in most states those individuals are not permitted to keep that income. Household size and total amount of income versus outgoing bills plays a part in determining the income limit for each family. Often times the nursing home works directly with. In 2018 the fbr is 750 meaning an ohio medicaid applicant may retain up to 2 250 of exempt income without disqualifying themselves from medicaid.

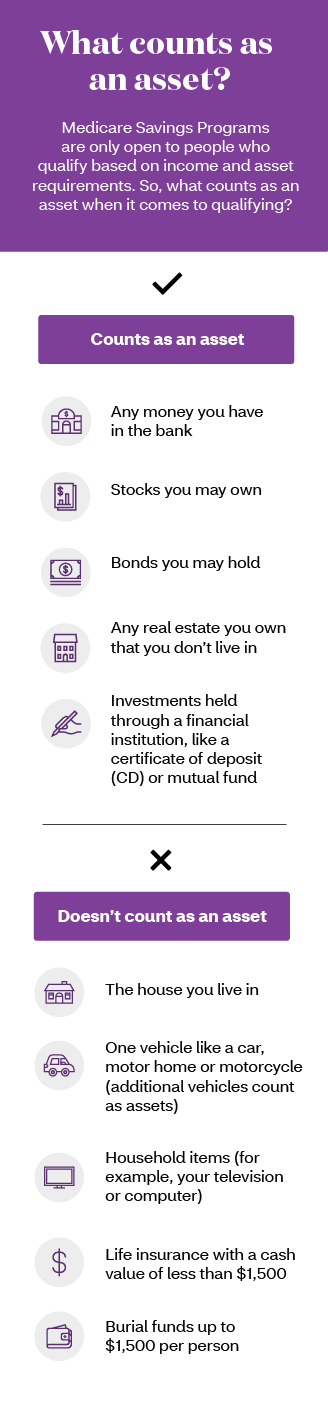

Income requirements for ohio medicaid. This is the minimum amount of monthly income to which the non applicant spouse is entitled. Income levels reflect the 1 conversion to magi eligibility and 2 addition of the 5 percentage point disregard. Ohio income requirements for medicaid take into account your household size your income and any assets you may have all measured up against the current federal poverty levels divided into patient groups.

The magi based rules generally include adjusting an individual s income by an amount.