Passive Income Is Subject To What Tax

On certain passive income cash and or property dividend share in the distributable net income of a partnership interest on any bank deposits royalties prizes except prizes amounting to p10 000 or less which is subject to tax under sec.

Passive income is subject to what tax. Interest income from depository bank under the expanded foreign currency deposit system received by a resident. 0 15 and 20 based on your income bracket. 20 january is the annual deadline for securing business permits and part of the process is paying local business tax lbt. Fortunately passive income investors are allowed to deduct the cost come tax season.

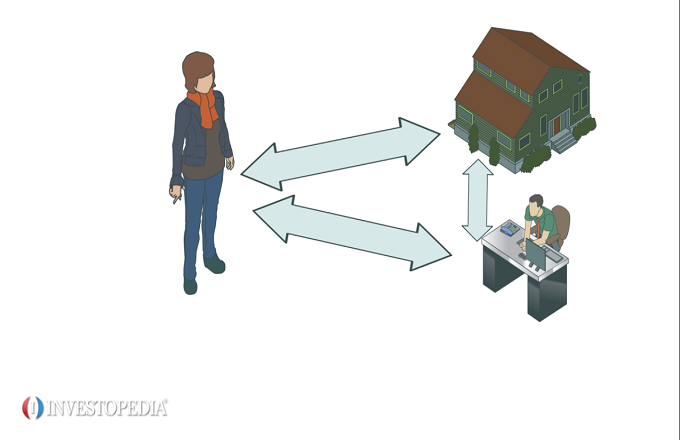

F the tax sparing rule is applicable to resident and non resident foreign corporations. What most people are referring to when they talk about. Passive income is earnings derived from a rental property limited partnership or other enterprise in which a person is not actively involved. As with active income passive income is usually.

Passive income is the money an investor stands to make from an activity in which they are not actively involved. 25 a 1 of the tax code. Employees and self employed people have to pay federal income tax on earnings related to work but the government also imposes income tax on various sources of passive income. Long term passive income tax rates long term capital gains assets held for more than one year are taxed at three rates.

If you re a passive income investor with a home office you re looking at an additional tax deductible. If your total income is less than 12 000 in a year and you are single or it is less than 18 000 and you qualify as head of the household then you most likely won t pay federal taxes on that residual income. If you run a residual or passive income business such as a blog then you may be exempt from paying taxes on the income the blog earns depending on how much income you earn both from the blog and from other work. Passive income or unearned income describes income that does not require active work such as interest credited to savings accounts and investment income.

In particular tax manager marion d. The federal income tax rate on unearned income varies from one type of passive income to another. Castañeda writes about holding companies not subject to lbt on passive income. By its broadest definition passive income would include nearly all investment income including interest dividends and capital gains.

For example a person filing as single earning less than 39 375 would owe 0 percent on any long term capital gains. Individual but not by a non resident individual. Shall be subject to tax as passive income in the aitr.